Dhariwalcorp Limited IPO Full Details

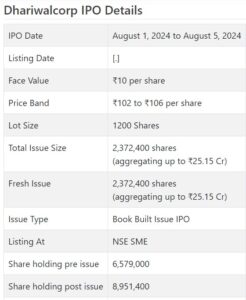

Dhariwalcorp Initial public offering is a book constructed issue of Rs 25.15 crores. The issue is totally a new issue of 23.72 lakh shares.

Dhariwalcorp Initial public offering opens for membership on August 1, 2024 and closes on August 5, 2024. The distribution for the Dhariwalcorp Initial public offering is supposed to be concluded on Tuesday, August 6, 2024. Dhariwalcorp Initial public offering will list on NSE SME with provisional posting date fixed as Thursday, August 8, 2024.

Dhariwalcorp Initial public offering cost band is set at ₹102 to ₹106 per share. The base parcel size for an application is 1200 Offers. The base measure of speculation expected by retail financial backers is ₹127,200. The base part size speculation for HNI is 2 parcels (2,400 offers) adding up to ₹254,400.

• The organization is taken part occupied with exchanging assortment of waxes, modern synthetic compounds, petrol jam and so forth.

• It posted irregularity in its monetary execution for the detailed periods.

• In view of FY24 super profit, the issue shows up forcefully evaluated.

• There is no mischief in avoiding this expensive bet.

ABOUT Organization:

Dhariwalcorp Ltd. taken part occupied with exchanging of complete scope of waxes, modern synthetic compounds, and oil jam. the organization is engaged with handling, buying, selling, bringing in, and exchanging different kinds of wax, including Paraffin Wax, Miniature Wax, Slack Wax, Carnauba Wax, Microcrystalline Waxes, Semi Refined Paraffin Wax, Yellow Beeswax, Hydrocarbon Wax, Montan Wax, Polyethylene Wax, Vegetable Wax, Buildup Wax, Palm Wax, BN Miniature Wax, Hydrogenated Palm Wax, Miniature Leeway Wax, PE Wax, Soya Wax, and so on.

Also, the Organization exchanges modern synthetics, for example, Elastic Cycle Oil, Light Fluid Paraffin (LLP), Citrus extract Monohydrate, Refined Glycerin, Bitumen, Stearic Corrosive, and Oil Jam, including Paraffin Petrol Jam and White Petrol Jam. Its item range incorporates a wide range of weighty and light synthetics, substance components and mixtures, petrochemicals, modern synthetics, blends, subordinates, articles, compounds, results, and exercises of a comparable sort. The organization serves different ventures including Compressed wood and Board, Paper Covering, Colored pencil Assembling, Candle Creation, Materials, Drugs, Oil Jam and Beauty care products, Cylinder and Tire Assembling, Match Creation, Food Handling, and Glue Assembling. With its different scope of items, the organization assumes a critical part in the store network of these areas, guaranteeing quality items and convenient conveyance.

Its items are sold both locally and universally. It has a Container India presence with 21 states and 3 Association domains for homegrown market (in view of deals made for the monetary years finished Walk 31, 2024, 2023, and 2022). It has additionally started trade division and is providing items to one country, in particular Nepal, in light of deals made for the monetary year finished Walk 31, 2024. To meet its Container India presence and guarantee ideal stockpile of items, it makes them process unit and three stockrooms arranged at Jodhpur, Rajasthan, one stockroom arranged at Bhiwandi, Maharashtra, one stockroom arranged at Ahmedabad, Gujarat, and one stockroom at Mundra, Dist. Kachchh, Gujarat, separately. It likewise follows a reevaluating model for running its stockrooms arranged at Bhiwandi, Ahmedabad, and Mundra to guarantee ideal conveyance of items to clients across geologies.

The organization is taken part in wax exchanging business, obtaining, handling, and dispersion of different sorts of waxes for a large number of utilizations. With its emphasis on quality, manageability, and consumer loyalty, the organization is focused on conveying results of pertinent quality that fulfill industry guidelines, guaranteeing consumer loyalty and trust. The organization consistently looks for better approaches to further develop items, cycles, and administrations, remaining in front of market patterns and client requests. As of Walk 31, 2024, it had 7 representatives on its finance.

ISSUE Subtleties/CAPITAL HISTORY:

The organization is emerging with its lady book building course Initial public offering of 2372400 value portions of Rs. 10 each to activate Rs. 25.15 cr. at the upper cap. It has reported a value band of Rs. 102 – Rs. 106 for every offer. The issue opens for membership on August 01, 2024, and will close on August 05, 2024. The base application to be made is for 1200 offers and in products subsequently, from there on. Post portion, offers will be recorded on NSE SME Arise. The issue comprises 26.50% of the post-Initial public offering settled up capital of the organization. From the net returns of the Initial public offering, it will use Rs. 8.00 cr. for working capital, Rs. 8.10 cr. for capex on development of distribution center, and the rest for general corporate purposes.

The issue is exclusively lead overseen by Shreni Offers Ltd., and Bigshare Administrations Pvt. Ltd. is the enlistment center to the issue. Shreni Offers Ltd. is additionally the market producer for the organization.

Having given introductory value shares at standard worth, the organization gave further value shares at a cost of Rs. 655.00 per share in December 2023. It has likewise given extra offers in the proportion of 50 for 1 in Walk 2024. The typical expense of securing of offers by the advertisers is Rs. 3.04, and Rs. 12.84 per share.

Post-Initial public offering, organization’s ongoing settled up value capital of Rs. 6.58 cr. will stand improved to Rs. 8.95 cr. In light of the upper Initial public offering cost band, the organization is searching for a market cap of Rs. 94.89 cr.

Monetary Execution:

On the monetary execution front, for the last three fiscals, the organization has posted a complete pay/net benefit of Rs. 159.20 cr. /Rs. 1.42 cr. (FY22), Rs. 195.19 cr. /Rs. 0.60 cr. (FY23), Rs. 231.11 cr. /Rs. 4.51 cr. (FY24). The organization posted irregularity in its top and main concerns for the announced periods, and flood in primary concern in pre-Initial public offering year causes a stir, yet in addition worry over its supportability.

For the last three fiscals, it has detailed a normal EPS of Rs. 4.10, and a typical RoNW of 46.07%. The issue is estimated at a P/BV of 7.95 in light of its NAV of Rs. 13.34 as of Walk 31, 2024, and at a P/BV of 3.06 in light of its post-Initial public offering NAV of Rs. 34.62 per share (at the upper cap).

On the off chance that we characteristic FY24 income to its post-Initial public offering completely weakened settled up capital, then the asking cost is at a P/E of 21.07. Hence the issue shows up forcefully estimated.

For the detailed periods, the organization has posted PAT edges of 0.90% (FY22), 0.31% (FY23), 1.97% (FY24), and RoE edges of 74.33%, 23.80%, 51.50% separately for the alluded periods.

Profit Strategy:

The organization has not pronounced any profits for the detailed times of the proposition report. It will embrace a judicious profit strategy in light of its monetary presentation and future possibilities.

Correlation WITH Recorded Friends:

According to the deal archive, the organization has no recorded companions to contrast and.

Dealer BANKER’S History:

This is the 32nd order from Shreni Offers in the last three fiscals (counting the continuous one), out of the last 10 postings, 1 opened at standard and the rest all recorded with expenses going from 4.88% to 141.94% on the date of posting.

End/Venture Technique

The organization is having exchanging exercises assortment of waxes, modern synthetic substances, petrol jam and so forth. It posted irregularity in its exhibitions for the detailed periods. In light of FY24 super profit, the issue shows up forcefully evaluated. The unexpected leap in main concern for FY24, for example pre-Initial public offering year causes a stir and worry over its maintainability. There is no damage in avoiding this expensive bet.

Commentator prescribes Stay away from to the issue.

Survey By Dilip Davda on July 30, 2024

Survey Creator

DISCLAIMER: No monetary data at all distributed anyplace here ought to be understood as a proposal to trade protections, or as counsel to do as such in any capacity at all. All matter distributed here is only for instructive and data purposes just and by no means ought to be utilized for settling on venture choices. My audits don’t cover GMP market and administrators courses of action. Perusers should counsel a certified monetary guide prior to pursuing any genuine speculation choices, put together the with respect to data distributed here. With passage boundaries, SEBI maintains that main very much educated financial backers should take part in such offers. With insane postings in the new past, SME Initial public offerings drew the consideration of financial backers in all cases and lead to diviner franticness. Be that as it may, as SME issues have passage boundaries and proceeded with low inclination from the broking local area, any peruser taking choices in light of any data distributed here does so altogether despite all advice to the contrary. The above data depends on data accessible as of date combined with market discernments. The Creator has no designs to put resources into this proposition.