Afcom Holdings Limited IPO Full Details

Afcom Property Initial public offering is a book fabricated issue of Rs 73.83 crores. The issue is totally a new issue of 68.36 lakh shares.

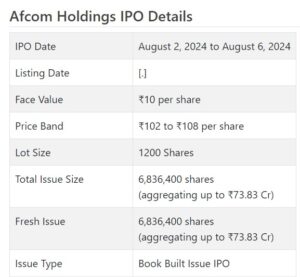

Afcom Property Initial public offering opens for membership on August 2, 2024 and closes on August 6, 2024. The portion for the Afcom Property Initial public offering is supposed to be settled on Wednesday, August 7, 2024. Afcom Possessions Initial public offering will list on BSE SME with conditional posting date fixed as Friday, August 9, 2024.

Afcom Property Initial public offering cost band is set at ₹102 to ₹108 per share. The base part size for an application is 1200 Offers. The base measure of venture expected by retail financial backers is ₹129,600. The base parcel size venture for HNI is 2 parts (2,400 offers) adding up to ₹259,200.

• The organization is taken part in carriage of freight on air terminal to-air terminal premise.

• It has made a specialty place in ASEAN nations where has dominated in administrations.

• The organization has posted consistent development with turning the corner in FY22.

• The patterns posted from FY22 onwards demonstrates what’s in store patterns and prospects.

• The organization will get first mover extravagant post posting.

• Financial backers might stop assets for the medium to long haul.

ABOUT Organization:

Afcom Possessions Ltd. (AHL) is taken part in carriage of freight on air terminal to-air terminal premise. Its Business is directed by three working standards: Human centricity: Its organization, courses and the arrangement it offers for the last mile network assists the business with tackling the inventory network issue that are looked by the clients. AHL’s Fundamental beliefs are: – Client first – Administration Greatness – Act with Honesty – Expand on trust – Development – Solid. It has designated General Deals and Administration Specialists (“GSSAs”) in India, Hong Kong, Singapore, Thailand, Japan, South Korea, China, Taiwan.

The Overall Deals and Administration Specialist – GSSAs address the Aircraft and market its freight space among different Cargo Forwarders on the lookout. They are the channel accomplice capability as the drawn out arm of the Carrier concerning booking the freight from the Cargo forwarders and direction with their Custom Clearing Specialist to clear the traditions and guarantee a smooth handover of the exceptionally cleared freight to the Carrier, alongside the expected records for shipment.

AHL has gone into concurrences with the GSSAs, as per which the GSSAs should give at least half of the volume of freight to it. The organization pay the GSSAs commission and motivator in view of the freight they give to it. Aside from GSSA, the organization additionally has business relations with cargo forwarders and freight deals specialists (“CSA”), who blocks space on AHL’s airplane and hand over the freight. It has gone into an understanding dated 24th September, 2021 with the Air Planned operations bunch (a piece of World Cargo Organization), which is a worldwide forerunner in the freight deals and administration business. The Air Planned operations bunch addresses the Organization as its GSSA in far-eastern nations. It has likewise gone into an understanding dated thirteenth October, 2022 with Taylor Planned operations Private Restricted, which is a piece of the TTK Gathering as its GSSA in India.

AHL’s central goal is to empower clients to work adaptable, solid and versatile inventory chains at a superior incentive. It gave production network answers for a different base of clients. Dynamic Clients like web based business commercial centers, direct-to-shopper e-rears and undertakings and SMEs across a few verticals like FMCG, purchaser durables, customer hardware, way of life, retail, car and assembling, through different Cargo Forwarders for the period finished February 29, 2024.

This is accomplished through top notch coordinated operations framework and organization designing, a tremendous organization of homegrown and worldwide accomplices and together, these make converging flywheels that drive network cooperative energies inside and across its administrations and upgrade incentive to clients. Delivering via air is a quick and productive method for shipping merchandise. Air Freight dealing with hardware becomes the overwhelming focus with regards to quickly getting merchandise across the globe. As the foundation of the Air Freight Industry, these instruments are utilized for stacking, dumping, arranging, and moving freight. We should dive into Air Freight dealing with hardware, investigating its sorts, capabilities, and importance in strategies.

Freight taking care of hardware guarantees the productive progression of merchandise around the world. These apparatuses work with freight development inside air terminals and airplane. Productive Air Freight taking care of gear is a structure block of the worldwide operations organization. In addition, with the development of web based business and global exchange, the interest for cutting edge and computerized taking care of gear has flooded. AHL’s absolute representative strength is 47 as on February 29, 2024 which comprises of 21 groups involving 10 commanders and 6 first officials and 3 Progress Skippers and 2 Learner First officials.

ISSUE Subtleties/CAPITAL HISTORY:

The organization is emerging with its lady book building course Initial public offering of 6836400 value portions of Rs. 10 each to activate Rs. 73.83 cr. at the upper cap. It has declared a value band of Rs. 102 – Rs. 108 for each offer. The issue opens for membership on August 02, 2024, and will close on August 06, 2024. The base application to be made is for 1200 offers and in products consequently, from there on. Post allocation, offers will be recorded on BSE SME. The issue comprises 27.50% of the post-Initial public offering settled up capital of the organization. From the net returns of the Initial public offering, it will use Rs. 42.80 cr. for capex on two new airplanes on rent premise, Rs. 10.00 cr. for prepayment/reimbursement of specific borrowings, Rs. 8.00 cr. for working capital, and the rest for general corporate purposes.

The issue is exclusively lead overseen by GYR Capital Guides Pvt. Ltd., and Connection Intime India Pvt. Ltd. is the recorder to the issue. Giriraj Stock Broking Pvt. Ltd. is the market creator for the organization.

Having given/changed over beginning value shares at standard worth, the organization gave/changed over additional value partakes in the value scope of Rs. 107 – Rs. 540 between May 2018 and January 2024. It has likewise given extra offers in the proportion of 4 5 for 10 in Walk 2023. The typical expense of procurement of offers by the advertisers is Rs. 4.68, Rs. 7.60, and Rs. 98.18 per share.

Post-Initial public offering, organization’s ongoing settled up value capital of Rs. 18.02 cr. will stand upgraded to Rs. 24.86 cr. In view of the upper Initial public offering cost band, the organization is searching for a market cap of Rs. 268.46cr.

Monetary Execution:

On the monetary execution front, for the last three fiscals, the organization has posted a complete income/net benefit/ – (loss) of Rs. 13.89 cr. /Rs. – (4.20) cr. (FY21), Rs. 48.67 cr. /Rs. 5.15 cr. (FY22), Rs. 84.90 cr. /Rs. 13.59 cr. (FY23). For 11M of FY24 finished on February 29, 2024, it procured a net benefit of Rs. 23.10 cr. on a complete income of Rs. 134.16 cr. The organization posted development in its top and primary concerns since FY22 onwards and the administration is certain of keeping up with this patterns in future too.

For the last three fiscals, it has revealed a normal EPS of Rs. 4.83, and a typical RoNW of 37.91%. The issue is valued at a P/BV of 1.93 in light of its NAV of Rs. 55.98 as of February 29, 2024, and at a P/BV of 1.54 in light of its post-Initial public offering NAV of Rs. 70.28 per share (at the upper cap).

On the off chance that we characteristic FY24 income to its post-Initial public offering completely weakened settled up capital, then the asking cost is at a P/E of 10.65, and in light of FY23 profit, the P/E remains at 19.74. The issue shows up sensibly valued.

For the announced periods, the organization has posted PAT edges of – (30.27) % (FY21), 10.66% (FY22), 16.15% (FY23), 17.28% (11M-FY24), and RoCE edges of – (103.67) %, 59.44%, 39.94%, 34.63% separately for the alluded periods.

Profit Strategy:

The organization has not announced any profits for any monetary year. It will embrace a reasonable profit strategy in view of its monetary exhibition and future possibilities.

Examination WITH Recorded Companions:

According to the proposition record, the organization has no recorded friends to contrast and.

Dealer BANKER’S History:

This is the 30th order from GYR Capital in the last four fiscals (counting the continuous one), out of the last 10 postings, all recorded with charges going from 36.36% to 366.67% on the date of posting.

End/Venture Technique

The organization is taken part in carriage of freight on Air terminal to-Air terminal premise. It has made a specialty place in the organization it works. The organization posted striking development since FY22 and the administration is sure of keeping up with the patterns going ahead with extra armada. In view of FY24 annualized profit, the issue shows up sensibly valued. It is set to get first mover extravagant post listing.,Investors might stop assets for the medium to long haul.

Commentator prescribes Buying into the issue.

Audit By Dilip Davda on July 30, 2024

Survey Creator

DISCLAIMER: No monetary data at all distributed anyplace here ought to be understood as a proposal to trade protections, or as counsel to do as such in any capacity at all. All matter distributed here is only for instructive and data purposes just and by no means ought to be utilized for settling on speculation choices. My surveys don’t cover GMP market and administrators approaches. Perusers should counsel a certified monetary guide prior to settling on any genuine speculation choices, put together the with respect to data distributed here. With section obstructions, SEBI believes just all around informed financial backers should partake in such offers. With insane postings in the new past, SME Initial public offerings drew the consideration of financial backers no matter how you look at it and lead to diviner franticness. Notwithstanding, as SME issues have passage obstructions and proceeded with low inclination from the broking local area, any peruser taking choices in light of any data distributed here does so completely in spite of all advice to the contrary. The above data depends on data accessible as of date combined with market discernments. The Creator has no designs to put resources into this proposition.