Beacon Trusteeship Limited IPO Full Details

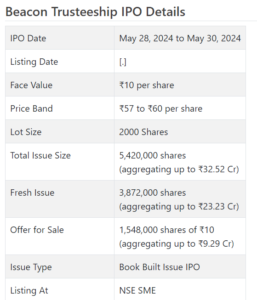

Reference point Trusteeship Initial public offering is a book constructed issue of Rs 32.52 crores. The issue is a blend of new issue of 38.72 lakh shares collecting to Rs 23.23 crores and make available for purchase of 15.48 lakh shares conglomerating to Rs 9.29 crores.

Reference point Trusteeship Initial public offering opens for membership on May 28, 2024 and closes on May 30, 2024. The distribution for the Reference point Trusteeship Initial public offering is supposed to be settled on Friday, May 31, 2024. Guide Trusteeship Initial public offering will list on NSE SME with conditional posting date fixed as Tuesday, June 4, 2024.

Reference point Trusteeship Initial public offering cost band is set at ₹57 to ₹60 per share. The base parcel size for an application is 2000 Offers. The base measure of venture expected by retail financial backers is ₹120,000. The base parcel size venture for HNI is 2 parts (4,000 offers) adding up to ₹240,000.

• The organization is fundamentally occupied with debenture trusteeship.

• It gives numerous security markets related administrations under one rooftop.

• The organization posted development in its top and main concerns for the revealed periods.

• In light of FY24 profit, the issue shows up completely estimated.

• Financial backers might stop assets for the medium to long haul rewards.

ABOUT Organization:

Guide Trusteeship Ltd. (BTL) is a SEBI enlisted Debenture Legal administrator vide Enrollment No. IND000000569, which gives extensive variety of trusteeship administration across different areas, for example, Debenture Legal administrator Administrations, Security Legal administrator Administrations, Legal administrator to frosts at large.

BTL gives trusteeship administrations by going about as mediator between the backer organization or substance and financial backers. The organization as a Debenture Legal administrator assumes a urgent part in its Extent of work under trusteeship administrations incorporates A reasonable level of effort, Custodial administrations, observing consistence, Documentation, Divulgences, Record keeping and so on. As a legal administrator, the organization assumes a pivotal part in keeping up with financial backer certainty by protecting their inclinations and advancing straightforwardness and responsibility. With the assistance of an innovation, a committed legitimate and consistence group for every one of its items viz. Debenture Trusteeship, Security Legal administrator for Credits, ified organization w.r.t. Data Security The executives Framework, showing execution abilities and proficiency in its tasks.

It has as of late extended locational presence by starting Business office at Gujarat Global Money Detective City (GIFT) which is a Worldwide Monetary Administrations Place (IFSC) to build its scope and to get different administrative benefits. The organization has locational presence in excess of 15 urban communities in India including significant urban areas like Mumbai, Delhi, Chennai, Hyderabad, Jaipur, Bangalore, Chandigarh, Indore, Kolkata, Lucknow and Gandhinagar whether through provincial workplaces or signatories.

BTL has proposed to put resources into innovative foundation, extend administration activities locally and universally from the Net proposition continues. The organization has procured Signal Financial backer Property Private Restricted (Previously known as Reference point RTA Administrations Private Restricted) as an Entirely Possessed Auxiliary as of April 05, 2024 and will Make Speculation through Value for the Permit of Safe Member and Enlistment center and Offer Exchange Specialist.

The organization likewise offers support as an Escrow and Checking specialist, by which the client selects it as the observing specialist to guarantee outward settlement from the Escrow Record are attributed exclusively to the Unique Reason Assortment Record or some other record as determined in the conventional understanding. Its extent of work incorporates Drafting and Verifying of Escrow Understanding, Set up of Escrow Instrument, Documentation and ideal observing administrations. As of Walk 31, 2024, it had 76 workers on its finance and has finished 589 tasks.

ISSUE Subtleties/CAPITAL HISTORY:

The organization is emerging with its lady book building course consolidated Initial public offering of 5420000 value portions of Rs. 10 each to prepare Rs. 32.52 cr. at the upper cap. The Initial public offering comprises of 3872000 new value shares worth Rs. 23.23 cr., and a Proposal available to be purchased (OFS) of 1548000 value shares worth Rs. 9.29 cr. at the upper cap. It has reported a value band of Rs. 57 – Rs. 60 for every offer. The issue opens for membership on May 28, 2024, and will close on May 30, 2024. The base application to be made is for 2000 offers and in products subsequently, from there on. Post designation, offers will be recorded on NSE SME Arise.

The issue is 30% of the post-Initial public offering settled up capital of the organization. From the net returns of the new value shares issue, it will use Rs. 7.00 cr. for redesigning innovation foundation for its current business, Rs. 6.99 cr. for interest in entirely claimed auxiliary Signal Financial backer Holding Pvt. Ltd., Rs. 3.25 cr. for acquisition of new office premises, and the rest for general corporate purposes.

The organization has dispensed not over half for QIBs, at the very least 35% for Retail financial backers and at least 15% for HNIs.

The issue is exclusively lead overseen by Straight shot Capital Counsels Pvt. Ltd., and KFin Advancements Ltd., is the recorder to the issue. Direct path Gathering’s Spread X Protections Pvt. Ltd. is the market producer for the organization.

Having given the underlying value shares at standard, the organization gave further value capital in the value scope of Rs. 11.50 – Rs. 84 (in view of Rs. 10 FV), between February 2017 and February 2022. It has likewise given extra offers in the proportion of 37 for 10 in February 2024. The typical expense of obtaining of offers by the advertisers/selling partners is Rs. Negative, Rs. 0.75, and Rs. 4.37 per share.

Post-Initial public offering, organization’s ongoing settled up value capital of Rs. 14.19 cr. will stand upgraded to Rs. 18.07 cr. In view of the upper Initial public offering cost band, the organization is searching for a market cap of Rs. 108.39 cr.

Monetary Execution:

On the monetary execution front, for the last three fiscals, the organization has (on a solidified premise) posted an all out income/net benefit of Rs. 5.60 cr. /Rs. 0.95 cr. (FY21), Rs. 10.49 cr. /Rs. 3.62 cr. (FY22), Rs. 15.72 cr. /Rs. 3.85 cr. (FY23), and Rs. 20.91 cr. /Rs. 5.16 cr. (FY24).

For the last three fiscals, it has detailed a normal EPS of Rs. 3.03 (straightforward normal), and a typical RoNW of 28.56%. The issue is estimated at a P/BV of 4.44 in view of its NAV of Rs. 13.50 as of Walk 31, 2024, and at a P/BV of 2.56 in light of its post-Initial public offering NAV of Rs. 23.47 per share (at the upper cap).

On the off chance that we characteristic FY24 income to its post-Initial public offering completely weakened settled up capital, then the asking cost is at a P/E of 20.98. In this manner the Initial public offering shows up completely estimated.

Profit Strategy:

The organization has not pronounced any profits for the detailed times of the proposition report. It will take on a reasonable profit strategy in view of its monetary presentation and future possibilities.

Correlation WITH Recorded Companions:

According to the deal record, the organization has no recorded companions to contrast and.

Shipper BANKER’S History:

This is the 40th command from Shortcut Capital in the last three fiscals (counting the continuous one, out of the last 10 postings, all recorded with charges going from 5.88% to 386.67% on the date of posting.

End/Venture Methodology

The organization is participated in giving security markets related administrations under one rooftop. It posted development in its top and primary concerns and ready for brilliant possibilities ahead as development in economy will grow the extent of safety market administrations and this organization has a specialty place in the section. In light of FY24 profit, the issue shows up completely valued. Financial backers might stop assets for the medium to long haul rewards considering the brilliant possibilities for this organization proceeding.