Macobs Technologies Limited IPO Full Details

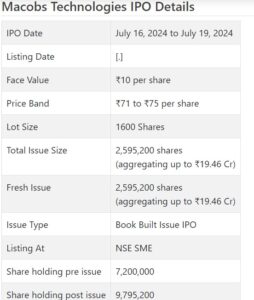

Macobs Innovations Initial public offering is a book constructed issue of Rs 19.46 crores. The issue is completely a new issue of 25.95 lakh shares.

Macobs Innovations Initial public offering opened for membership on July 16, 2024 and will close on July 19, 2024. The distribution for the Macobs Innovations Initial public offering is supposed to be concluded on Monday, July 22, 2024. Macobs Innovations Initial public offering will list on NSE SME with conditional posting date fixed as Wednesday, July 24, 2024.

Macobs Innovations Initial public offering cost band is set at ₹71 to ₹75 per share. The base part size for an application is 1600 Offers. The base measure of speculation expected by retail financial backers is ₹120,000. The base part size speculation for HNI is 2 parcels (3,200 offers) adding up to ₹240,000.

• MTL is working in the male prepping industry through web based business stage.

• The organization posted development in its top and primary concerns for the detailed periods.

• Technocrat advertisers have received the rewards of their endeavors and desires to work on further.

• In view of FY24 profit, the issue shows up forcefully estimated.

• Very much educated financial backers might stop assets for the medium to long haul.

ABOUT Organization:

Macobs Advancements Ltd. (MTL) works inside the male prepping industry, spend significant time in the specialty area of disgraceful preparing, and leads its business only through web based business channels, for example, its site without keeping up with actual stores or a customary retail impression. This center tends to a huge hole on the lookout, especially in districts where conversation around such parts of individual consideration is many times restricted. It offers a scope of items explicitly intended for men’s preparing needs, enveloping instruments like specific clippers for delicate regions, cleanliness items customized for male skin, and an assortment of taking care of oneself things.

These items are created with a guarantee to development, security, and viability, taking special care of the interesting prerequisites of their objective segment. Past its item range, the Organization is devoted to teaching and changing cultural insights about male prepping, essentially utilizing on the web stages. This includes making and sharing substance that advances mindfulness and open discussion on subjects generally viewed as no.

The organization’s methodology is profoundly client driven, zeroing in on understanding and meeting the developing requirements of its buyers through advanced commitment and criticism systems. As of the date of recording this proposition report, it had 15 representatives on its finance.

This organization is advanced by technocrats knowledgeable with the online business fragment and have yielded the advantages of their endeavors in quick development. Post more supports accessibility after the Initial public offering, they are sure to work on their presentation as the interest for the items promoted is on the ascent.

ISSUE Subtleties/CAPITAL HISTORY:

The organization is emerging with its lady book building course Initial public offering of 2595200 value portions of Rs. 10 each to prepare Rs. 19.46 cr. at the upper cap. It has declared a value band of Rs. 71 – Rs. 75 for every offer. The issue opens for membership on July 16, 2024, and will close on July 19, 2024. The base application to be made is for 1600 offers and in products subsequently, from there on. Post portion, offers will be recorded on NSE SME Arise. The issue comprises 26.50% of the post-Initial public offering settled up capital of the organization. From the net returns of the Initial public offering, it will use Rs. 2.00 cr. for client securing, Advertising and Mindfulness, Rs. 1.50 cr. for reimbursement/prepayment of specific borrowings, Rs. 12.00 cr. working capital, and the rest for general corporate purposes.

The issue is exclusively lead overseen by SKI Capital Administrations Ltd., and Maashitla Protections Pvt. Ltd. is the recorder to the issue. SKI Capital Administrations Ltd. is likewise the market creator for the organization.

The organization has given whole value shares at standard worth up until this point. It has additionally given extra offers in the proportion of 2 for 1 in July 2023. The typical expense of procurement of offers by the advertisers is Rs. 7.19 per share.

Post-Initial public offering, organization’s ongoing settled up value capital of Rs. 7.20 cr. will stand improved to Rs. 9.80 cr. In light of the upper Initial public offering cost band, the organization is searching for a market cap of Rs. 73.46 cr.

Monetary Execution:

On the monetary execution front, for the last three fiscals, the organization has posted a complete pay/net benefit of Rs. 6.02 cr. /Rs. 0.39 cr. (FY22), Rs. 14.83 cr. /Rs. 2.05 cr. (FY23), and Rs. 20.75 cr. /Rs. 2.21 cr. (FY24).

For the last three fiscals, it has revealed a normal EPS of Rs. 3.71, and a typical RoNW of 55.35%. The issue is valued at a P/BV of 5.50 in view of its NAV of Rs. 13.65 as of Walk 31, 2024, and at a P/BV of 2.51 in light of its post-Initial public offering NAV of Rs. 29.90 per share (at the upper cap).

On the off chance that we trait FY24 income to its post-Initial public offering completely weakened settled up capital, then the asking cost is at a P/E of 33.19. Accordingly the issue shows up forcefully valued.

For the announced periods, the organization has posted PAT edges of 6.47% (FY22), 13.84% (FY23), 10.73% (FY24), and RoCE edges of 96.30%, 106.02%, 30.53% separately for the alluded periods.

Profit Strategy:

The organization has not pronounced any profits since fuse. It will embrace a reasonable profit strategy in light of its monetary exhibition and future possibilities.

Examination WITH Recorded Friends:

According to the proposition report, the organization has shown FSN Internet business, and Honasa Shopper as their recorded friends. They are exchanging at a P/E of 433.78 and 126.96 (as of July 12, 2024). Nonetheless, they are not similar on an apple-to-apple premise. These friends contrast shows up with be an eyewash.

Shipper BANKER’S History:

This is the first command from SKI Capital in the progressing fiscals and has no previous histories.

End/Venture Methodology

The organization is advertising the male prepping items on web based business stage and has prevailed with regards to come by the ideal outcomes. The administration is certain on further developing its exhibition post Initial public offering subsidizes accessibility. It posted development in its top and main concerns for the announced periods. In light of FY24 profit, the issue shows up forcefully estimated. All around informed financial backers might stop assets for the medium to long haul.

Survey By Dilip Davda on July 13, 2024