Jay Kailash Namkeen Limited IPO Subscription and Allotments

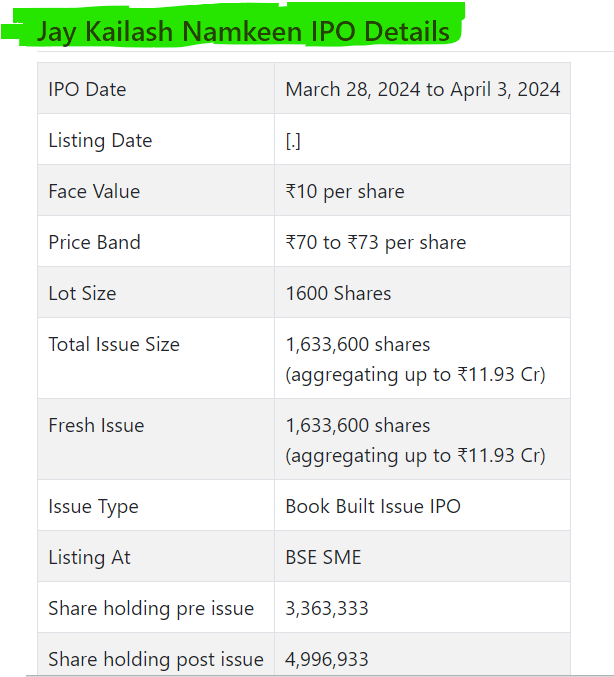

Jay Kailash Namkeen Initial public offering is a book fabricated issue of Rs 11.93 crores. The issue is completely a new issue of 16.34 lakh shares.

Jay Kailash Namkeen Initial public offering opened for membership on Walk 28, 2024 and will close on April 3, 2024. The portion for the Jay Kailash Namkeen Initial public offering is supposed to be concluded on Thursday, April 4, 2024. Jay Kailash Namkeen Initial public offering will list on BSE SME with provisional posting date fixed as Monday, April 8, 2024.

Jay Kailash Namkeen Initial public offering cost band is set at ₹70 to ₹73 per share. The base parcel size for an application is 1600 Offers. The base measure of venture expected by retail financial backers is ₹116,800. The base parcel size venture for HNI is 2 parts (3,200 offers) adding up to ₹233,600.

• The organization is taken part occupied with assembling and advertising of bundled Indian tidbits.

• It has an arrangement of 56 items with 186 SKUs.

• It posted irregularity in its top and main concerns for the revealed periods.

• In light of FY24 annualized profit, the issue is extremely estimated.

• There is no damage in skirting this expensive bet.

ABOUT Organization:

Jay Kailash Namkeen Ltd. (JKNL) is participated occupied with assembling of bundled Indian tidbits. Its scope of Indian tidbits incorporates Chana Jor Namkeen, Masala Chana Jor, Pudina Chana, Masala Mung Jor, Plain Mung Jor, Soya Sticks, Haldi Chanas, Chana dal, Sev Murmura and Garlic Sev Murmura, Bhavnagari Gathiya, Chana Dal, Sing Bhujia, Popcorn, Cooked Peanuts, and so on. The organization has 186 SKUs of its 56 items having retail and discount packs.

Its differentiated item portfolio is in this way, somewhat less vulnerable to shifts in purchaser inclinations, market patterns and dangers of working in a specific item fragment. The Organization was at first participated in B2B business wherein it fabricated items in mass amounts for other all around perceived organizations/brands in same industry. It makes items and supplies in the provinces of Assam, Bihar, Chhattisgarh, Gujarat, Madhya Pradesh, Maharashtra, Odisha, Rajasthan, Telangana and Uttar Pradesh. Be that as it may, from April 2022 onwards it has likewise begun B2C business alongside existing B2B business under own image name “Jay Kailash”. It is additionally into discount exchange of Chana Jor namkeen.

The organization has creation limit of 10 tons each functioning day at assembling office. Notwithstanding, its ability use is exceptionally low (normal 32% for FY22, FY23 and 8M-FY24). As of November 30, 2023, it had 14 representatives on its finance and a power of 35 on request workers for creation and dispatch. It likewise has 6 faculty for advertising.

ISSUE Subtleties/CAPITAL HISTORY:

The organization is emerging with its lady book building course Initial public offering of 1633600 value portions of Rs. 10 each to assemble Rs. 11.93 cr. at the upper cap. It has declared a value band of Rs. 70 – Rs. 73 for each offer. The issue opens for membership on Walk 28, 2024, and will close on April 03, 2024. The base application to be made is for 1600 offers and in products subsequently, from that point. Post assignment, offers will be recorded on BSE SME. The issue is 32.69% of the post-Initial public offering settled up capital of the organization. From the net returns of the Initial public offering, it will use Rs. 7.00 cr. for working capital, and the rest for general corporate purposes.

The issue is exclusively lead overseen by Master Worldwide Specialists Pvt. Ltd., and Horizon Monetary Administrations Pvt. Ltd. is the enlistment center of the issue. Rikhav Protections Ltd. is the market creator for the organization.

Having given starting value capital at standard, the organization gave/changed over additional value partakes in the value scope of Rs. 42.51 – Rs. 550 between May 2022 and May 2023. It has additionally given extra offers in the proportion of 43 for 1 in June 2022 and 1 for 3 in January 2023. The typical expense of securing of offers by the advertisers is Rs. 0.17, Rs. 12.04 per share.

Post-Initial public offering, organization’s ongoing settled up value capital of Rs. 3.36 cr. will stand improved to Rs. 5.00 cr. In light of the upper Initial public offering cost band, the organization is searching for a market cap of Rs. 36.48 cr.

Monetary Execution:

On the monetary execution front, for the last three fiscals, the organization has posted an all out income/net benefit of Rs. 13.15 cr. /Rs. 0.09 cr. (FY21), Rs. 3.17 c/Rs. 0.05 cr. (3M-FY22), Rs. 7.26 cr. /Rs.0.49 cr. (9M-FY22). Rs. 9.88 cr. /Rs. 0.89 cr. (FY23). For 8M of FY24 finished on November 30, 2023, it procured a net benefit of Rs. 0.41 cr. on an all out income of Rs. 6.46 cr.

For the last three fiscals, it has detailed a normal EPS of Rs. 2.66, and a typical RONW of 53.97%. The issue is evaluated at a P/BV of 4.14 in view of its NAV of Rs. 17.62 as of November 30, 2023. The Initial public offering cost band promotion is feeling the loss of its post-Initial public offering NAV information on the lower and upper cap.

On the off chance that we characteristic annualized FY24 income to its post-Initial public offering completely weakened paid-p capital, then, at that point, the asking cost is at a P/E of 60.33. Accordingly the Initial public offering is excessively estimated.

For the announced periods, the organization has posted PAT edges of 0.67% (FY21), 1.62% (3M-FY22), 6.81% (9M-FY22), 9.06% (FY23), 6.32% (8M-FY24) and RoCE edges of 25.94%, 12.06%, 139.51%, 31.91%, 11.10%, individually for the alluded periods. KPI information varies as seen on P 89, 90, and P115.

Profit Strategy:

The organization has not announced any profits since fuse. It will embrace a judicious profit strategy in light of its monetary exhibition and future possibilities.

Examination WITH Recorded Friends:

According to the proposition archive, the organization has shown Annapurna Swadisht and Prataap Snacks as their recorded friends. They are exchanging at a P/E of 64.0 and 114.0 (as of Walk 22, 2024). Nonetheless, they are not practically identical on an apple-to-apple premise.

Vendor BANKER’S History:

This is the seventh order from Master Worldwide in the last two fiscals, out of the last 6 postings, 1 opened at rebate, 1 at standard and the rest with expenses going from 10.47% to 90% upon the arrival of posting.