Nifty and Bank Nifty Index Market Prediction: 2nd August 2024

As we approach the trading session on 2nd August 2024, both the Nifty 50 and Bank Nifty indices are poised for significant movements, driven by a mix of global cues, domestic economic data, and corporate earnings reports. Here’s a detailed analysis and prediction for tomorrow’s market.

Nifty 50 Index Prediction

Current Market Sentiment

The Nifty 50, India’s premier stock market index, has been on a bullish trend over the past few weeks, primarily driven by strong corporate earnings, robust foreign institutional investor (FII) inflows, and positive global market trends. As of the last trading session, the index closed at 19,750, just shy of the psychological 20,000 mark.

Key Drivers for 2nd August 2024

- Global Market Cues:

- Overnight, global markets, including the US and European indices, closed in the green, indicating a positive sentiment that could spill over into the Indian markets.

- Any developments in the ongoing geopolitical tensions or global economic indicators, such as US GDP growth data or European Central Bank policies, could influence the market sentiment.

- Domestic Economic Data:

- Recent reports on India’s GDP growth, inflation rates, and industrial production have shown mixed results, with inflation moderating but industrial production showing signs of slowing.

- Investors will keep an eye on any new economic data releases or updates from the Reserve Bank of India (RBI) regarding interest rates, which could sway market sentiment.

- Corporate Earnings Season:

- The earnings season is in full swing, with several major companies set to release their quarterly results. Positive earnings surprises, especially from heavyweights like Reliance Industries, Infosys, and HDFC Bank, could drive the index higher.

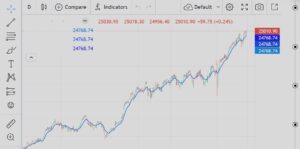

Technical Analysis

- Support Levels: The Nifty has strong support around the 24,500 level. If the index faces selling pressure, this level is likely to act as a cushion.

- Resistance Levels: On the upside, the immediate resistance is pegged at 25,000, a crucial psychological barrier. A breach of this level could lead to further upside towards 20,200.

Prediction

Given the positive global cues and strong domestic earnings reports, the Nifty 50 index is expected to open on a positive note. However, it may face resistance around the 20,000 mark. If global markets remain stable and domestic corporate earnings continue to impress, we could see the Nifty 50 closing above 25,000, entering uncharted territory.

Bank Nifty Index Prediction

Current Market Sentiment

The Bank Nifty index, which tracks the performance of the banking sector in India, has also been performing well, driven by strong quarterly results from major banks and a stable interest rate environment. The index closed at 51,500 in the last session, continuing its upward trajectory.

Key Drivers for 2nd August 2024

- Banking Sector Earnings:

- Leading banks like ICICI Bank, HDFC Bank, and State Bank of India have reported strong earnings, with healthy loan growth and improved asset quality.

- Positive earnings surprises from mid-cap banks could provide additional momentum to the index.

- Interest Rate Environment:

- The RBI’s current stance on interest rates, with a bias towards maintaining status quo to support growth, has been favorable for the banking sector.

- Any hints from the RBI regarding future rate cuts could further boost the Bank Nifty.

- Credit Growth and NPAs:

- The banking sector has seen robust credit growth, which is a positive sign for the economy and the banks’ profitability.

- Additionally, declining non-performing assets (NPAs) have improved investor sentiment towards the sector.

Technical Analysis

- Support Levels: The Bank Nifty has strong support at the 50,500 level. This level is likely to act as a safety net in case of any downside.

- Resistance Levels: On the upside, the immediate resistance is seen at 51,500. A breakout above this level could lead to a rally towards 46,000.

Prediction

The Bank Nifty is likely to continue its upward momentum, buoyed by strong earnings and positive sectoral sentiment. We expect the index to test the 45,500 resistance level early in the session. If this level is breached, we could see a rally towards 52,000. However, profit-booking at higher levels could lead to some volatility.

Overall Market Outlook

Both the Nifty 50 and Bank Nifty indices are expected to open on a positive note on 2nd August 2024, supported by strong global and domestic factors. However, traders should remain cautious as the markets approach key resistance levels. Profit-taking at higher levels could lead to some intraday volatility.

For traders and investors, it is advisable to keep a close watch on global cues, domestic economic data, and earnings announcements. Positioning with appropriate stop losses and staying updated with market news will be crucial to navigate the session successfully.

малый бизнес-идеи малый бизнес-идеи .

Вывод из запоя Вывод из запоя .

бизнесы бизнесы .

Как кодируются от алкоголя в Алматы Как кодируются от алкоголя в Алматы .

найти по номеру найти по номеру .

курс долара курс долара .

Rus-Evakuator https://evakuator-mow.ru .

instagram stories anonymous instagram stories anonymous .

Нужна шлифовка деревянного дома? Наша бригада из опытных строителей из Белоруссии готова воплотить ваши идеи в реальность! Современные технологии, индивидуальный подход, и качество – это наши гарантии. Посетите наш сайт шлифовка дома и начните строительство вашего уюта прямо сейчас! #БелорусскаяБригада #Шлифовка

ig stories anonymous ig stories anonymous .

центр реабилитации алкоголизма центр реабилитации алкоголизма .

stories without stories without .

insta viewer insta viewer .

instagram profile without instagram profile without .

вывод из запоя в ростове-на-дону вывод из запоя в ростове-на-дону .

ростов вывод из запоя ростов вывод из запоя .

анонимный. вывод. из. запоя. ростов. анонимный. вывод. из. запоя. ростов. .

нарколог на дом срочно нарколог на дом срочно .

нарколог на дом нарколог на дом .

view instagram stories anonymously view instagram stories anonymously .

Tempat paling asik bermain slot game hanya di big77

Daftar Beberapa Harga Borak

вывод из запоя http://www.vyvod-iz-zapoya-krasnodar16.ru .

Üsküdar yağ tıkanıklığı açma Tıkanıklık sorunuyla karşılaştığımızda, bu firma ile iletişime geçtik ve gerçekten memnun kaldık. Hızlı cevapları ve profesyonel hizmetleri sayesinde sorunumuzu kısa sürede çözdüler.Teşekkür ederiz! https://topkif.nvinio.com/read-blog/12418_istanbulda-tesisatci.html

купить диплом в чите orik-diploms.ru .

купить диплом о школьном образовании landik-diploms.ru .

Как правильно купить диплом колледжа и пту в России, подводные камни

pansocialnetwork.mn.co/posts/69601958

Легальная покупка диплома о среднем образовании в Москве и регионах

Üsküdar su borusu kaçak tespiti Su sızıntısı problemiyle başa çıkın! Üsküdar su kaçağı tespiti hizmetimiz, su kaçaklarını kırmadan ve hızlıca bulur. https://www.gumrukmedyasi.com/blogs/363/%C3%9Csk%C3%BCdar-Su-Ka%C3%A7a%C4%9F%C4%B1-bulma

купить диплом рхту arusak-diploms.ru .

Официальная покупка диплома вуза с сокращенной программой в Москве

купить диплом в чайковском russa-diploms.ru .

Сколько стоит диплом высшего и среднего образования и как его получить?

Купить диплом дефектолога

kyc-diplom.com/diplomy-po-professii/kupit-diplom-defektologa.html

купить диплом о среднем образовании в омске landik-diploms.ru .

купить диплом библиотекаря orik-diploms.ru .

купить диплом повара 4 разряда prema-diploms.ru .

диплом высшее образование купить диплом высшее образование купить .

Узнайте, как безопасно купить диплом о высшем образовании

Где и как купить диплом о высшем образовании без лишних рисков

Thinker Pedia This is my first time pay a quick visit at here and i am really happy to read everthing at one place

Рекомендации по безопасной покупке диплома о высшем образовании

gamesfortop.ru/diplom-na-zakaz-nikakih-lishnih-hlopot-tolko-rezultat

blacksprut ссылка tor – blacksprut зеркала tor, сайт блэк спрут ссылка

newretrocasino https://newretrocasino-casino3.ru .