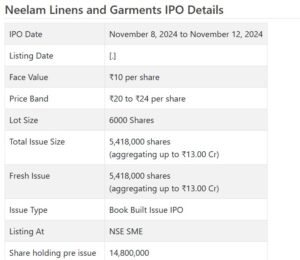

Neelam Cloths and Pieces of clothing Initial public offering is a book fabricated issue of Rs 13.00 crores. The issue is completely a new issue of 54.18 lakh shares.

Neelam Cloths and Pieces of clothing Initial public offering opened for membership on November 8, 2024 and will close on November 12, 2024. The apportioning for the Neelam Cloths and Articles of clothing Initial public offering is supposed to be concluded on Wednesday, November 13, 2024. Neelam Materials and Articles of clothing Initial public offering will list on NSE SME with speculative posting date fixed as Monday, November 18, 2024.

Neelam Cloths and Pieces of clothing Initial public offering cost band is set at ₹20 to ₹24 per share. The base part size for an application is 6000 Offers. The base measure of speculation expected by retail financial backers is ₹144,000. The base part size speculation for HNI is 2 parcels (12,000 offers) adding up to ₹288,000.

• The organization is taken part occupied with exchanging and handling of home outfitting items, related administrations and offer of import licenses.

• The organization posted however static, yet conflicting monetary execution for revealed periods.

• In view of FY25 annualized super profit, the issue shows up completely evaluated.

• Higher obligation raises central issue as its obligation value proportion is 3.12 as of June 30, 2024.

• The organization works in a profoundly cutthroat and divided fragment.

• There is no damage in avoiding this “High Gamble/Low Return” bet.

ABOUT Organization:

Neelam Materials and Pieces of clothing (India) Ltd. (NLGIL) is occupied with handling and exchanging of items, offer of licenses. It works as a delicate home outfitting organization based out of Maharashtra, India, stretching out its administrations to a worldwide customers, including USA, Australia and Far East. The organization works in the handling, getting done and providing of bedsheets, Pad cover, Duvet Cover, Towels, Carpets, Doher, Shirts and Articles of clothing overwhelmingly for limited retail outlets. It sources excess or somewhat flawed texture from the homegrown market, applying esteem added administrations like planning, advanced printing, coloring, sewing, weaving, and different improvements. Accordingly, it conveys these refined items to limited retail outlets in different nations.

The organization entered the clothing business by beginning an in-house creation of people’s design attire starting around 2023. It likewise acquires income from offer of import licenses. An import permit is a legislative approval expected for the imports of products that are not unreservedly importable. Licenses of this structure confine the quantity of things entering a country to the very prerequisites of those items and the country’s traditions guidelines. The public authority fundamentally offers the licenses as a monetary motivation to exporters, and once conceded, they become products. Import licenses, which award the holder the option to import merchandise that might be confined or controlled, are viewed as a help when they are sold or moved.

The offer of permit business of the Organization can be bifurcated into two sections, for example offer of the import permit got from the public authority as a motivation and exchanging of the import permit accessible on the lookout. The offer of import permit got from government as a piece of motivator incorporates RODTEP (Reduction of obligations and duties on send out item) and ROSCTL (Discount of state and focal Charges and Requires). These e-scripts are given by customs in regard of Abatement of implanted neighborhood obligations and duties collected on Coxcomb worth of the sent out merchandise. As the Organization imports no sort of products, they deal something similar to the merchant accessible in the market at a sensible markdown. As of June 30, 2024, it had 56 representatives on its finance (counting 48 provisional laborers).

ISSUE Subtleties/CAPITAL HISTORY:

The organization is emerging with its lady book building course Initial public offering of 5418000 value portions of Rs. 10 each to prepare Rs. 13.00 cr. (at the upper cap). The organization has declared a value band of Rs. 20 – Rs. 24 for each offer. The issue opens for membership on November 08, 2024, and will close on November 12, 2024. The base number of offers to be applied is for 6000 offers and in products subsequently, from that point. Post assignment, offers will be recorded on NSE SME Arise. The issue comprises 26.80% of the post-Initial public offering settled up capital of the organization. From the net returns of the Initial public offering, the organization will use Rs. 5.57 cr. for capex on acquisition of weaving machines for development, Rs. 4.00 cr. for reimbursement/prepayment of specific borrowings, and the rest for general corporate purposes.

The Initial public offering is exclusively lead overseen by Master Worldwide Specialists Pvt. Ltd., while Purva Sharegistry (India) Pvt. Ltd. is the recorder to the issue. Globalworth Protections Ltd., is the Market Creator for the organization. The issue is endorsed to the tune of 15% by Master Worldwide and 85% by Globalworth.

Having given beginning value shares at standard worth, the organization gave further value partakes in the value scope of Rs. 33.00 – Rs. 1076 for every divide among May 2011, and July 2022. It has likewise given extra offers in the proportion of 30 for 1 in July 2022, and 1 for 1 in June 2023. The typical expense of procurement of offers by the advertisers is Rs. 3.39, and Rs. 8.76 per share.

Post-Initial public offering, organization’s ongoing settled up value capital of Rs. 14.80 cr. will stand upgraded to Rs. 20.22 cr. In view of the upper value band of the Initial public offering, the organization is searching for a market cap of Rs. 48.52 cr.

Monetary Execution:

On the monetary execution front, for the last three fiscals, the organization has posted a complete pay/net benefit of Rs. 103.80 cr. /Rs. 2.99 cr. (FY22), Rs. 105.41 cr. /Rs. 2.38 cr. (FY23), and Rs. 104.74 cr. /Rs. 2.46 cr. (FY24). For Q1 of FY25 finished on June 30, 2024, it procured a net benefit of Rs. 0.81 cr. on a complete pay of Rs. 21.95 cr.

For the last three fiscals, the organization has detailed a normal EPS of Rs. 1.75 and a normal RoNW of 12.40%. The issue is valued at a P/BV of 1.46 in view of its NAV of Rs. 16.41 as of June 30, 2024, yet post-Initial public offering NAV information is missing from offer archives.

On the off chance that we trait FY25 annualized super income on post-Initial public offering completely weakened value capital, then the asking cost is at a P/E of 15.09, and in view of FY24 profit, the P/E remains at 19.67. The issue shows up completely valued.

For the detailed periods, the organization has posted PAT edges of 2.94% (FY22), 2.30 % (FY23), 2.40% (FY24), 3.69% (Q1-FY25), and RoCE edges of 16.74% (FY22), 13.64% (FY23), 13.69% (FY24), 3.84% (Q1-FY25). Its obligation value proportion of 3.12 as of June 30, 2024 raise concern.

Profit Strategy:

The organization has not delivered any profits since fuse. It will take on a reasonable profit strategy post posting, in light of its monetary exhibition and future possibilities.

COMPARISION WITH Recorded Companions:

According to the deal report, the organization has shown Steadfast Materials, Bannari Amman Spg., as their recorded companions. It is exchanging at a P/E of NA and NA (as of November 05, 2024). In any case, they are not really tantamount on an apple-to-apple premise.

Vendor BANKER’S History:

This is the thirteenth order from Master Worldwide in the last three fiscals (counting the continuous one). Out of the last 10 postings, 2 opened at rebate, and the rest opened with an expenses going from 15% to 110.36% on the date of posting.

End/Venture Technique

The organization is taken part in a profoundly serious and divided section of handling and exchanging home goods and related administrations. It is additionally managing in offer of import licenses. The organization posted static yet conflicting monetary exhibitions up until this point. Its obligation value proportion of 3.12 as of June 30, 2024 raises main pressing issue. In view of FY25 super annualized profit, the issue shows up completely estimated. There is no mischief in avoiding this “High Gamble/Low Return” offer.