Ceigall India Limited IPO Full Details

Ceigall India Initial public offering is a book fabricated issue of Rs 1,252.66 crores. The issue is a mix of new issue of 1.71 crore shares collecting to Rs 684.25 crores and make available for purchase of 1.42 crore shares conglomerating to Rs 568.41 crores.

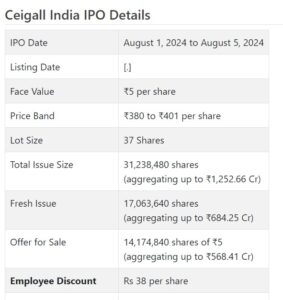

Ceigall India Initial public offering opens for membership on August 1, 2024 and closes on August 5, 2024. The apportioning for the Ceigall India Initial public offering is supposed to be settled on Tuesday, August 6, 2024. Ceigall India Initial public offering will list on BSE, NSE with speculative posting date fixed as Thursday, August 8, 2024.

Ceigall India Initial public offering cost band is set at ₹380 to ₹401 per share. The base parcel size for an application is 37 Offers. The base measure of venture expected by retail financial backers is ₹14,837. The base parcel size venture for sNII is 14 parts (518 offers), adding up to ₹207,718, and for bNII, it is 68 parcels (2,516 offers), adding up to ₹1,008,916.

The issue incorporates a booking of up to 55,096 offers for representatives presented at a markdown of Rs 38 to the issue cost.

• CIL is a presumed EPC project worker and has posted quickest development in its exhibition.

• It has turned into a favored accomplice for NHAI projects and has as of late held hands with Delhi Metro for rail infra improvements.

• It has posted wonderful CAGR development in its top and primary concerns for the announced periods.

• As of Walk 31, 2024, it had a request book worth Rs. 9470+ cr. available. In this way it’s a drawn out play.

• In light of FY24 profit, the issue shows up forcefully evaluated.

• Financial backers might stop moderate assets as long as possible.

ABOUT Organization:

Ceigall India Ltd. (CIL) a framework development organization with experience in endeavor particular underlying work like raised streets, flyovers, spans, rail route over spans, burrows, thruways, freeways and runways. It is one of the quickest developing designing, obtainment and development (“EPC”) organization as far as three-year income CAGR as of Financial 2024, among the organizations with a turnover of over Rs. 1000 cr. in Financial 2024 (Source: CARE Report) with north of 20 years of involvement with the business.

It has accomplished one of the greatest year-on-year income development of around 43.10% in Monetary 2024 among the friends. The organization has developed at a CAGR of 50.13% between Fiscals 2021 to 2024 (Source: CARE Report). Throughout the course of recent many years, the Organization has changed from a little development organization to a laid out EPC player, showing skill in the plan and development of different street and roadway projects remembering particular designs across 10 states for India (Source: CARE Report).

Its foremost business tasks are extensively isolated into EPC activities and crossover annuity model (“HAM”) projects, which are spread more than ten states in India. The Organization was consolidated in July 2002 and from that point forward, it has steadily expanded execution capacities regarding size of the activities. One of its underlying street projects that it executed for the Punjab Public Works Division, Ludhiana division, was granted in 2006 with a total task cost of Rs. 6.29 cr. for 20.42 path km. In 2014, it was granted the initial four path roadway EPC project from NHAI for 24.08 path km with a task cost of Rs. 37.81 cr. also, the latest four path raised hallway EPC project, which comprises of one of the longest four path raised passageway piece of 14.26 kms in India according to Mind Report, was granted

by NHAI with an undertaking cost of Rs. 1969.39 cr. also, complete length of 100.32 path km.

As on the date of this Distraction Plan, it is qualified to offer for single NHAI EPC projects up to a worth of Rs. 5700 cr. furthermore, for single NHAI HAM projects up to a worth of Rs. 5500 cr. As on the date of this Distraction Outline, it has been empaneled to take part with the Delhi Metro Rail Company Restricted in its impending tenders including bury alia development of rail routes, super extensions and passages in India and abroad and furthermore with a public area undertaking for thruways, scaffolds and passage development work in north-eastern territories of India, and such empanelment is extendable together.

As on the date of this Distraction Outline, the Organization has finished more than 34 tasks, including 16 EPC, one HAM, five O&M and 12 Thing Rate Ventures, in the streets and expressways area. Right now, it has 18 continuous ventures, including 13 EPC tasks and five HAM projects which incorporates raised hallways, spans, flyovers, rail over-spans, burrows, interstate, runway, metro projects and multi-path roadways. As well as attempted activity and support (“O&M”) exercises as per its legally binding commitments under the EPC/HAM concession arrangements, it has additionally embraced autonomous O&M projects. Further, it has likewise attempted previously and keep on endeavor sub-contracting projects.

Its Structure Book, as on June 30, 2024 and Fiscals 2024, 2023 and 2022, added up to Rs. 9470.84 cr., Rs. 9225.78 cr., Rs. 10809.04 cr., and Rs. 6346.13 cr. separately. Throughout the long term, the Organization has turned into a foundation development organization with experience in endeavor specific underlying work like raised streets, flyovers, spans, rail route over spans, burrows, parkways, turnpikes and runways and has a standing of conveying quality undertakings. It has a predictable history of execution of tasks either on time or early. As of Walk 31, 2024, it had 2256 representatives on its finance, and is additionally employing provisional worker as and when required.

ISSUE Subtleties/CAPITAL HISTORY:

The organization is emerging with its lady/combo Initial public offering of new value shares issue worth Rs. 684.25 cr. (approx. 17063591 offers at the upper cap), and a Proposal available to be purchased (OFS) of 14174840 value shares (worth Rs. 568.41 cr. at the upper cap). The organization has reported a value band of Rs. 380 – Rs. 401 for every value portions of Rs. 5 each. The general size of the issue will be approx. 31238431 offers worth Rs. 1252.66 cr. The issue opens for membership on August 01, 2024, and will close on August 05, 2024. The base application to be made is for 37 offers and in products consequently, from that point. Post assignment, offers will be recorded on BSE and NSE. The issue is 17.93% of the post-Initial public offering settled up value capital. From the net returns of the new value issue, the organization will use Rs. 99.79 cr. for acquisition of types of gear, Rs. 413.40 cr. for reimbursement/prepayment of specific borrowings by the actual organization and its auxiliary, and the rest for general corporate purposes.

The organization has saved value shares worth Rs. 2.00 cr. for its qualified workers and offering them a rebate of Rs. 38 for every offer. From the rest, it has assigned not over half for QIBs, at least 15% for HNIs and at the very least 35% for Retail financial backers.

The joint Book Running Lead Directors (BRLMs) to this issue are ICICI Protections Ltd., IIFL Protections Ltd., and JM Monetary Ltd., while Connection Intime India Pvt. Ltd. is the enlistment center to the issue.

Having given beginning value shares at standard, the organization gave further value shares at a decent cost of Rs. 525 for every offer (in view of Rs. 5 FV), in February 2020. It has likewise given extra offers in the proportion of 39 for 1 in Walk 2022, and 1 for 1 in August 2023. The typical expense of obtaining of offers by the advertisers/selling partners is Rs. Nothing, Rs. 0.02, Rs. 0.06, and Rs. 9.30 per share.

Post-Initial public offering, its ongoing settled up value capital of Rs. 78.57 cr. will stand improved to Rs. 87.10 cr. In light of the upper cap of the Initial public offering cost band, the organization is searching for a market cap of Rs. 6985.40 cr.

Monetary Execution:

On the monetary execution front, for the last three fiscals, the organization has (on a united premise) posted a complete pay/net benefit of Rs. 1146.50 cr. /Rs. 125.86 cr. (FY22), Rs. 2087.04 cr. /Rs. 167.27 cr. (FY23), and Rs. 3066.19 cr. /Rs. 304.31 cr. (FY24).

For the last three fiscals, the organization has posted a normal EPS of Rs. 14.57 and a normal RoNW of 31.05%. The issue is evaluated at a P/BV of 6.95 in light of its NAV of Rs. 57.68 as of Walk 31, 2024, and at a P/BV of 4.39 in view of its post-Initial public offering NAV of Rs. 91.31 per share (at the upper cap).

On the off chance that we quality FY24 annualized income to its post-Initial public offering completely weakened settled up value capital, then, at that point, the asking cost is at a P/E of 22.95. In light of FY23 profit, the P/E remains at 41.77. Accordingly the issue shows up forcefully valued limiting close to term up-sides.

The organization announced PAT edges of 11.10% (FY22), 8.09% (FY23), 10.05% (FY24), and RoCE edges of 29.84%, 28.67%, 31.98% for the alluded periods, individually.

Profit Strategy:

The organization has delivered profits for FY23 (15%) and FY24 (15%). It has proactively embraced a profit strategy in Walk 2024, in light of its monetary exhibition and future possibilities.

Correlation WITH Recorded Companions:

According to the deal archive, the organization has shown PNC Infra, G R Infra, HG Ingra, KNR Developments, ITD Cementation, and J Kumar Infra as their recorded companions. They are exchanging at a P/E of 14.4, 15.4, 20.4, 15.3, 32.9, and 19.4 (As of July 30 2024) Nonetheless, they are not really similar on an apple-to-apple premise.

Dealer BANKER’S History:

The three BRLMs related with the proposition have taken care of 78 pubic issues in the beyond three fiscals, out of which 20 issues shut beneath the deal cost on the posting date.

End/Speculation System

The organization is an EPC infrastructural worker for hire and has as of late restricted with Delhi Metro for rail infra projects. It has made a specialty place for NHAI projects. It is working in a profoundly serious and divided fragment. In light of FY24 profit, the issue shows up forcefully valued. In any case, taking into account inflow of orders and request book close by, it is an unadulterated long haul play. Financial backers might stop moderate assets as long as possible.

Audit By Dilip Davda on July 30, 2024

Audit Creator

DISCLAIMER: No monetary data at all distributed anyplace here ought to be understood as a proposal to trade protections, or as guidance to do as such in any capacity at all. All matter distributed here is only for instructive and data purposes just and by no means ought to be utilized for settling on venture choices. Perusers should counsel a certified monetary consultant prior to pursuing any real speculation choices, in view of the data distributed here. My audits don’t cover GMP market and administrators approaches. Any peruser taking choices in view of any data distributed here does so completely despite copious advice to the contrary. Financial backers ought to remember that any interest in securities exchanges is dependent upon capricious market-related gambles. The above data depends on RHP and different archives accessible as of date combined with market discernment. The creator has no designs to put resources into this proposition.