Owais Metal and Mineral Processing Limited IPO Subscription and Allotment

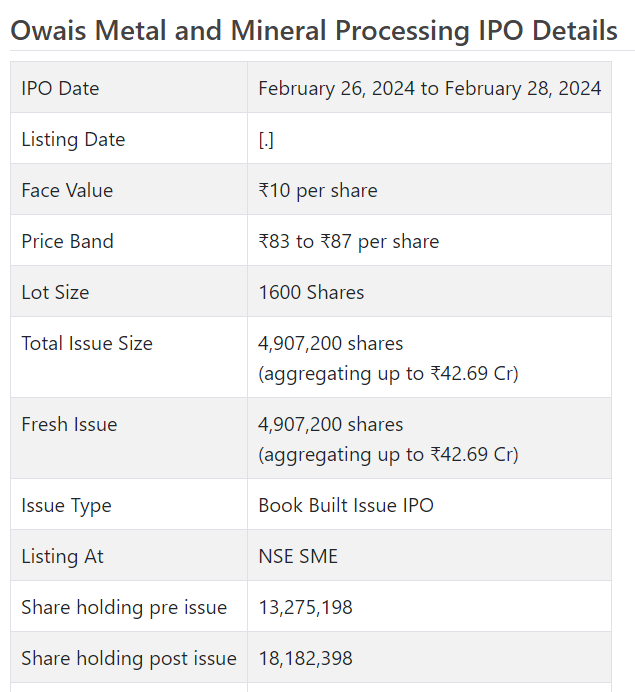

Owais Metal and Mineral Handling Initial public offering is a book fabricated issue of Rs 42.69 crores. The issue is completely a new issue of 49.07 lakh shares.

Owais Metal and Mineral Handling Initial public offering opens for membership on February 26, 2024 and closes on February 28, 2024. The designation for the Owais Metal and Mineral Handling Initial public offering is supposed to be concluded on Thursday, February 29, 2024. Owais Metal and Mineral Handling Initial public offering will list on NSE SME with speculative posting date fixed as Monday, Walk 4, 2024.

Owais Metal and Mineral Handling Initial public offering cost band is set at ₹83 to ₹87 per share. The base part size for an application is 1600 Offers. The base measure of venture expected by retail financial backers is ₹139,200. The base parcel size venture for HNI is 2 parts (3,200 offers) adding up to ₹278,400.

• OMMPL is in the assembling and processor of different metals and minerals.

• It got changed over in the public restricted organization is April 2023.

• The abrupt lift in its main concerns from FY23 onwards causes a commotion and worry over its manageability proceeding.

• In view of its FY24 annualized super profit, the issue shows up completely estimated.

• There is no damage in skirting this “High Gamble/Low Return” bet.

ABOUT Organization:

Owais Metal and Mineral Handling Ltd. (OMMPL) is the producer and processor of different metals and minerals. Exceptionally differentiated across the expansive range of normal assets with primary interests in assembling and handling metal and minerals. The organization is taken part in the assembling and handling of the accompanying items.

1. Manganese Oxide (MNO)

2. MC Ferro Manganese

3. Assembling of Wood Charcoal

4. Handling of Minerals like Ferro Composite, Quartz and Manganese Metal.

Its items like Manganese Oxide is utilized in manure industry and is additionally utilized by the Manganese Sulfate Plants. Manganese Mineral is utilized in assembling of Ferro Manganese, Silico Manganese, Manganese Oxide, Batteries and other Ferro items likewise it tends to be straightforwardly sellable on the lookout. MC Ferro Manganese is utilized in steel and projecting businesses, as it helps with eliminating sulfur from steel and further develop properties, similar to solidness, machinability and flexibility. It can deoxidize liquid metal.

Its Wood Charcoal is utilized in heaters of ventures which requires high intensity for their assembling cycle like Steel industry. Handled Quartz is being utilized inn industry, Ferro Composites industry, tiles and fired industry, glass industry and industry of insides and furniture. As on date of recording of the proposition reports, its significant items are being provided to the territory of Madhya Pradesh, Maharashtra Punjab, Delhi and Gujrat.

The organization has as of late added new items to its portfolio these items are Wood Charcoal and Handled Quartz. The organization has an assembling unit for wood charcoal at Rajasthan and Meghnagar. Handling of Quartz has been finished through its Meghnagar plant. As of December 31, 2023, it had 25 workers on its finance.

ISSUE Subtleties/CAPITAL HISTORY:

The organization is emerging with its lady book building course Initial public offering of 4907200 value portions of Rs. 10 every (value Rs. 42.69 cr. at the upper cap). It has reported a value band of Rs. 83 – Rs. 87 for every offer. The issue opens for membership on February 26, 2024, and will close on February 28, 2024. The base application to be made is for 1600 offers and in products subsequently, from there on. Post portion, offers will be recorded on NSE SME Arise. The issue comprises 26.99% of the post-Initial public offering settled up capital of the organization. From the net returns of the new value issue, it will use Rs. 19.78 cr. for acquisition of supplies to work with assembling, Rs. 18.00 cr. for working capital, and the rest for general corporate purposes.

The issue is exclusively lead overseen by Gretex Corporate Administrations Ltd., and Bigshare Administrations Pvt. Ltd. is the enlistment center of the issue. GRETEX gathering’s Gretex Offer Broking Ltd. is the market producer for the organization.

Having given introductory value capital at standard, the organization gave further value shares at a proper cost of Rs. 200 for each offer (in light of FV of Rs. 10) between Walk 2023 and June 2023. It has likewise given extra offers in the proportion of 16 for 1 in September 2023. The typical expense of obtaining of offers by the advertisers is Rs. Nothing, Rs. 0.59, and Rs. 10.46 per share

Post-Initial public offering, organization’s ongoing settled up value capital of Rs. 13.28 cr. will stand improved to Rs. 18.18 cr. In light of the upper Initial public offering cost band, the organization is searching for a market cap of Rs. 158.19 cr.

Monetary Execution:

On the monetary execution front, for the last three fiscals, the organization has (as an ownership concern) posted a complete pay/net benefit of Rs. 21.09 cr. /Rs. 0.24 cr. (FY21), Rs. 28.33 cr. /Rs. 0.49 cr. (FY22), and Rs. 39.74 cr. /Rs. 5.41 cr. (FY23). In this manner the unexpected leap in main concerns cause a stir, yet additionally gives off an impression of being a window dressing to match the asking cost.

For 3Qs of FY24 finished on December 31, 2023, as a public restricted concern, it procures a net benefit of Rs. 7.66 cr. on an all out pay of Rs. 39.78 cr. Subsequently its top and primary concerns flood cause a stir and worry over its supportability proceeding.

For the progressing monetary, it has posted an EPS of Rs. 5.85 and a RoNW of 36.06%. The issue is valued at a P/BV of 5.37 in light of its NAV of Rs. 16.21 as of December 31, 2023. The Initial public offering promotion is missing information on its post-Initial public offering NAV on lower and upper cost band premise.

On the off chance that we quality annualized FY24 income to its post-Initial public offering completely weakened paid-p capital, then, at that point, the asking cost is at a P/E of around 15.50. In this way the issue shows up completely estimated.

For the continuous monetary, the organization has posted PAT edges of 19.37% (3Qs-FY24), and RoCE edges of 41.73% separately for the alluded periods. (On non-annualized premise).

Profit Strategy:

The organization has not pronounced any profits for the announced times of the proposition archive. It will embrace a judicious profit strategy in view of its monetary presentation and future possibilities.

Examination WITH Recorded Companions:

According to the proposition record, the organization has shown Impex Ferro, and Indian Metal as their recorded companions. They are exchanging at a P/E of NA and 9.11 (as of February 21, 2024). Nonetheless, they are not similar on an apple-to-apple premise.

Trader BANKER’S History:

This is the 22nd command from Gretex Corporate in the last three fiscals, out of the last 10 postings, 3 opened at rebate, 1 at standard and the rest with charges going from 4.26% to 90% on the date of posting.

End/Venture Methodology

The organization is in the assembling and handling of minerals and metals. It stamped hop in its primary concerns from FY23 onwards that cause a stir as well as worry over its manageability going ahead. In view of its FY24 annualized super profit, the issue shows up completely valued. There is no mischief is avoiding this “High Gamble/Low Return” bet.