Deem Roll Tech Limited IPO Subscription and Allotments

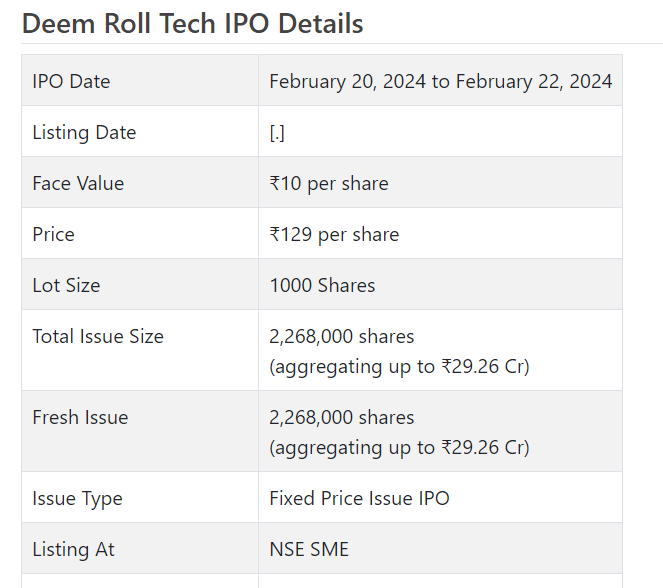

Deem Roll Tech Initial public offering is a proper value issue of Rs 29.26 crores. The issue is completely a new issue of 22.68 lakh shares.

Consider Roll Tech Initial public offering opens for membership on February 20, 2024 and closes on February 22, 2024. The assignment for the Consider Roll Tech Initial public offering is supposed to be finished on Friday, February 23, 2024. Consider Roll Tech Initial public offering will list on NSE SME with conditional posting date fixed as Tuesday, February 27, 2024.

Consider Roll Tech Initial public offering cost is ₹129 per share. The base part size for an application is 1000 Offers. The base measure of speculation expected by retail financial backers is ₹129,000. The base part size venture for HNI is 2 parcels (2,000 offers) adding up to ₹258,000.

• DRTL is occupied with assembling top notch steel and combination rolls in India.

• It posted consistent development in its top and main concerns for the revealed periods.

• With push for infra advancement and extension of steel industry, this organization is ready for splendid possibilities ahead.

• In light of its FY24 annualized profit, the issue shows up completely valued.

• Financial backers might stop moderate asset for the medium to long haul rewards.

ABOUT Organization:

Consider Roll Tech Ltd. (DRTL) is one of the makers of top notch steel and combination Rolls in India, which is the structure block of the iron and steel moving factory industry. The Rolls fabricated by the Organization finds its application in the iron and steel moving plant enterprises in the homegrown and worldwide business sectors.

The organization has been inseparable from quality and dependability in the Roll fabricating industry which it produces both under standard detail and customized according to the client explicit necessities. It supplies Rolls straightforwardly to moving plant producers (“OEMs”) and in the substitution market to the iron and steel moving factories through an organization of sellers/merchants and specialists. The organization trades Rolls to more than 10 nations, like USA, Germany, Europe, Center East, Oman, Saudi Arabia, South Africa, Nepal and Bangladesh.

As on September 30, 2023, the organization has taken special care of more than 340 homegrown clients and 30 product clients. It makes items from steel scrap, roll scrap, pig iron, nickel, ferro molybdenum, other ferro composites, gum covered sand, and so forth adjusting to worldwide guidelines. Its assembling Units comprises of designing and configuration, shape making, liquefying, projecting, machining and dispatch areas supported by related quality testing and affirmation gear. By and by, it utilizes static cast and radially cast innovation for the assembling of Rolls.

Rolls are tailor-made according to the factory necessity of the clients. Since a significant amount of the cast Rolls and fashioned Rolls are created for use in the moving factories of the steel business, consequently the Roll business is firmly connected with the steel business. The development in the steel business offers great potential for Rolls producers. With both vehicle and foundation areas showing solid development rate, there will be an interest push impact for both level item and long item rolls. Interest for top caliber, elite execution cast rolls, which are essential to the moving of high-grade steel sheets or strips, is supposed to go through critical development. Likewise, the interest for Rolls will be straightforwardly connected with capex plans of the iron and steel industry and furthermore the interest for steel. As of Walk 31, 2023, it had orders worth approx. Rs. 55 cr. from 129 clients. As of December 31, 2023, it had 275 representatives on its finance.

ISSUE Subtleties/CAPITAL HISTORY:

The organization is emerging with its lady Initial public offering of 2268000 value portions of Rs. 10 each at a proper cost of Rs. 129 for every offer to activate Rs. 29.26 cr. The issue opens for membership on February 20, 2024, and will close on February 22, 2024. The base application to be made is for 1000 offers and in products consequently, from that point. Post portion, offers will be recorded on NSE SME Arise. The issue comprises 27.20% of the post-Initial public offering settled up capital of the organization. The organization is spending Rs. 4.98 cr. for this Initial public offering and from the net returns, it will use Rs. 20.00 cr. for capex on extension of its current assembling office, Rs. 3.50 cr. for working capital and Rs. 0.78 cr. for general corporate purposes.

The issue is exclusively lead overseen by Fedex Protections Pvt. Ltd., and Bigshare Administrations Pvt. Ltd. is the enlistment center of the issue. SS Corporate Protections Ltd. is the market creator for the organization.

The organization has given/changed over starting value capital at standard and has given further value partakes in the value scope of Rs. 129 – Rs. 200 for every divide among October 2009 and February 2024. It has likewise given extra offers in the proportion of 3.22 for 1 in July 2023. The typical expense of procurement of offers by the advertisers is Rs. 6.48, and Rs. 20.60 per share.

Post-Initial public offering, organization’s ongoing settled up value capital of Rs. 6.07 cr. will stand upgraded to Rs. 8.34 cr. In view of the upper Initial public offering cost band, the organization is searching for a market cap of Rs. 107.55 cr.

Monetary Execution:

On the monetary execution front, for the last three fiscals, the organization has posted an all out pay/net benefit of Rs. 64.62 cr. /Rs. 2.98 cr. (FY21), Rs. 92.12 cr. /Rs. 4.10 cr. (FY22), and Rs. 104.49 cr. /Rs. 6.92 cr. (FY23). For H1 of FY24 finished on September 30, 2023, it procures a net benefit of Rs. 3.72 cr. on an all out pay of Rs. 50.28 cr. In this manner its top and primary concerns posted development for the announced periods.

For the last three fiscals, it has detailed a normal EPS of Rs. 9.12, and a typical RONW of 17.34%. The issue is estimated at a P/BV of 1.99 in view of its NAV of Rs. 64.76 as of September 30, 2023, and at a P/BV of 1.54 in light of its post-Initial public offering NAV of Rs. 84.02 per share.

On the off chance that we quality annualized FY24 income to its post-Initial public offering completely weakened paid-p capital, then the asking cost is at a P/E of 14.46. Subsequently the issue shows up completely evaluated.

For the detailed periods, the organization has posted PAT edges of 4.67% (FY21), 4.47% (FY22), 6.69% (FY23), 7.42% (H1-FY24), and RoCE edges of 21.68%, 18.27%, 20.26%, 9.93% individually for the alluded periods.

Profit Strategy:

The organization has not announced any profits since joining. It will take on a reasonable profit strategy in view of its monetary presentation and future possibilities.

Examination WITH Recorded Friends:

According to the proposition report, the organization has shown Tayo Rolls as their recorded friends. It is exchanging at a P/E of NA (as of February 16, 2024). Be that as it may, they are not tantamount on an apple-to-apple premise.

Dealer BANKER’S History:

This is the 26th order from Fedex Protections in the last four fiscals, out of the last 10 postings, 2 opened at rebate and the rest with charges going from 6.49% to 140.82% on the date of posting.

End/Speculation Procedure

The organization is in the assembling of great of steel and compound moves that will create popularity considering push for the infra advancement and development in steel fabricating. In this way the organization is ready for brilliant possibilities ahead. In light of its FY24 annualized profit, the issue shows up completely estimated. Little value base post Initial public offering demonstrates longer incubation period for relocation to the mainboard. Financial backers might stop moderate assets for the medium to long haul rewards.

Audit By Dilip Davda on February 16, 2024