Kizi Apparels Limited IPO Full Details

Kizi Clothes Initial public offering is a decent value issue of Rs 5.58 crores. The issue is totally a new issue of 26.58 lakh shares.

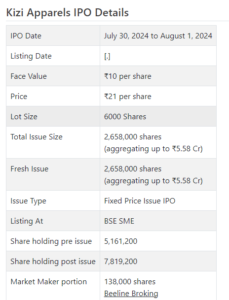

Kizi Clothes Initial public offering opens for membership on July 30, 2024 and closes on August 1, 2024. The portion for the Kizi Clothes Initial public offering is supposed to be finished on Friday, August 2, 2024. Kizi Clothes Initial public offering will list on BSE SME with provisional posting date fixed as Tuesday, August 6, 2024.

Kizi Clothes Initial public offering cost is ₹21 per share. The base part size for an application is 6000 Offers. The base measure of venture expected by retail financial backers is ₹126,000. The base parcel size speculation for HNI is 2 parts (12,000 offers) adding up to ₹252,000.

• The organization is in design piece of clothing business having own outlets and Internet business stage showcasing network.

• It has restrict with Dependence Retail for mass supplies.

• The organization posted development in its top and primary concerns for the detailed periods.

• In light of FY24 profit, the issue shows up forcefully valued.

• All around informed financial backers might stop moderate assets for the medium term.

ABOUT Organization:

Kizi Clothes Ltd. (KAL) is taken part in assembling and exchanging of readymade articles of clothing through its own Display areas, wholesalers and shopping centers and online stage. In 2019, by teaming up with the one of the India’s driving brands, “Arvind Way of life Brand Restricted in picked up speed and keeps on providing them the tailor made items. The organization sent off its most memorable r own image “ANUTARRA” in the ladies’ ethnic wear section.

As a piece of additional turn of events, it has recorded items on the vast majority of the accessible Web based business stages in the F.Y. 2019-20. With savvy items made in its own office the organization had the option to give the best quality item at an entirely reasonable cost on the lookout. This has provoked more interest for items/brands on the lookout. In 2020 it teamed up with Dependence Retail and increased business to another level. When the greater part of the business in the entire world was severally impacted because of Coronavirus. In the next year, it became one standard makes of Dependence Retail. In 2021, it sent off ladies western wear brand by the name of “KIZI”.

The organization additionally give offices of occupation working to the prestigious brands of India like Fab India. The organization is working on B2B and D2C models. To advance its own Brands: 1. “Anutarra” – an ethnic wear assortment for the ladies and 2. “Kizi” – a western wear assortment for the ladies, it has own customers situated in Jaipur just, who buy in mass from the Organization and deal it in the nearby business sectors through their shops. The organization has significant spotlight on Web based business stage to grow its compass. As of June 30, 2024, it had 18 workers on its finance. It additionally draws in work laborers as and when required.

ISSUE Subtleties/CAPITAL HISTORY:

The organization is emerging with its lady Initial public offering of 2658000 value portions of Rs. 10 each at a proper cost of Rs. 21 for each offer to assemble Rs. 5.58 cr. The issue opens for membership on July 30, 2024, and will close on August 01, 2024. The base application to be made is for 6000 offers and in products subsequently, from that point. Post allocation, offers will be recorded on BSE SME. The issue comprises 33.99% of the post-Initial public offering settled up capital of the organization. The organization is spending Rs. 0.60 cr. for this Initial public offering process, and from the net returns, it will use Rs. 0.30 cr. for reimbursement of unstable advances, Rs. 3.49 cr. for working capital, and Rs. 1.20 cr. for general corporate purposes.

The issue is exclusively lead overseen by Intelligent Monetary Administrations Pvt. Ltd., and Bigshare Administrations Pvt. Ltd. is the enlistment center to the issue. Direct path Broking Ltd. is the market producer for the organization.

Having given beginning value shares at standard worth, the organization gave/changed over additional value shares at a cost of Rs. 21 in June 2023. The typical expense of securing of offers by the advertisers is Rs. 12.00, and Rs. 24.63 per share.

Post-Initial public offering, organization’s ongoing settled up value capital of Rs. 5.16 cr. will stand upgraded to Rs. 7.82 cr. In view of the upper Initial public offering cost band, the organization is searching for a market cap of Rs. 16.42 cr.

Monetary Execution:

On the monetary execution front, for the last three fiscals, the organization has posted an all out pay/net benefit of Rs. 5.39 cr. /Rs. 0.21 cr. (FY22), Rs. 15.50 cr. /Rs. 0.55 cr. (FY23), and Rs. 20.27 cr. /Rs. 0.72 cr. (FY24).

For the last three fiscals, it has revealed a normal EPS of Rs. 1.12, and a typical RoNW of 11.81%. The issue is valued at a P/BV of 1.85 in light of its NAV of Rs. 11.38 as of Walk 31, 2024, and at a P/BV of 1.43 in view of its post-Initial public offering NAV of Rs. 14.65 per share.

On the off chance that we trait FY24 income to its post-Initial public offering completely weakened settled up capital, then the asking cost is at a P/E of 22.83. Accordingly the issue shows up forcefully estimated.

For the announced periods, the organization has posted PAT edges of 0.04% (FY22), 0.04% (FY23), 0.04% (FY24), and RoCE edges of 0.09%, 0.17%, 0.14% individually for the alluded periods.

Profit Strategy:

The organization has not announced any profits since joining. It will embrace a reasonable profit strategy in light of its monetary presentation and future possibilities.

Examination WITH Recorded Companions:

According to the proposition record, the organization has shown Thomas Scott, and Bizotic Business, as their recorded friends. They are exchanging at a P/E of 27.8 and 12.6 (as of July 26, 2024). In any case, they are not similar on an apple-to-apple premise.

Dealer BANKER’S History:

This is the seventeenth order from Intuitive Monetary in the last three fiscals (counting the continuous one), out of the last 10 postings, 3 opened at rebate, 1 at standard and the rest recorded with expenses going from 2.86% to 71.43% on the date of posting.

End/Venture Methodology

The organization is taken part in ethnic articles of clothing and design wears. It has restricted with Dependence Retail for mass supplies. It likewise has own outlets and internet business advertising organization. In view of FY24 profit, the issue shows up forcefully estimated. Very much educated financial backers might stop moderate assets for the medium term.

Survey By Dilip Davda on July 27, 2024

Audit Creator

DISCLAIMER: No monetary data at all distributed anyplace here ought to be understood as a proposal to trade protections, or as counsel to do as such in any capacity at all. All matter distributed here is only for instructive and data purposes just and by no means ought to be utilized for going with venture choices. My surveys don’t cover GMP market and administrators approaches. Perusers should counsel a certified monetary consultant prior to pursuing any genuine speculation choices, put together the with respect to data distributed here. With passage obstructions, SEBI maintains that main all around informed financial backers should partake in such offers. With insane postings in the new past, SME Initial public offerings drew the consideration of financial backers no matter how you look at it and lead to diviner franticness. In any case, as SME issues have section obstructions and proceeded with low inclination from the broking local area, any peruser taking choices in view of any data distributed here does so totally despite copious advice to the contrary. The above data depends on data accessible as of date combined with market insights. The Creator has no designs to put resources into this proposition.