GEM Enviro Management Limited IPO Full Details

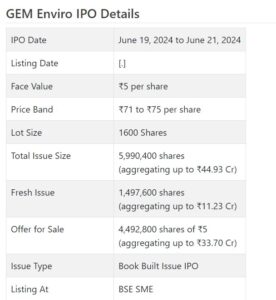

Pearl Enviro Initial public offering is a book constructed issue of Rs 44.93 crores. The issue is a blend of new issue of 14.98 lakh shares collecting to Rs 11.23 crores and make available for purchase of 44.93 lakh shares conglomerating to Rs 33.70 crores.

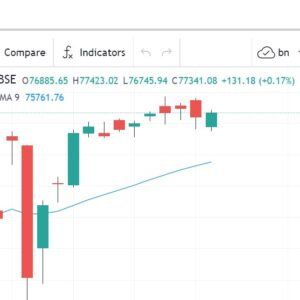

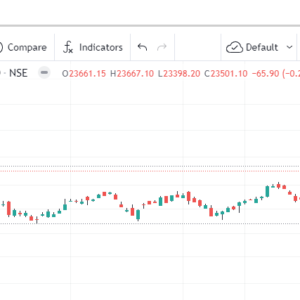

Pearl Enviro Initial public offering opens for membership on June 19, 2024 and closes on June 21, 2024. The distribution for the Jewel Enviro Initial public offering is supposed to be concluded on Monday, June 24, 2024. Diamond Enviro Initial public offering will list on BSE SME with conditional posting date fixed as Wednesday, June 26, 2024.

Pearl Enviro Initial public offering cost band is set at ₹71 to ₹75 per share. The base part size for an application is 1600 Offers. The base measure of venture expected by retail financial backers is ₹120,000. The base parcel size speculation for HNI is 2 parts (3,200 offers) adding up to ₹240,000.

• The organization is participated in giving assortment and reusing of a wide range of bundling waste.

• It expanded into execution of plastic broadened maker obligation program.

• Right now it is giving warning job to PWM Rules to limit plastic waste issue.

• It posted development in its top and main concerns from FY21 to FY23.

• The lift in main concern for 9MFY24 shows what’s to come possibilities.

• In light of FY24 annualized super profit, the issue shows up completely estimated.

• Financial backers might stop assets for the medium to long haul rewards.

ABOUT Organization:

Jewel Enviro The board Ltd. (GEML) was laid out in the year 2013 for assortment and reusing of a wide range of Bundling waste including the Plastic Waste. In this manner, the organization differentiated to execution of Plastic Broadened Maker Obligation Projects for different association (to satisfy their commitments according to PWM Rules 2016 and revisions) and which has turned into the biggest Business vertical of the Organization (adding to 82.41% of income in the year 2022-2023).

Assortment and reusing of Modern Plastic Waste added to 17.42% of income and Deals and showcasing of reused items added to 0.18% of income in FY 2022-2023. Further in year 2023-2024 the organization has wandered into new extra organizations in the field of Manageability and as on today the Organization offers following Types of assistance:

1. EPR consultancy and satisfaction for Plastic Waste

2. Assortment and reusing of Modern Plastic Waste

3. Deals and Promoting of reused items

4. ESG Counseling and BRSR (Business Obligation and Supportability Announcing)

Furthermore, the organization likewise sorts out mindfulness programs for making individuals mindful about legitimate removal of plastic waste and need of reusing consistently. Laid out in the year 2013, from the year 2013 to 2018, it was participated in exchanging of plastic waste material and exchanging of the product made out of the waste reusing. The organization was focused on feasible plastic waste administration and natural stewardship, giving a bin of administrations to clients incorporates yet not restricted to plastic waste assortment and arranging, reusing and reusing, squander exchanging, giving climate consultancy and so on.

In the year 2016, Service of Climate, Woodland and Environmental Change (Service) told Plastic Waste Administration Rules, 2016 (“PWM Rules”). The PWM Rules command the generators of plastic waste to do whatever it takes to limit age of plastic waste, not to litter the plastic waste, guarantee isolated capacity of waste at source and hand over isolated squander as per rules. As a feature of this drive, the service likewise gave complete rules on Broadened Maker Obligation (EPR) for plastic bundling in February 2022. These rules lay out a design for the successful execution of EPR, illustrating the particular obligations and commitments of Makers, Merchants, Brand Proprietors, Recyclers, Squander Processors, and other important partners.

As per the administration, the organization is sans obligation and is working on a resource light plan of action and is the arising pioneer in PWM section and are sure of keeping up with the development patterns posted up until this point. It appreciates great piece of the pie of around 21-25% in the section among unlisted companions and is the most favored specialist co-op among 200+ prestigious industry players.

Notwithstanding, Organization’s ongoing debt holders’ day of 250+ days will lessen to 210 days, yet at the same time stays as a main pressing issue. As of the date of recording this deal report, it had 51 representatives on its finance.

ISSUE Subtleties/CAPITAL HISTORY:

The organization is emerging with its lady combo book building course Initial public offering of 5990400 value portions of Rs. 10 each to activate Rs. 44.93 cr. at the upper cap. The Initial public offering comprises of 1497600 new value shares (worth Rs. 11.23 cr. at the upper cap), and a Proposal available to be purchased (OFS) of 4492800 offers (worth Rs. 33.70 cr. at the upper cap), It has reported a value band of Rs. 71 – Rs. 75 for every offer. The issue opens for membership on June 19, 2024, and will close on June 21, 2024. The base application to be made is for 1600 offers and in products subsequently, from that point. Post designation, offers will be recorded on BSE SME. The issue comprises 26.56% of the post-Initial public offering settled up capital of the organization. From the net returns of the new value issue, it will use Rs. 7.00 cr. for working capital, and the rest for general corporate purposes.

The issue is mutually lead overseen by Offer India Capital Administrations Pvt. Ltd., and Fintellectual Corporate Guides Pvt. Ltd., while Horizon Monetary Administrations Pvt. Ltd. is the enlistment center to the issue. Share India gathering’s Portion India Protections Ltd. is the market producer for the organization. The Initial public offering is endorsed to the degree of 85% by Offer India Capital and 15% by Fintellectual Corporate.

Having given starting value share at standard worth, the organization gave further value partakes in the value scope of Rs. 14 – Rs. 239.50 (in view of Rs. 5 FV). It has likewise given extra offers in the proportion of 16 for 1 in September 2023, and 1 for 1 in December 2023. The typical expense of obtaining of offers by the advertisers/selling partners is Rs. 0.15, Rs. 0.24, and Rs. 0.41 per share.

Post-Initial public offering, organization’s ongoing settled up value capital of Rs. 10.53 cr. will stand improved to Rs. 11.28 cr. In light of the upper Initial public offering cost band, the organization is searching for a market cap of Rs. 169.13 cr.

Monetary Execution:

On the monetary execution front, for the last three fiscals, the organization has posted a complete income/net benefit of Rs. 25.61 cr. /Rs. 5.83 cr. (FY21), Rs. 32.92 cr. /Rs. 7.45 cr. (FY22), and Rs. 42.81 cr. /Rs. 10.02 cr. (FY23). For 9M of FY24 finished on December 31, 2023, it procured a net benefit of Rs. 8.40 cr. on a complete income of Rs. 26.21 cr.

For the last three fiscals, it has revealed a normal EPS of Rs. 4.01, and a typical RoNW of 56.36%. The issue is valued at a P/BV of 5.09 in view of its NAV of Rs. 14.74 as of December 31, 2023, and at a P/BV of 4.00 in light of its post-Initial public offering NAV of Rs. 18.74 per share (at the upper cap).

On the off chance that we trait annualized FY24 income to its post-Initial public offering completely weakened settled up capital, then the asking cost is at a P/E of 15.09. Consequently the issue shows up completely valued. Nonetheless, taking into account the business drifts, the organization is ready for brilliant possibilities ahead.

For the revealed periods, the organization has posted PAT edges of 22.78% (FY21), 22.64% (FY22), 23.40% (FY23), 31.84% (9M-FY24), and RoCE edges of 76.58%, 58.15%, 55.98%, 36.55% individually for the alluded periods.

Profit Strategy:

The organization delivered a profit of Rs. 0.54 cr. (FY22), and Rs. 1.49 cr. (FY23). It has taken on a judicious profit strategy in the period of December 2023, in view of its monetary exhibition and future possibilities.

Examination WITH Recorded Companions:

According to the proposition record, the organization has no recorded companions to contrast and.

Vendor BANKER’S History:

This is the eleventh order from Offer India Capital in the last two fiscals (counting the continuous one), out of the last 10 postings, 1 opened at rebate, 2 at standard and the rest with charges going from 5.33% to 120% on the date of posting.

This is the principal command from Fintellectual Corporate in the current fiscals, and has no previous history.

End/Speculation Technique

However the organization is participated in plastic waste administration (PWM) section which is profoundly divided one, its more than decade experience and long haul relations with the eminent clients is ascribed to its exhibition up to this point. Annualized FY24 profit the issue shows up completely valued, however it demonstrates the probable patterns before very long with rising commitment of the organization in PWM fragment. Financial backers might stop assets for the medium to long haul compensations in this profit paying organization.