Bulkcorp International Limited IPO Full Details

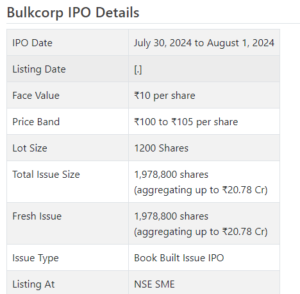

Bulkcorp Initial public offering is a book constructed issue of Rs 20.78 crores. The issue is totally a new issue of 19.79 lakh shares.

Bulkcorp Initial public offering opens for membership on July 30, 2024 and closes on August 1, 2024. The apportioning for the Bulkcorp Initial public offering is supposed to be settled on Friday, August 2, 2024. Bulkcorp Initial public offering will list on NSE SME with speculative posting date fixed as Tuesday, August 6, 2024.

Bulkcorp Initial public offering cost band is set at ₹100 to ₹105 per share. The base parcel size for an application is 1200 Offers. The base measure of speculation expected by retail financial backers is ₹126,000. The base part size venture for HNI is 2 parcels (2,400 offers) adding up to ₹252,000.

• The organization is one of the main player in FIBC packs with significant income from trades.

• The organization posted irregularity for the revealed periods in accordance with the Pandemic and Worldwide aggravations.

• In view of FY24 profit, the issue shows up completely evaluated.

• The organization is making arrangements for hostage sun based power plant to decreased energy cost.

• Financial backers might stop assets as long as possible.

ABOUT Organization:

Bulkcorp Worldwide Ltd. (BIL) is taken part in assembling and supply of Food Grade Adaptable Middle Mass Compartment (“FIBC”) packs. The assembling unit of the Organization is arranged at Changodar, Ahmedabad. Its assembling office meets the prerequisites set out in BRC Worldwide Norm for Pressing and Bundling Materials and has accomplished guaranteed Grade A. It offers an extensive variety of adjustable bundling arrangements FIBC packs (Gigantic Sacks) which come in eight varieties and compartment liners. BIL’s assembling office situated at Changodar, Ahmedabad is furnished with the expected offices including apparatus, and other taking care of gear to work with smooth assembling process.

It attempts to keep up with wellbeing and high cleanliness in premises by sticking to key security and cleanliness standards as determined by BRC. Organization’s assembling office has an in-house testing research center to guarantee that the completed items match the quality principles as determined by clients. All its FIBC packs are made as per ISO 21898 and they have gone through quality tests at very much rumored labs. It significantly acquires unrefined substances from Gujarat. As its assembling unit is decisively associated with the Public Expressway and is situated amidst a created modern region, this gives functional benefit as transportation process becomes time effective.

The organization has extended its introduced limit by putting in new hardware at the premises contiguous its current assembling office. Because of development, introduced limit of the organization producing office has multiplied from 2400 MTPA to 4800 MTPA.

It takes care of the prerequisites of essential businesses like farming, substance, development, food, drug, and mining. Its client base is spread across the globe with presence in nations like US of America, Canada, Joined Realm, South Africa, Ivory Coast, South Korea, Spain, Europe, Egypt and so forth. As of May 31, 2024, it had 195 workers on its finance.

ISSUE Subtleties/CAPITAL HISTORY:

The organization is emerging with its lady book building course Initial public offering of 1978800 value portions of Rs. 10 each to prepare Rs. 20.78 cr. at the upper cap. It has reported a value band of Rs. 100 – Rs. 105 for every offer. The issue opens for membership on July 30, 2024, and will close on August 01, 2024. The base application to be made is for 1200 offers and in products subsequently, from that point. Post apportioning, offers will be recorded on NSE SME Arise. The issue is 26.33% of the post-Initial public offering settled up capital of the organization. From the net returns of the Initial public offering, it will use Rs. 11.00 cr. for working capital, Rs. 2.18 cr. for capex on hostage sun oriented power plant, and the rest for general corporate purposes.

The issue is exclusively lead overseen by Insignia Investmart Ltd., and KFin Innovations Ltd. is the recorder to the issue. Sunflower Broking Pvt. Ltd. is the market producer for the organization.

Having given beginning value shares at standard worth, the organization gave further value shares at a cost of Rs. 285 in February 2024. It has additionally given reward in the proportion of 2 for 1 in Walk 2024. The typical expense of securing of offers by the advertisers is Rs. 2.04, Rs. 3.75, and Rs. 4.38 per share.

Post-Initial public offering, organization’s ongoing settled up value capital of Rs. 5.54 cr. will stand upgraded to Rs. 7.51 cr. In view of the upper Initial public offering cost band, the organization is searching for a market cap of Rs. 78.90 cr.

Monetary Execution:

On the monetary execution front, for the last four fiscals, the organization has posted a complete pay/net benefit of Rs. 31.76 cr. /Rs. 0.64 cr. (FY21), Rs. 49.20 cr. /Rs. 1.73 cr. (FY22), Rs. 38.96 cr. /Rs. 1.21 cr. (FY23), Rs. 46.51 cr. /Rs. 3.56 cr. (FY24). The organization announced irregularity in its top and main concerns.

For the last three fiscals, it has detailed a normal EPS of Rs. 4.01, and a typical RoNW of 35.89%. The issue is estimated at a P/BV of 6.22 in view of its NAV of Rs. 16.87 as of Walk 31, 2024, and at a P/BV of 2.62 in view of its post-Initial public offering NAV of Rs. 40.08 per share (at the upper cap).

On the off chance that we quality FY24 income to its post-Initial public offering completely weakened settled up capital, then, at that point, the asking cost is at a P/E of 22.15. The issue shows up completely estimated.

For the detailed periods, the organization has posted PAT edges of 2.02% (FY21), 3.56% (FY22), 3.15% (FY23), 7.88% (FY24), and RoCE edges of 36.55%, 27.62%, 19.85%, 40.25% individually for the alluded periods.

Profit Strategy:

The organization has not proclaimed any profits for the revealed times of the deal report. It will embrace a reasonable profit strategy in light of its monetary exhibition and future possibilities.

Examination WITH Recorded Friends:

According to the deal record, the organization has shown Rishi Techtex, Large Packs as their recorded friends. They are exchanging at a P/E of 33.7 and 11.8 (as of July 26, 2024). In any case, they are not similar on an apple-to-apple premise.

Vendor BANKER’S History:

This is the eleventh order from Insignia Investmart in the last four fiscals (counting the continuous one), out of the last 10 postings, 2 opened at rebate, 1 at standard and the rest recorded with expenses going from 4.17% to 110.64% on the date of posting.

End/Venture Procedure

However the organization is working in a profoundly cutthroat and divided section, it has made a specialty place and having significant commitment from high edge sends out business. In view of FY24 profit, the issue shows up completely estimated. Financial backers might stop assets for the drawn out remunerations.