Aimtron Electronics Limited IPO Full Details

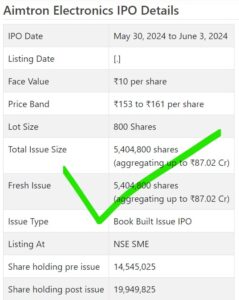

Aimtron Hardware Initial public offering is a book constructed issue of Rs 87.02 crores. The issue is totally a new issue of 54.05 lakh shares.

Aimtron Hardware Initial public offering opens for membership on May 30, 2024 and closes on June 3, 2024. The allocation for the Aimtron Gadgets Initial public offering is supposed to be concluded on Tuesday, June 4, 2024. Aimtron Gadgets Initial public offering will list on NSE SME with conditional posting date fixed as Thursday, June 6, 2024.

Aimtron Hardware Initial public offering cost band is set at ₹153 to ₹161 per share. The base parcel size for an application is 800 Offers. The base measure of venture expected by retail financial backers is ₹128,800. The base parcel size speculation for HNI is 2 parts (1,600 offers) adding up to ₹257,600.

• The organization is participated occupied with giving items and answers for hardware frameworks.

• It checked irregularity in its monetary execution with helped main concerns throughout the previous 21 months working.

• In light of annualized super profit for FY24, the issue shows up forcefully estimated.

• The organization is working in an exceptionally serious and divided section.

• There is no mischief in skirting this avariciously estimated offer.

Prelude:

This organization recorded its DRHP on December 18, 2023, yet this archives were accessible just on the assigned trade site, and shockingly it was not accessible on either Lead Director’s site or the Organization site till Tuesday – May 28, 2024 morning. The Initial public offering cost band declaration came in Monetary Express dated May 24, 2024, yet no RHP was accessible on any open areas. It’s an issue of consistence, where LM has neglected to keep its site refreshed and has not even maybe taught the organization for such compliances. We are neglecting to comprehend the reason why such passes are found and no move from controllers is made in the right soul. Such a things have become normal for SME Initial public offerings overall and with this lead director specifically. Such thing isn’t seen as, taking everything into account.

ABOUT Organization:

Aimtron Gadgets Ltd. (AEL) is participated occupied with giving items and arrangements towards hardware framework plan and assembling (“ESDM”) administrations with an emphasis on high worth accuracy designing items. It gives item and arrangements right from printed circuit board (“PCB”) plan and gathering to the assembling of complete electronic frameworks (“Box Work”), to specific homegrown and worldwide makers situated in India, US of America, Hong Kong, Joined Realm, Spain, Mexico.

The organization offers customized answers for clients’ requirements, including computerized miniature gadgets gathering and accuracy part incorporation. AEL’s answers include its client giving the plan to the item for which it gives fabricating administrations or at times require AEL to plan the important item founded on the particulars given by the client including assembling of the item. Its answers fundamentally contain: (I) printed circuit board gathering (“PCBA”), (ii) any case construct congregations as well as finding its application in battery the executives frameworks utilized in electrical vehicles (iii) plan arrangements offering start to finish benefits right from conceptualizing the plan, designing, item model turn of events, assembling of turnkey necessities for clients.

AEL began in 2011 as an unadulterated play PCB originator and constructing agent and over the course of the years has put resources into capacities and become one stop ESDM arrangement supplier. Every one of its differentiated capacities remains solitary on its own legitimacy, giving clients various choices while additionally empowering its development in every one of these areas. The Organization offers an expansive scope of items and administrations across numerous industry fragments. These ESDM items and administrations are fundamental for modern mechanization, electric vehicle portability, IoT and inserted frameworks, medtech and wearables, gaming, advanced mechanics and so on. They give more significant level observing and control different elements of machines to characterize, sort out, and meet creation goals. The end-use ventures that it takes care of include: Modern area, Clinical and Medical services Gear, Autos, Power, Gaming, Robots and UAV (automated flying vehicle) and so forth. As of December 31, 2023, it had 132 workers on its finance.

ISSUE Subtleties/CAPITAL HISTORY:

The organization is emerging with its lady book building course Initial public offering of 5404800 value portions of Rs. 10 each to prepare Rs. 87.02 cr. at the upper cap. It has reported a value band of Rs. 153 – Rs. 161 for every offer. The issue opens for membership on May 30, 2024, and will close on June 03, 2024. The base application to be made is for 800 offers and in products consequently, from that point. Post designation, offers will be recorded on NSE SME Arise. The issue comprises 26.48% of the post-Initial public offering settled up capital of the organization. From the net returns of the Initial public offering, it will use Rs. 15 cr. for reimbursement of specific remarkable borrowings, Rs. 18.63 cr. for capex on establishment of extra plant and hardware, Rs. 25.20 cr. for working capital, and the rest for general corporate purposes.

As the organization did a pre-Initial public offering situation of 464000 value shares at a cost of Rs. 148 for each offer (worth Rs. 6.87 cr.), the Initial public offering size is decreased to that degree.

The issue is exclusively lead overseen by Stitch Protections Ltd., and Connection Intime India Pvt. Ltd., is the enlistment center to the issue. Sew gathering’s Fix Finlease Pvt. Ltd. is the market creator for the organization.

Having given beginning value shares at standard worth, the organization gave further value capital in the value scope of Rs. 75.26 – Rs. 550 for each divide among December 2015 and February 2024. It has additionally given extra offers in the proportion of 4 for 1 in October 2023.The normal expense of obtaining of offers by the advertisers is Rs. 2.00, Rs. 3.11, and Rs. 18.93 per share.

Post-Initial public offering, organization’s ongoing settled up value capital of Rs. 15.01 cr. will stand improved to Rs. 20.41 cr. In light of the upper Initial public offering cost band, the organization is searching for a market cap of Rs. 328.66 cr.

Monetary Execution:

On the monetary execution front, for the last three fiscals, the organization has posted a complete income/net benefit/ – (loss) of Rs. 54.06 cr. /Rs. 15.72 cr. (FY21), Rs. 26.89 cr. /Rs. – (1.80) cr. (FY22), Rs. 72.40 cr. /Rs. 8.63 cr. (FY23). For 9M of FY24 finished on December 31, 2023, it procured a net benefit of Rs. 9.77 cr. on an all out income of Rs. 67.64 cr.

For the last three fiscals, it has revealed a normal EPS of Rs. 9.14 and a normal RoNW of 23.09%. The issue is estimated at a P/BV of 5.71 in view of its NAV of Rs. 28.19 as of December 31, 2023. Its post-Initial public offering NAV information on the lower and upper cost band is absent from Initial public offering cost band notice.

On the off chance that we quality annualized FY24 income to its post-Initial public offering completely weakened settled up capital, then, at that point, the asking cost is at a P/E of 25.24. Consequently the Initial public offering shows up forcefully valued and has posted irregularity in its top and main concerns. The unexpected lift in primary concerns throughout the previous 21 months cause a commotion and worry over its maintainability as it is working in a profoundly cutthroat and divided portions.

For the announced periods, the organization has posted PAT edges of 29.78% (FY21), – (6.84) % (FY22), 12.06% (FY23), 14.56% (9M-FY24), and RoCE edges of 87.29%, – (5.55) %, 25.33%, 27.93% individually for the alluded periods.

Profit Strategy:

The organization has not announced any profits for the revealed times of the proposition record. It will take on a judicious profit strategy in light of its monetary exhibition and future possibilities.

Correlation WITH Recorded Companions:

According to the proposition archive, the organization has shown Kaynes Techno, Vinyas Imaginative, Avalon Techno, and Syrma SGS, as their recorded companions. They are exchanging at a P/E of 115, 99.7, 113, and 76.9 (as of May 28, 2024). In any case, they are not equivalent on an apple-to-apple premise.

Shipper BANKER’S History:

This is the 44th command from Fix Protections in the last three fiscals (counting the continuous one), out of the last 10 postings, 1 recorded at markdown and the rest with charges going from 4.63% to 165.22% on the date of posting.

End/Venture Technique

The organization posted irregularity in its monetary exhibitions for the detailed periods. Supported main concerns throughout the previous 21 months’ presentation cause a commotion and worry over its manageability as it is working in a profoundly cutthroat and divided fragment. In view of annualized super profit for FY24, the issue shows up forcefully valued. There is no damage in skirting this ravenously valued. Wager.