Analyzing Europe Market Indexes on April 18th, 2024

Introduction

In this comprehensive analysis, we delve into the intricate details of the Europe market indexes as of April 18th, 2024. Our aim is to provide valuable insights to investors, analysts, and enthusiasts alike, shedding light on the current state of the European financial landscape.

European Market Overview

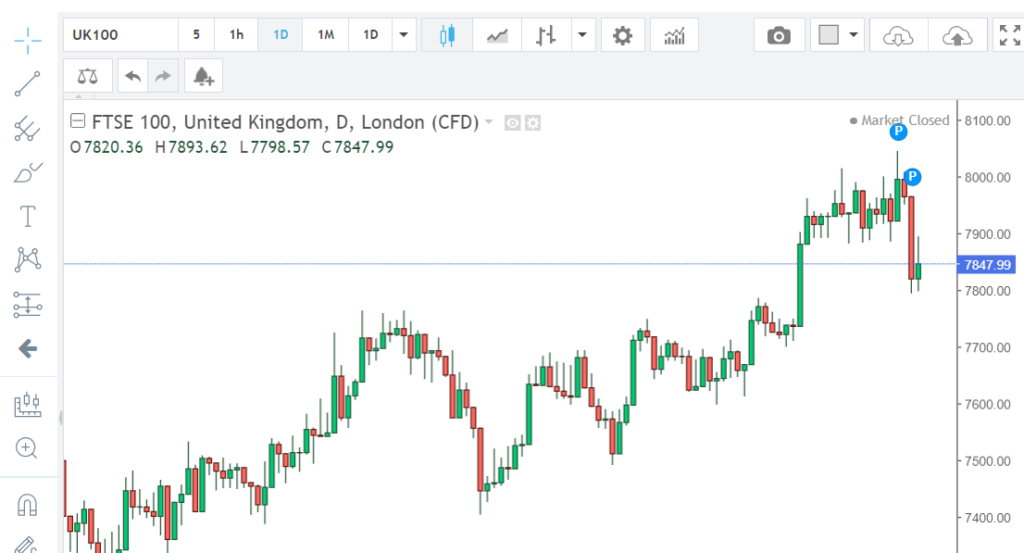

FTSE 100

The FTSE 100, representing the top 100 companies listed on the London Stock Exchange, exhibited a slight upward trend on April 18th, 2024. Despite initial volatility, the index managed to close the day with a marginal gain, driven by strong performances in the technology and healthcare sectors. Investor sentiment remained cautiously optimistic, with hopes pinned on robust earnings reports and favorable economic indicators.

CAC 40

Moving to the CAC 40, the French stock market index, we observed a mixed picture on April 18th, 2024. While certain sectors such as energy and consumer goods experienced gains, others like financials and industrials faced downward pressure. The index closed the day with a modest decline, reflecting broader uncertainties surrounding geopolitical tensions and global economic forecasts.

DAX Index

Germany’s DAX Index showcased resilience amidst market fluctuations on April 18th, 2024. Buoyed by strong performances in the automotive and manufacturing sectors, the index demonstrated stability despite external challenges. Investors closely monitored developments in trade policies and supply chain disruptions, which could potentially impact future market dynamics.

Key Factors Influencing Market Performance

Economic Indicators

GDP growth, unemployment rates, and inflation figures serve as critical barometers of economic health, exerting significant influence on market sentiment and investment decisions. Analysts closely scrutinize these indicators to gauge the overall direction of the economy and anticipate potential market trends.

Geopolitical Developments

Geopolitical tensions, trade disputes, and diplomatic negotiations can profoundly affect market stability and investor confidence. Events such as international conflicts, trade agreements, and political upheavals have the potential to trigger market volatility and reshape investment strategies.

Corporate Earnings

The financial performance of individual companies plays a pivotal role in driving market movements. Quarterly earnings reports, revenue forecasts, and corporate strategies are closely monitored by investors seeking insights into company fundamentals and growth prospects. Positive earnings surprises can bolster market sentiment, while disappointing results may lead to sell-offs and reevaluations.

Monetary Policy

Central bank actions, including interest rate decisions and monetary stimulus measures, have significant implications for financial markets. Changes in monetary policy can influence borrowing costs, currency valuations, and investor sentiment, thereby shaping overall market dynamics and investment strategies.

Conclusion

In conclusion, analyzing Europe’s market indexes on April 18th, 2024, provides valuable insights into the region’s economic landscape and investment opportunities. While certain indexes experienced fluctuations, others demonstrated resilience amid prevailing uncertainties. By closely monitoring key factors such as economic indicators, geopolitical developments, corporate earnings, and monetary policy, investors can make informed decisions to navigate dynamic market conditions effectively.