Durlax Top Surface Limited IPO Full Details

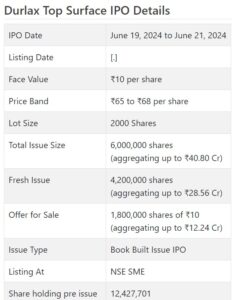

Durlax Top Surface Initial public offering is a book constructed issue of Rs 40.80 crores. The issue is a mix of new issue of 42 lakh shares collecting to Rs 28.56 crores and make available for purchase of 18 lakh shares conglomerating to Rs 12.24 crores.

Durlax Top Surface Initial public offering opens for membership on June 19, 2024 and closes on June 21, 2024. The allocation for the Durlax Top Surface Initial public offering is supposed to be finished on Monday, June 24, 2024. Durlax Top Surface Initial public offering will list on NSE SME with conditional posting date fixed as Wednesday, June 26, 2024.

Durlax Top Surface Initial public offering cost band is set at ₹65 to ₹68 per share. The base part size for an application is 2000 Offers. The base measure of speculation expected by retail financial backers is ₹136,000. The base part size venture for HNI is 2 parcels (4,000 offers) adding up to ₹272,000.

• The organization is participated occupied with assembling strong surface materials.

• It posted consistent development in its top and primary concerns for the revealed periods.

• In light of FY24 profit, the issue shows up covetously estimated.

• All around informed financial backers might stop moderate assets for the medium term.

ABOUT Organization:

Durlax Top Surface Ltd. (DTSL) is participated occupied with assembling of strong surface material, which is sold across India, through a broad dispersion organization of wholesalers and direct clients and furthermore traded to different nations like Dubai, Bahrain, Greece, Nepal. It works through two brands specifically LUXOR® and ASPIRON®, which give a great many strong surfaces.

DTSL’s LUXOR® image offers Acrylic UV Strong Surfaces, while ASPIRON® offers Altered Strong Surfaces. Arranged in Vapi, its assembling office is furnished with German and South Korean advancements and high level hardware to create strong surface materials. The organization expects to fulfill the consistently advancing needs of clients and make useful spaces across different areas. Its strong surfaces track down applications in private, business, neighborliness, medical services, outside, and various ventures, giving in vogue and solid answers for ledges, vanities, workplaces, retail spaces, lodgings, clinics, open air tasks, and that’s only the tip of the iceberg. As of Walk 31, 2024, it had 120 merchants in India and 5 in adjoining nations. Its homegrown income share was 95.51% and global income share was 4.49% as of Walk 31, 2024. As of the said date, it had 69 workers on its finance.

ISSUE Subtleties/CAPITAL HISTORY:

The organization is emerging with its lady book building course Initial public offering of 6000000 value portions of Rs. 10 each to prepare Rs. 40.80 cr. at the upper cap. It has reported a value band of Rs. 65 – Rs. 68 for every offer. The Initial public offering comprises of 4200000 new value shares (worth Rs. 28.56 cr.at the upper cap) and 1800000 value shares via Offer available to be purchased (OFS – worth Rs. 12.24 cr. at the upper cap). The issue opens for membership on June 19, 2024, and will close on June 21, 2024. The base application to be made is for 2000 offers and in products consequently, from that point. Post apportioning, offers will be recorded on NSE SME Arise. The issue comprises 36.08% of the post-Initial public offering settled up capital of the organization. The organization is spending Rs. 5.00 cr. for the new value issue, and from the net returns of the new value issue, it will use Rs. 17.50 cr. for phrasing capital, and Rs. 6.00 cr. for general corporate purposes.

The issue is exclusively lead overseen by Master Worldwide Specialists Pvt. Ltd., and Bigshare Administrations Pvt. Ltd., is the enlistment center to the issue. Globalworth Protections Ltd. is the market producer for the organization.

Having given starting value shares at standard worth, the organization gave further value partakes in the value scope of Rs. 30 – Rs. 1220 for every divide among Decembner2015 and April 2023. It has likewise given extra offers in the proportion of 78 for 1 in December 2022. The typical expense of procurement of offers by the advertisers/selling partners is Rs. 7.44, and Rs. 11.18 per share.

Post-Initial public offering, organization’s ongoing settled up value capital of Rs. 12.43 cr. will stand upgraded to Rs. 16.63 cr. In view of the upper Initial public offering cost band, the organization is searching for a market cap of Rs. 113.07 cr.

Monetary Execution:

On the monetary execution front, for the last three fiscals, the organization has posted an all out pay/net benefit of Rs. 47.42 cr. /Rs. 0.48 cr. (FY22), Rs. 66.84 cr. /Rs. 2.09 cr. (FY23), and Rs. 90.84 cr. /Rs. 5.05 cr. (FY24).

For the last three fiscals, it has detailed a normal EPS of Rs. 2.68, and a typical RoNW of 16.36%. The issue is estimated at a P/BV of 3.89 in light of its NAV of Rs. 17.58 as of Walk 31, 2024, and at a P/BV of 2.24 in light of its post-Initial public offering NAV of Rs. 30.31 per share (at the upper cap).

On the off chance that we characteristic annualized FY24 income to its post-Initial public offering completely weakened settled up capital, then the asking cost is at a P/E of 22.37. In this manner the issue shows up eagerly valued.

For the detailed periods, the organization has posted PAT edges of 1.02% (FY22), 3.14% (FY23), 5.56% (FY24), and RoCE edges of 12.35%, 16.13%, 20.20% separately for the alluded periods.

Profit Strategy:

The organization has not pronounced any profits since fuse. It will embrace a reasonable profit strategy in view of its monetary exhibition and future possibilities.

Examination WITH Recorded Companions:

According to the proposition record, the organization has shown Kaka Ind., Dhabriya Handle, and Pokarna Ltd., as their recorded companions. They are exchanging at a P/E of 19.0, 26.4, and 22.2 (as of June 14, 2024). Nonetheless, they are not equivalent on an apple-to-apple premise.

Dealer BANKER’S History:

This is the ninth order from Master Worldwide in the last three fiscals (counting the continuous one). Out of the last 8 postings, 1 opened at rebate, 1 at standard and the rest with expenses going from 10.47% to 90% on the date of posting.

End/Venture System

The organization is in the assembling of strong surface materials. It stamped consistent development in its top and primary concerns for the announced periods. In light of FY24 profit, the issue shows up covetously estimated. All around informed financial backers might stop moderate assets for the medium term.

Survey By Dilip Davda on June 15, 2024