Akme Fintrade India Ltd IPO Full Details

Aasaan Credits Initial public offering is a book constructed issue of Rs 132.00 crores. The issue is totally a new issue of 1.1 crore shares.

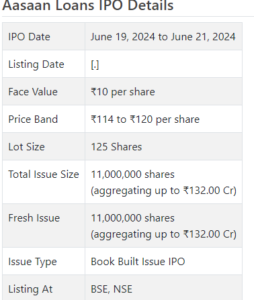

Aasaan Advances Initial public offering opens for membership on June 19, 2024 and closes on June 21, 2024. The designation for the Aasaan Advances Initial public offering is supposed to be finished on Monday, June 24, 2024. Aasaan Advances Initial public offering will list on BSE, NSE with conditional posting date fixed as Wednesday, June 26, 2024.

Aasaan Advances Initial public offering cost band is set at ₹114 to ₹120 per share. The base parcel size for an application is 125 Offers. The base measure of speculation expected by retail financial backers is ₹15,000. The base part size venture for sNII is 14 parcels (1,750 offers), adding up to ₹210,000, and for bNII, it is 67 parcels (8,375 offers), adding up to ₹1,005,000.

• AFIL is RBI enrolled NBFC having north driven business of monetary administrations contributions.

• It posted irregularity in its top and primary concerns for the announced periods.

• It stamped extreme difficulty for FY22 following the pandemic.

• In light of FY24 annualized profit, the issue seems aggresively estimated.

• There is no damage in avoiding this expensive issue.

ABOUT Organization:

Akme Fintrade India Ltd. (AFIL) is a non-banking finance organization (“NBFC”) consolidated in the year 1996 enrolled with the Hold Bank of India as a Non-foundationally significant non-store taking organization with more than twenty years of loaning experience in provincial and semi-metropolitan topographies in India. It is essentially participated in provincial and semi-metropolitan driven loaning answers for take care of the necessities and yearnings of country and semi-metropolitan people. Organization’s portfolio incorporates Vehicle Money and Business Money Items to entrepreneurs.

It has a long history of serving rustic and semi-metropolitan business sectors with high development potential and have kept a history of monetary execution and functional proficiency through reliably high paces of client procurement and maintenance and minimal expense venture into underpenetrated regions. Consequently, AFIL decisively centers around clients in the country and semi-metropolitan area. Its computerized loaning stage www.aasaanloans.com is at present a work in progress and will be carried out in a staged way. This computerized loaning stage, www.aasaanloans.com, has been as of now sent to a the expected credit principles prior to extending the rollout to a more extensive crowd at its branches.

As a primer measure, it has stepped up of sending off the site aasaanloans.com. This unmistakable methodology works with the distinguishing proof of organizations with okay and high potential, accordingly offering valuable open doors to people who recently needed admittance to both present moment and long haul supporting choices. AFIL has its impressions in provincial and semi-metropolitan topographies in 4 Indian states Rajasthan, Maharashtra, Madhya Pradesh and Gujarat through enrolled office situated at Udaipur, Rajasthan, its Corporate Office situated in Mumbai, Maharashtra, 12 branches and north of 25 marks of presence including advanced and actual branches having served more than 2,00,000 clients till date. As of December 31, 2023, it had 125 representatives on its finance.

ISSUE Subtleties/CAPITAL HISTORY:

The organization is emerging with its lady book-building course Initial public offering of 11000000 value portions of Rs. 10 each to activate Rs. 132 cr. at the upper cap of the cost band. The organization has reported a value band of Rs. 114 – Rs. 120 for every offer. The issue opens for membership on June 19, 2024, and will close on June 21′, 2024. The base application to be made is for 125 offers and in products consequently, from there on. The issue is 25.78% of post-Initial public offering settled up capital of the organization. Post portion, offers will be recorded on BSE and NSE. From the net returns of the Initial public offering, the organization will use the whole sum for expanding meeting future requirements capital base.

The organization has saved 550000 value shares for its qualified representatives and from the rest, it has allotted not over half for QIBs, at least 15% for HNIs, and at the very least 35% for Retail financial backers.

The issue is exclusively lead overseen by Gretex Corporate Administrations Ltd., and Bigshare Administrations Pvt. Ltd. is the recorder to the issue.

Having given beginning value shares at standard worth, the organization gave/changed over additional value partakes in the value scope of Rs. 30 – Rs. 800 between Walk 2004 and December 2022. It has likewise given extra offers in the proportion of 0.18 for 1 in September 2017, 4 for 1 in February 2020, and 0.13 for 1 in July 2022. The typical expense of securing of offers by the advertisers is Rs. 1.77, Rs. 1.82, Rs. 11.49, and Rs. 26.09 per share.

Post-Initial public offering, organization’s ongoing settled up value capital of Rs. 31.68 cr. will stand improved to Rs. 42.68 cr. In light of the upper cap of Initial public offering cost band, the organization is searching for a market cap of Rs. 512.10 cr.

Monetary Execution:

On the monetary execution front, for the last three fiscals, the organization has revealed an all out pay/net benefit of Rs. 86.79 cr. /Rs. 16.31 cr. (FY21), Rs. 67.50 cr. /Rs. 4.12 cr. (FY22), and Rs. 69.57 cr. /Rs. 15.80 cr. (FAY23). For 9M of FY24 finished on December 31, 2023, it procured a net benefit of Rs. 12.25 cr. on an all out pay of Rs. 53.45 cr.

For the last three fiscals, the organization has posted a normal EPS of Rs. 4.60 and a normal RoNW of 7.92%. The issue is evaluated at a P/BV of 1.75 in light of its NAV of Rs. 68.51 as of December 31, 2023, and at a P/BV of 1.47 in view of its post-Initial public offering NAV of Rs. 81.78 per share (at the upper cap).

On the off chance that we trait FY24 income to its post-Initial public offering completely weakened settled up value capital, then, at that point, the asking cost is at a P/E of 31.33. Subsequently the issue shows up forcefully estimated.

For the revealed periods, the organization has posted PAT edges of 18.92% (FY21), 6.11% (FY22), 22.73% (FY23), 22.93% (9M-FY24), and Repetition (Return on Unmistakable Value) 13.81%, 3.14%, 9.37%, 5.89% separately for the alluded periods.

Profit Strategy:

The organization has not proclaimed any profits for the detailed times of the proposition record. It took on a reasonable profit strategy in January 2023, in view of its monetary presentation and future possibilities.

Correlation WITH Recorded Companions:

According to offer archive, the organization has shown MAS Monetary, Shriram Money, Cholamandalam Venture, Arman Monetary, and CSL Money as their recorded friends. They are exchanging at a P/E of 20.3, 14.0, 35.5, 14.8, and 16.5 (as of June 14, 204). Nonetheless, they are not similar on an apple-to-apple premise.

Dealer BANKER’S History:

This is the 23rd order from Gretex Corporate in the last three fiscals (counting the continuous one). This is the first mainboard order from the LM in the progressing financial. It had 22 orders in the last three fiscals, out of which 5 issues shut underneath the proposition cost on posting date.