Deepak Builders & Engineers India Limited IPO Full Details

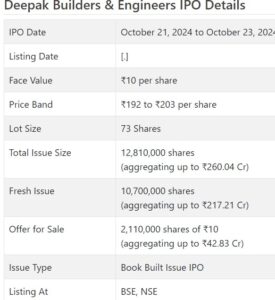

Deepak Manufacturers and Designers Initial public offering is a book fabricated issue of Rs 260.04 crores. The issue is a blend of new issue of 1.07 crore shares collecting to Rs 217.21 crores and make available for purchase of 0.21 crore shares conglomerating to Rs 42.83 crores.

Deepak Manufacturers and Designers Initial public offering opened for membership on October 21, 2024 and will close on October 23, 2024. The portion for the Deepak Manufacturers and Designers Initial public offering is supposed to be concluded on Thursday, October 24, 2024. Deepak Developers and Architects Initial public offering will list on BSE, NSE with speculative posting date fixed as Monday, October 28, 2024.

Deepak Manufacturers and Designers Initial public offering cost band is set at ₹192 to ₹203 per share. The base parcel size for an application is 73 Offers. The base measure of venture expected by retail financial backers is ₹14,819. The base parcel size speculation for sNII is 14 parts (1,022 offers), adding up to ₹207,466, and for bNII, it is 68 parcels (4,964 offers), adding up to ₹1,007,692.

• The organization is an EPC worker for hire gaining practical experience in different kinds of development projects.

• The organization posted development in its top and primary concerns for the announced periods.

• It has a request book worth Rs. 1380+ cr. as of June 30, 2024, with significant commitment coming from railroads.

• The unexpected lift in edges from FY24 causes a stir.

• Very much educated financial backers might stop moderate assets for long haul.

ABOUT Organization:

Deepak Developers and Specialists Ltd. (DBEL) is a coordinated designing and development organization, represent considerable authority in execution and development of managerial and institutional structures, emergency clinics and clinical schools, modern structure, verifiable dedication complex, arena and sports mind boggling, private perplexing and different formative and other development action (“Development Tasks”). While its essential concentration and strength are well established in Development Activities, it has enhanced in endeavor specific primary work, for example, flyovers, rail under span, rail over spans, move toward streets and improvement and redevelopment of rail route stations (“Framework Tasks”) (Development Ventures and Foundation Activities on the whole alluded to as “Development and Framework Ventures”). It embraces Development and Foundation Undertakings both, as EPC administrations on a fixed-total turnkey premise as well as on a thing rate premise/rate premise.

As a designing and development organization, it has a demonstrated history of executing turnkey projects involving building and primary work, common works, central air, Mechanical Electrical and Plumbing (“MEP”) works, firefighting and alarm frameworks, general wellbeing administrations, data innovation framework, secluded activity theater, clinical gas pipeline frameworks and outer improvement work, including finishing work. It has changed into a laid out EPC player, exhibiting skill in different development and framework advancement projects including particular designs across four (4) territories of India, for example Punjab, Haryana, Rajasthan, Uttarakhand and two (2) Association Regions for example Chandigarh and Public Capital Region of Delhi.

At present, the Organization has twelve (12) continuous undertakings, including seven (7) EPC ventures and five (5) thing rate/rate contracts. Of its absolute continuous activities, Development Tasks includes four (4) emergency clinic and clinical school projects, one (1) authoritative and institutional structures; one (1) modern structure; and Framework Ventures involves four (4) projects connecting with upgradation/advancement/redevelopment of Rail line Station and related work, and two (2) streets and scaffolds projects connecting with rail over spans. Further, it additionally attempts activity and support (“O&M”) exercises as per its authoritative commitments under the ventures.

The organization had a request book worth Rs. 1380.39 cr. as of June 30, 2024. As of the said date, it had 632 representatives on its finance, it additionally employs provisional laborers as and when required.

The sum including criminal and common prosecution connecting with tasks of the Organization as on June 30, 2024 is Rs. 37.55 cr. (to the degree quantifiable). There are different prosecutions forthcoming at different stages adding up to Rs. 50.90 cr. This stays main issues for some time.

ISSUE Subtleties/CAPITAL HISTORY:

The organization is emerging with its lady combo book building course Initial public offering of 12810000 value portions of Rs. 10 every value Rs. 260.04 cr. (at the upper cap). The organization has declared a value band of Rs. 192 – Rs. 203 for each offer. The issue comprises 10700000 new value shares (worth Rs. 217.21 cr. at the upper cap), and a proposal available to be purchased (OFS) of 2110000 offers (worth Rs. 42.83 cr. at the upper cap). The issue opens for membership on October 21, 2024, and will close on October 23, 2024. The base application to be made is for 73 offers and in products subsequently, from that point. Post allocation, offers will be recorded on BSE and NSE. The Initial public offering comprises 27.50% of the post-Initial public offering settled up value capital of the organization. From the net returns of the new value issue, the organization will use Rs. 111.96 cr. for working capital, Rs. 30.00 cr. for reimbursement/prepayment of specific borrowings, and the rest for general corporate purposes and unidentified inorganic acquisitions.

The sole Book Running Lead Director (BRLM) to this issue is Fedex Protections Pvt. Ltd., while KFin Advances Ltd. is the enlistment center to the issue. Partner part for the issue is Khandwala Protections Ltd.

The organization has given/changed over whole value capital at standard worth up until this point. The typical expense of procurement of offers by the advertisers/selling partners is Rs. 9.87, and Rs. 10.00 per share.

Post Initial public offering, organization’s ongoing settled up value capital of Rs. 35.88 cr. will stand improved to Rs. 46.58 cr. In light of the upper cap of Initial public offering valuing, the organization is searching for a market cap of Rs. 945.59 cr.

Monetary Execution:

On the monetary execution front, for the last three fiscals, the organization has posted a complete income/net benefit of Rs. 363.05 cr. /Rs. 17.66 cr. (FY22), Rs. 433.46 cr. /Rs. 21.40 cr. (FY23), and Rs. 511.40 cr. /Rs. 60.41 cr. (FY24). For Q1 of FY25 finished on June 30, 2024, it procured a net benefit of Rs. 14.21 cr. on an all out pay of Rs. 105.11 cr. The quantum hop in main concerns for FY24 cause a stir and worry over its manageability proceeding.

For the last three fiscals, the organization has revealed a normal EPS of Rs. 11.23, and a typical RoNW of 39.86%. The issue is valued at a P/BV of 4.68 in light of its NAV of Rs. 43.42 as of June 30, 2024, and is at a P/BV of 2.54 in light of its post-Initial public offering NAV of Rs. 80.08 per share (At upper cap). Its Net Obligation/EBITDA Proportion at 4.83 as of June 30, 2024 raises concern.

On the off chance that we quality FY25 annualized super income to its post-Initial public offering completely weakened settled up value capital, then the asking cost is at a P/E of 16.64. In light of FY24 income, the issue is at a P/E of 15.65. The issue moderately shows up completely valued.

The organization announced PAT edges of 4.87% (FY22), 4.94% (FY23), 11.81% (FY24), 13.52% (Q1-FY25), and RoCE edges of 27.26%, 26.10%, 41.72%, 8.97% for the alluded periods, separately.

Profit Strategy:

The organization has not pronounced any profits for the last five fiscals. It embraced a profit strategy in February 2024, in light of its monetary presentation and future possibilities.

COMPARISION WITH Recorded Companions:

According to the deal record, the organization has shown IRCON Intl., Ahluwalia Agreements, PSP Tasks, and ITD Cementation, as their recorded friends, they are exchanging at a P/E of 21.06, 36.7, 21.2, and 31.3 (as of October 18, 2024). Nonetheless, they are not genuinely similar on an apple-to-apple premise.

Vendor BANKER’S History:

This is the 34th order from Fedex Protections in the last four fiscals (counting the continuous one). Out of the last 10 postings, all opened with charges going from 1.43% to 55.04% on the date of posting.

End/Speculation Procedure

The organization is an EPC project workers gaining practical experience in different kinds of developments. It checked development in its top and main concerns for the revealed periods, however unexpected lift in edges for FY24 cause a stir. It has a request book worth Rs. 1380+ cr. as of June 30, 2024, with more than 66% commitment from Rail line contracts. Prosecution matter adding up to over Rs. 87 cr. raises concern. Very much educated financial backers might stop moderate assets for long haul.

Survey By Dilip Davda on October 18, 2024

Survey Creator

DISCLAIMER: No monetary data at all distributed anyplace here ought to be understood as a proposal to trade protections, or as counsel to do as such in any capacity at all. All matter distributed here is only for instructive and data purposes just and by no means ought to be utilized for settling on venture choices. Perusers should counsel a certified monetary guide prior to going with any genuine venture choices, in light of the data distributed here. My surveys don’t cover GMP market and administrators approaches. Any peruser taking choices in view of any data distributed here does so totally notwithstanding copious advice to the contrary. Financial backers ought to remember that any interest in securities exchanges is dependent upon eccentric market-related gambles. The above data depends on RHP and different records accessible as of date combined with market discernment. The creator has no designs to put resources into this proposition.

About Dilip Davda

Dilip Davda, an independent writer

Dilip Davda is veteran writer related with securities exchange beginning around 1978. He is adding to print and electronic media on securities exchanges/protection/finance beginning around 1985.

Dilip Davda is a main commentator of public issues and NCDs in the essential financial exchange in India. The information he acquired north of thirty years while working in the financial exchange and a solid relationship with famous lead chiefs makes his surveys special. His detail key and monetary examination of organizations thinking of Initial public offering helps financial backers in the essential securities exchange. Dilip Davda has an extraordinary interest in dissecting the SME organizations and composing surveys about their public issues. His audits are routinely distributed on the web and in news papers.

(Dilip Davda – SEBI enrolled Exploration Examiner Mumbai,

Enrollment no. INH000003127 (Ceaseless)

Email id: dilip_davda@rediffmail.com ).

Deepak Developers and Designers Initial public offering FAQs

1. Why Deepak Developers and Specialists Initial public offering?

The underlying public proposition (Initial public offering) of Deepak Manufacturers and Designers India Restricted offers an early venture a potential open door in Deepak Developers and Specialists India Restricted. A financial exchange financial backer can purchase Deepak Manufacturers and Designers Initial public offering shares by applying in Initial public offering before Deepak Developers and Specialists India Restricted shares get recorded at the stock trades. A financial backer could put resources into Deepak Manufacturers and Designers Initial public offering for transient posting gain or a long haul.

2. How is Deepak Developers and Architects Initial public offering?

Peruse the Deepak Manufacturers and Architects Initial public offering proposals by the leadi