Bank Nifty and Nifty Prediction for Tomorrow, 27 March 2024

Indian value benchmarks finished with humble misfortunes on Tuesday, snapping a three-day series of wins. The homegrown value market files opened a hole down in the wake of a monotonous end of the week, following the negative signs from Money Road short-term. Sensex and Nifty exchanged underneath their impartial line over the course of the day on the rear of selling in heavyweight stocks.

Among the areas, Nifty Realty, Metal, and PSU Bank finished higher, while the Media, IT, and Banking areas saw selling pressure. The market broadness was powerless. On the NSE, 910 offers were progressed, while 1733 offers declined. The NSE’s unpredictability file “India VIX” hopped 4.90% to 12.82.

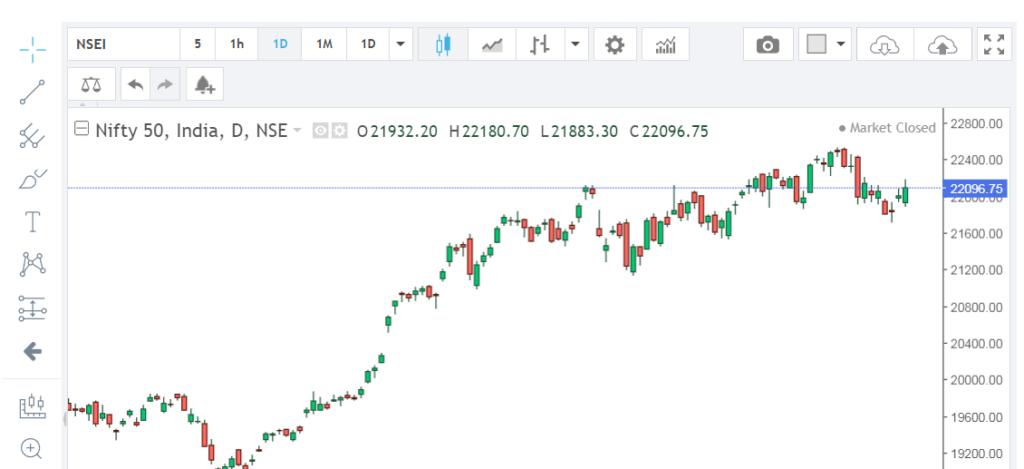

The more extensive business sectors beat the value benchmarks, as Clever mid and smallcap lists acquired 1.05% and 0.41% separately. Eventually, Sensex declined 361.64 focuses or 0.50% and shut down at 72470.30, while Nifty was somewhere around 92.05 focuses or 0.42% and shut down at 22004.70.

Nifty and Bank Nifty Futures Price Movement

The Nifty prospects cost for the Walk series opened at 22026.25 making a hole down opening of 139.2 focuses on Tuesday. It has contacted an intraday high of 22150 and a day’s low of 21850

The Nifty prospects cost has given an intraday development of 300 places. Eventually, the Clever fates shut lower by 70.45 focuses or 0.32% at the 22095 level.

The Bank Nifty prospects for the Walk series opened at 46805.40 It made a negative opening of 123.6 focuses on Tuesday. The Bank Nifty fates contacted an intraday high at 46878.10 and a day’s low at 46610.30.

During the day, the Bank Nifty prospects have given a development of 267.8 places. Eventually, Bank Nifty Prospects shut lower by 206.40 focuses or 0.44 percent and shut at the 46722.60 level.

Nifty Futures Prediction for Tomorrow, 27 March 2024

Range-Bound Pattern: All up Moves can start benefit Booking @ 22200 though Generally Down Moves can Start Short Covering @ 22000

Nifty fates Walk series shut down at 22095 a premium of 90.3 when contrasted with Nifty end 22004.70 in the money market.

Assume the Nifty fates move over 22119 and support. Then, at that point, the Nifty file can exchange a scope of 22150-22185-22218 levels during the day.

Assuming the Nifty prospects share cost moves under 22070 and is maintained. Then, at that point, the file prospects can exchange at 22036-22003-21970 levels during the day.

Bank Nifty Futures Prediction for Tomorrow, 27 March 2024

Essential Pattern in Bank Nifty Fates Negative

Range-Bound Pattern of Bank Nifty Future: All up moves can Start Benefit Booking @ 47050 though Generally down moves can Start Short Covering @ 46400.

Bank Nifty fates for the Walk series shut down at 46728, along with some hidden costs of 127.8 contrasted with Bank Nifty end of 46600.20 in the money market.

Assume the Bank Nifty fates move over 46855 and maintain, then the file can exchange the scope of 46935-47055-47230 levels during the day.

In the event that the Bank Nifty fates move under 46600 and maintain, the file can exchange the scope of 46515-46425-46330 levels during the day.

Global Market Updates

The other Asian securities exchange files shut for the most part in the green on Tuesday, as financial backers surveyed the monetary information delivered in the district. Japan’s Nikkei 225 shut level, as the nation’s administration maker cost was unaltered in February, contrasted with the last month. South Korea’s Kospi file shut higher by 0.71% in the wake of hitting its most elevated level in 2 years.

The Waterways Times rose 1.10%, as Singapore’s assembling yield expanded 14.2% in February from January. Hang Seng acquired 0.87%, fully backed up by energy and modern stocks, while Shanghai finished possibly higher by 0.17%. SET composite shut higher by 0.34%, while Taiwan and Jakarta finished losing money.

European securities exchanges generally opened lower, as financial backers booked some benefit after records shut higher in the past meeting because of hopefulness about loan fee cuts. Nonetheless, the “purchase on plunge” technique upheld the business sectors to turn positive once more.

Dow and Nasdaq prospects are exchanging higher in the US, showing a positive opening for the US showcases today.