Analyzing Europe Market Indexes on April 15th, 2024

Introduction

On April 15th, 2024, the European market indexes underwent significant movements, drawing attention from investors worldwide. In this analysis, we delve into the performance of major European indexes and the underlying factors driving these market movements.

Overview of Europe Market Indexes

European market indexes serve as crucial indicators of regional economic health and investor sentiment. They encompass a diverse range of sectors and companies, reflecting the overall performance of the European economy.

Performance of Major European Indexes

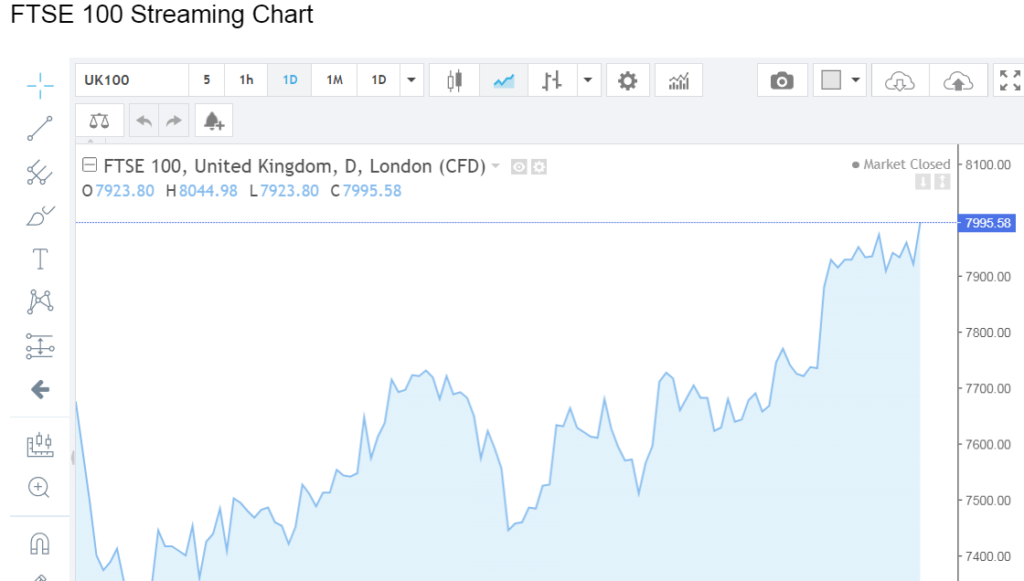

1. FTSE 100 (United Kingdom)

The FTSE 100 index, comprising the top 100 companies listed on the London Stock Exchange, experienced fluctuations on April 15th, influenced by Brexit-related uncertainties, corporate earnings reports, and geopolitical developments.

2. DAX (Germany)

Germany’s DAX index, representing the performance of the Frankfurt Stock Exchange’s 30 largest companies, demonstrated resilience amidst global economic challenges, driven by robust exports and technological innovation in key industries.

3. CAC 40 (France)

The CAC 40 index, comprising the 40 largest companies listed on the Euronext Paris, reflected France’s economic performance and policy decisions. On April 15th, it experienced volatility due to macroeconomic data releases and investor sentiment.

4. IBEX 35 (Spain)

Spain’s IBEX 35 index, consisting of the 35 most liquid Spanish stocks traded on the Madrid Stock Exchange, faced headwinds from domestic political uncertainties and fluctuations in commodity prices, impacting investor confidence.

Factors Influencing Market Movements

1. Economic Indicators and Trends

Economic indicators such as GDP growth, inflation rates, and unemployment figures influenced investor sentiment and market expectations. Positive economic data often led to bullish sentiments, while negative trends triggered caution among investors.

2. Geopolitical Events Impacting Markets

Geopolitical tensions, including trade disputes, diplomatic conflicts, and regional instability, had a significant impact on European markets, leading to volatility and risk aversion among investors seeking safe-haven assets.

3. Corporate Performance and Earnings Reports

Earnings reports and corporate announcements played a crucial role in shaping market movements, with companies exceeding or falling short of analysts’ expectations influencing stock prices and investor confidence.

4. Monetary Policy Decisions

Central bank actions, including interest rate decisions, quantitative easing programs, and forward guidance, influenced market liquidity, borrowing costs, and investor sentiment, with implications for asset prices and economic growth prospects.

5. Industry-Specific Analysis

Different industries within the European market exhibited varying performance based on sector-specific factors such as technological advancements, regulatory changes, and consumer trends, influencing overall market dynamics.

6. Impact of Technological Advancements

Technological innovations and digital transformations reshaped traditional business models and industry landscapes, presenting both opportunities and challenges for European companies and investors navigating evolving market conditions.

7. Investor Sentiment and Behavior

Investor sentiment, influenced by market news, social media trends, and psychological factors, played a pivotal role in driving short-term market movements, often leading to herd behavior and momentum trading.

Conclusion

The analysis of Europe market indexes on April 15th, 2024, highlights the complex interplay of economic, geopolitical, and industry-specific factors shaping market dynamics. By staying informed and adopting a long-term perspective, investors can navigate volatility with confidence and capitalize on opportunities for sustainable growth.

Unique FAQs

- How do geopolitical events impact European markets?

- Geopolitical events such as trade tensions and regional conflicts can lead to market volatility and risk aversion among investors, affecting asset prices and economic outlooks.

- What role do central banks play in influencing European market movements?

- Central banks’ monetary policy decisions, including interest rate adjustments and stimulus measures, impact market liquidity, borrowing costs, and investor sentiment, shaping overall market dynamics.

- How does investor sentiment affect market behavior?

- Investor sentiment, influenced by news, social media trends, and psychological factors, can drive short-term market movements, leading to herd behavior and volatility.

- What are some industry-specific factors impacting European markets?

- Industry-specific factors such as technological advancements, regulatory changes, and consumer trends can significantly influence the performance of European markets, affecting individual sectors and companies differently.

- How can investors navigate market volatility in Europe?

- By staying informed, diversifying portfolios, and maintaining a long-term perspective, investors can effectively navigate market volatility in Europe and capitalize on opportunities for sustainable growth.