GP Eco Solutions India Limited IPO Full Details

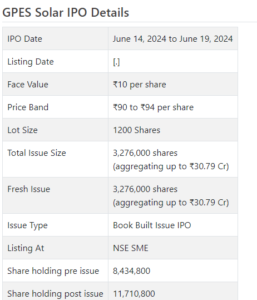

GPES Sun oriented Initial public offering is a book constructed issue of Rs 30.79 crores. The issue is completely a new issue of 32.76 lakh shares.

GPES Sun oriented Initial public offering opened for membership on June 14, 2024 and will close on June 19, 2024. The distribution for the GPES Sun oriented Initial public offering is supposed to be concluded on Thursday, June 20, 2024. GPES Sun oriented Initial public offering will list on NSE SME with provisional posting date fixed as Monday, June 24, 2024.

GPES Sun oriented Initial public offering cost band is set at ₹90 to ₹94 per share. The base part size for an application is 1200 Offers. The base measure of speculation expected by retail financial backers is ₹112,800. The base part size speculation for HNI is 2 parcels (2,400 offers) adding up to ₹225,600.

• The organization is fundamentally connected as a wholesaler for sun powered inverters and boards.

• It stamped consistent development in its top and primary concerns from FY21 to FY23.

• The unexpected lift in its primary concerns for 9M-FY24 cause a commotion and worry over its manageability proceeding.

• In light of FY24 super annualized profit, the issue shows up completely valued.

• All around informed/cash overflow financial backers might stop moderate assets for long haul rewards.

ABOUT Organization:

GP Eco Arrangements India Ltd. (GESIL) is engaged with the dissemination of a great many sun based inverters and sun powered chargers. The organization is an approved wholesaler of Sungrow India Pvt Ltd or “Sungrow” for Sun powered Inverters in North India, and is additionally approved merchants for Saatvik Efficient power Energy Private Restricted or “Saatvik” and LONGi Sun based Innovation Co. Ltd or “LONGi” for sun powered chargers in North India. Also, it fills in as a coordinated sun powered energy arrangements supplier, conveying thorough designing, acquirement, and development (“EPC”) administrations to business and private clients, but the commitment of this portion is relatively less when contrasted with business of dispersion of sun based inverters and sunlight powered chargers.

The organization additionally has its own image called “Invergy”. Under the Invergy brand, it sells half breed sun powered inverters and lithium ferro phosphate (LFP) batteries. Invergy bargains in OEM fabricating for mixture and LFP items. Invergy has its own quality and solid convention for contract assembling of these items. Invergy deals with its own inventory network stream to give simple and agreeable advances. The organization creates around 15% income on own brands and the rest from outsider brands, and has B2B deals of around 99.9% and balance from B2C as of December 31, 2023. As of the date of RHP, it had 16 workers on its finance.

ISSUE Subtleties/CAPITAL HISTORY:

The organization is emerging with its lady book building course Initial public offering of 3276000 value portions of Rs. 10 each to prepare Rs. 30.79 cr. at the upper cap. It has reported a value band of Rs. 90 – Rs. 94 for every offer. The issue opens for membership on June 14, 2024, 2024, and will close on June 19, 2024. The base application to be made is for 1200 offers and in products consequently, from there on. Post allocation, offers will be recorded on NSE SME Arise. The issue is 27.97% of the post-Initial public offering settled up capital of the organization. From the net returns of the Initial public offering, it will use Rs. 12.45 cr. for working capital, Rs. 7.60 cr. for interest in auxiliary (Invergy India), and the rest for general corporate purposes.

The issue is exclusively lead overseen by Corporate Capitalventures Pvt. Ltd., and Bigshare Administrations Pvt. Ltd. is the enlistment center to the issue. SS Corporate Protections Ltd. is the market producer for the organization.

Having given starting value shares at standard, the organization gave further value shares at a decent cost of Rs. 50 for every offer in January 2024, and has likewise given extra offers in the proportion of 35 for 1 in December 2023. The typical expense of procurement of offers by the advertisers is Rs. Nothing, Rs. 0.28 and Rs. 11.46 per share.

Post-Initial public offering, organization’s ongoing settled up value capital of Rs. 8.43 cr. will stand upgraded to Rs. 11.71 cr. In view of the upper Initial public offering cost band, the organization is searching for a market cap of Rs. 110.08 cr.

Monetary Execution:

On the monetary execution front, for the last three fiscals, the organization has posted a complete pay/net benefit of Rs. 46.53 cr. /Rs. 0.97 cr. (FY21), Rs. 83.53 cr. /Rs. 2.77 cr. (FY22), and Rs. 104.48 cr. /Rs. 3.70 cr. (FY23). For 9M of FY24 finished on December 31, 2023, it procured a net benefit of Rs. 4.73 cr. on an all out pay of Rs. 78.59 cr.

For the last three fiscals, it has detailed a normal EPS of Rs. 4.07, and a typical RoNW of 71.52%. The issue is estimated at a P/BV of 5.21 in light of its NAV of Rs. 18.03 as of December 31, 2023, and at a P/BV of 2.20 in view of its post-Initial public offering NAV of Rs. 42.65 per share (at the upper cap).

On the off chance that we quality annualized FY24 super income to its post-Initial public offering completely weakened settled up capital, then, at that point, the asking cost is at a P/E of 17.44. Accordingly the issue shows up completely evaluated.

For the announced periods, the organization has posted PAT edges of 2.08% (FY21), 3.32% (FY22), 3.54% (FY23), 6.02% (9M-FY24), and RoCE edges of 30.16%, 44.15%, 14.24%, 26.51% separately for the alluded periods.

Profit Strategy:

The organization has not announced any profits since fuse. It will take on a reasonable profit strategy in light of its monetary exhibition and future possibilities.

Correlation WITH Recorded Friends:

According to the deal record, the organization has shown Sungarner Energies as their recorded companions. It is exchanging at a P/E of 93.0 (as of June 11, 2024). Be that as it may, they are not practically identical on an apple-to-apple premise.

Trader BANKER’S History:

This is the thirteenth command from Corporate Capital in the last four fiscals (counting the continuous one), out of the last 11 postings, all recorded with expenses going from 17.65% to 245.24% on the posting date.

End/Speculation System

The organization is in dispersion of sunlight based inverters and boards which is a profoundly serious and divided fragment. The organization posted consistent development in its top and primary concerns for FY21 to FY23, however its main concern supported for 9M-FY24 that cause a stir and worry over its supportability. In view of FY24 annualized super profit, the issue shows up completely estimated. All around informed/cash overflow financial backers might stop moderate assets for long haul rewards.

Audit By Dilip Davda on June 11, 2024

Audit Creator

DISCLAIMER: No monetary data at all distributed anyplace here ought to be understood as a proposal to trade protections, or as counsel to do as such in any capacity at all. All matter distributed here is only for instructive and data purposes just and by no means ought to be utilized for settling on venture choices. My surveys don’t cover GMP market and administrators courses of action. Perusers should counsel a certified monetary guide prior to going with any genuine speculation choices, put together the with respect to data distributed here. With section obstructions, SEBI believes that main all around informed financial backers should partake in such offers. With insane postings in the new past, SME Initial public offerings drew the consideration of financial backers in all cases and lead to diviner frenzy. Nonetheless, as SME issues have passage obstructions and proceeded with low inclination from the broking local area, any peruser taking choices in view of any data distributed here does so totally notwithstanding the obvious danger ahead. The above data depends on data accessible as of date combined with market insights. The Creator has no designs to put resources into this proposition.