Bank Nifty and Nifty Support and Resistance Today, 21 March 2024

The Indian financial exchange records opened higher on Wednesday following the positive worldwide signs and before long deleted all increases. The homegrown business sectors exchanged pointedly lower in the first part of the day bargains and later recuperated. Among the areas, Energy, Auto, and IT are acquiring the most, while Metal, PSU Bank, and Monetary Administrations are hauling the business sectors.

The Nifty deleted intraday misfortunes and exchanged higher by 42 or 0.20% at 21860 levels. The record made a high of 21891.70 and a day’s low of 21710.20, with a development of 181.5 focuses till now. The Nifty Fates Walk series is exchanging at a 72-point premium at 21932, contrasted with the Clever 50 spot cost.

The NSE week after week choice chain information for 21 Walk showed that the Open Interest (OI) appropriation for Nifty Put choices is generally eminent at 21700 and 21500, demonstrating likely help for now. In the interim, on the Call side, significant Open Interest fixations are distinguished at the 21900 and 22000 strike costs, recommending potential opposition levels for Clever.

As indicated by Prabhudas Lilladher, the rumored broking house, Nifty has support at 21678 levels and has obstruction at 21933 and 22048 for the afternoon.

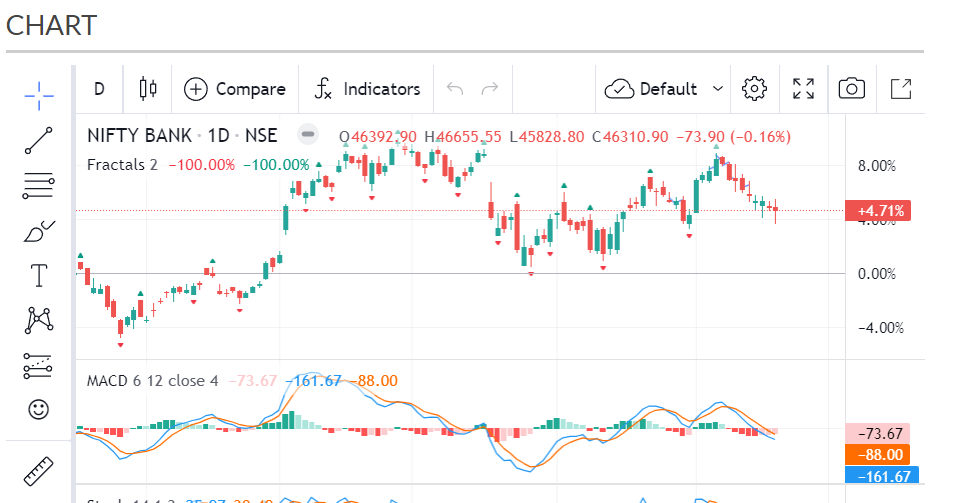

Bank Nifty Support and Resistance

The Bank Nifty record exchanged exceptionally unpredictable the morning arrangements and exchanges lower by 118 or 0.26% at 46268 level. The record made a high of 46570.25, while hit a day’s low at 45828.80 such a long ways on the spot cost, with a development of 741.45 places. The Bank Clever Prospects for Spring series is exchanging at a higher cost than normal of 137 focuses at 46405 contrasted with the Bank Nifty spot cost.

Today is Bank Nifty week by week choices expiry, the NSE week after week choice chain information for 20 Walk uncovers that the Put choices 46000 and 45800 hold the most significant focus. This level will probably act as a basic help zone for the afternoon. Alternately, the Bank Nifty Call strike at 46500 shows prominent OI focuses, implying potential opposition levels for the afternoon.

Bank Nifty Futures Prediction for Tomorrow, 21 March 2024

Essential Pattern in Bank Nifty Prospects Negative

Range-Bound Pattern of Bank Nifty Future: All up moves can Start Benefit Booking @ 46800 while Generally down moves can Start Short Covering @ 46150.

Bank Nifty prospects for the Walk series shut down at 46429.90, along with some built-in costs of 45.1 contrasted with Bank Clever’s end of 46384.80 in the money market.

Assume the Bank Nifty prospects move over 46510 and maintain, then, at that point, the file can exchange the scope of 46600-46680-46800 levels during the day.

On the off chance that the Bank Nifty prospects move under 46300 and maintain, the file can exchange the scope of 46215-46130-45970 levels during the day.

Global Market Updates

The other Asian securities exchange files generally shut in the red on Tuesday, as financial backers stayed wary in front of the US Took care of’s gathering and stresses over China’s property emergency. True to form, the Bank of Japan finished its negative loan fee and abrogated its yield bend control strategy.

Japan’s Nikkei 225 was at first unstable after the strategy declaration and later shut over 40000 imprint, while Japanese government security yields fell. In the mean time, Australia’s S&P ASX 200 record shut higher, as the Hold Bank of Australia (RBA) kept the financing costs unaltered at a 12-year high.

Hang Seng shut lower as tech stocks hauled the files, while Shanghai broadened early misfortunes. Somewhere else, South Korea’s Kospi record, Taiwan, and SET composite shut lower while, the Waterways Times and Jakarta Composite finished in the green.

European securities exchange files are exchanging blended in with little changes on Tuesday as financial backers stay careful in front of the US Took care of’s gathering for additional hints about loan cost cuts in June. In the US, Dow Jones and Nasdaq fates are exchanging lower showing a negative opening for the US showcases today.