DelaPlex Limited IPO Subscription Status

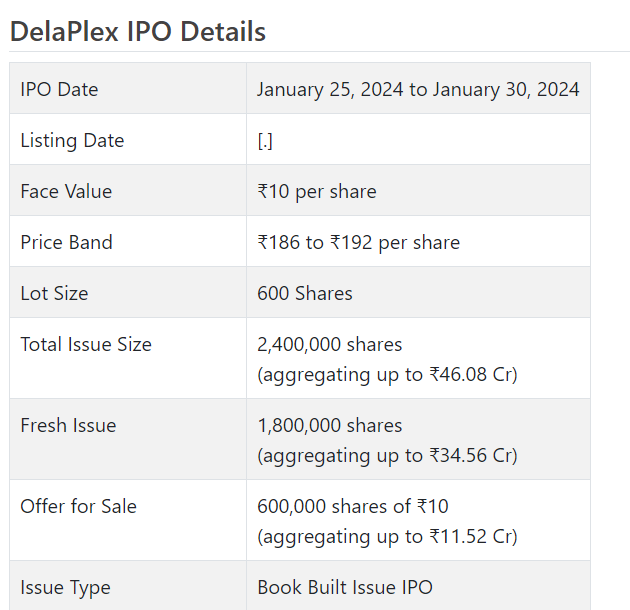

DelaPlex Initial public offering is a book constructed issue of Rs 46.08 crores. The issue is a mix of new issue of 18 lakh shares collecting to Rs 34.56 crores and make available for purchase of 6 lakh shares conglomerating to Rs 11.52 crores.

DelaPlex Initial public offering opens for membership on January 25, 2024 and closes on January 30, 2024. The designation for the DelaPlex Initial public offering is supposed to be finished on Wednesday, January 31, 2024. DelaPlex Initial public offering will list on NSE SME with speculative posting date fixed as Friday, February 2, 2024.

DelaPlex Initial public offering cost band is set at ₹186 to ₹192 per share. The base parcel size for an application is 600 Offers. The base measure of venture expected by retail financial backers is ₹115,200. The base parcel size speculation for HNI is 2 parts (1,200 offers) adding up to ₹230,400.

• DPL is a worldwide IT arrangements supplier with related administrations.

• It posted consistent development in its top and main concerns for the detailed periods.

• In light of FY24 annualized profit, the Initial public offering shows up completely evaluated.

• All around informed financial backers might stop assets for the medium to long haul rewards.

ABOUT Organization:

DelaPlex Ltd. (DPL) is an innovation and programming improvement arrangement and counseling supplier, helping client organizations to accomplish in determining development, income and commercial center worth. The Organization has created mastery and associations with different industry players that give the most recent innovation, apparatuses, and programming advancement arrangements. DPL is a worldwide innovation accomplice in Store network Counseling, Custom Programming Improvement, Cloud Administrations, and Information Science.

Further the Organization, offers different tech arrangements including programming characterized server farms, incorporated foundation, cloud advances, DevOps, security arrangements, information investigation, and man-made reasoning. Worked for its channel accomplices and end clients I, we make cutting edge answers for address IT issues.

As a start to finish coordinated Omni-channel production network counseling and programming arrangements supplier, it helps organizations overall in upgrading their stockpile chains. DPL’s emphasis is on robotization, IT drives, computerized devices, and worth driven approaches, guaranteeing its clients can satisfy their remarkable needs rapidly and proficiently.

The organization offers administrations across businesses and an expanded client base significantly in the US of America which incorporate clients from Broadcasting, Petrol, Retail, 3PL, WFM, QSRs, Friendliness, IT and ITES, Telecom and so on. The Organization provides food fundamentally to global business sectors. Its client base is spread across the globe with presence in nations significantly US of America. It likewise has a presence in worldwide business sectors via its unfamiliar holding Organization and unfamiliar Gathering Organization like DelaPlex INC and Xperity LLC.

DelaPlex Restricted (DPL) is an auxiliary of DelaPlex INC., a U.S.- based undertaking, where DelaPlex INC. holds 51% of the organization’s portions. As of September 2023, it had 300 workers on its finance (counting 14 workers for hire).

ISSUE Subtleties/CAPITAL HISTORY:

The organization is emerging with its lady combo book building course Initial public offering of 2400000 value portions of Rs. 10 every (value Rs. 46.08 cr. at the upper cap) comprising 1800000 new value shares (worth Rs. 34.56 cr. at the upper end), and a Proposal available to be purchased (OFS) of 600000 offers (worth Rs. 11.52 cr. at the upper cap). It has reported a value band of Rs. 186 – Rs. 192 for every offer. The issue opens for membership on January 24, 2024, and will close on January 29, 2024. The base application to be made is for 600 offers and in products subsequently, from that point. Post designation, offers will be recorded on NSE SME Arise. The issue comprises 26.34% of the post-Initial public offering settled up capital of the organization. From the net returns of the new value issue, it will use Rs. 4.16 cr. for APAC – promoting/showcasing cost for upgrading mindfulness, Rs. 0.65 cr. for capex for acquisition of Office hardware, Rs. 13.34 cr. for working capital and the rest for general corporate purposes.

The issue is exclusively lead overseen by Shreni Offers Ltd., and Bigshare Administrations Pvt. Ltd. is the enlistment center of the issue. Shreni Offers Ltd. is additionally the market producer for the organization.

The organization has given whole value capital at standard up to this point and has likewise given extra offers in the proportion of 730 for 1 in October 2023. The typical expense of procurement of offers by the advertisers/selling partners is Rs. Nothing, Rs. 9.68, and Rs. 50 for each offer

Post-Initial public offering, organization’s ongoing settled up value capital of Rs. 7.31 cr. will stand upgraded to Rs. 9.11 cr. In view of the upper Initial public offering cost band, the organization is searching for a market cap of Rs. 174.91 cr.

Monetary Execution:

On the monetary execution front, for the last three fiscals, the organization has posted an all out pay/net benefit of Rs. 36.33 cr. /Rs. 4.04 cr. (FY21), Rs. 50.34 cr. /Rs. 6.12 cr. (FY22), and Rs. 55.22 cr. /Rs. 7.91 cr. (FY23). For H1 of FY24 finished on September 30, 2024, it procures a net benefit of Rs. 4.26 cr. on an all out pay of Rs. 28.14 cr. Consequently its top and primary concerns posted development for the revealed periods.

For the last three fiscals, it has detailed a normal EPS of Rs. 9.12, and a typical RONW of 37.01%. The issue is evaluated at a P/BV of 5.06 in light of its NAV of Rs. 37.97 as of September 30, 2023, and at a P/BV of 3.11 in light of its post-Initial public offering NAV of Rs. 61.73 per share (at the upper cap).

On the off chance that we characteristic annualized FY24 income to its post-Initial public offering completely weakened paid-p capital, then, at that point, the asking cost is at a P/E of 20.56. Hence the issue shows up completely valued.

For the revealed periods, the organization has posted PAT edges of 11.15% (FY21), 12.30% (FY22), 14.64% (FY23), 15.27% (H1-FY24), and RoCE edges of 72.68%, 68.81% 56.73%, 23.04% separately for the alluded periods.

Profit Strategy:

The organization has not proclaimed any profits since fuse. It will embrace a reasonable profit strategy in light of its monetary exhibition and future possibilities.

Correlation WITH Recorded Companions:

According to the deal record, the organization has shown Ksolves India, Micropro Delicate., and Sigma Address as their recorded companions. They are exchanging at a P/E of 50.47, 13.6, and 213.59 (as of January 20, 2024). Nonetheless, they are not tantamount on an apple-to-apple premise.

Vendor BANKER’S History:

This is the 27th order from Shreni Offers in the last three fiscals, out of the last 10 postings, all opened at expenses going from 4.94% to 143.24% on the date of posting.