Unlocking Insights: Nifty50 and Bank Nifty Full Analysis for June 13, 2024

In the ever-evolving landscape of finance, staying ahead of the curve is paramount. Today, we delve into a comprehensive analysis of the Nifty50 and Bank Nifty indices, providing you with invaluable insights to inform your investment decisions.

Understanding Nifty50: Unveiling Opportunities

The Nifty50 index, comprising fifty diversified stocks, is a barometer of the Indian equity market. As we navigate through the intricate web of market dynamics, it’s essential to decipher the underlying trends and patterns.

Exploring Market Trends: Key Highlights

- Market Sentiment: The sentiment surrounding Nifty50 remains optimistic, buoyed by robust economic indicators and favorable policy measures.

- Sectoral Analysis: Diving deeper into sectoral performance reveals promising growth prospects in sectors such as IT, healthcare, and consumer goods.

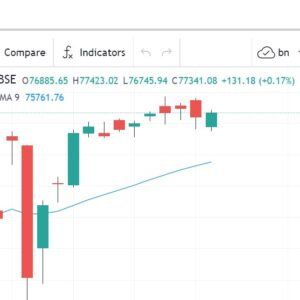

- Technical Analysis: Analyzing technical indicators unveils potential entry and exit points, empowering investors to make informed decisions.

Bank Nifty: Unraveling Financial Dynamics

The Bank Nifty index, encompassing banking stocks, holds significant sway over the financial markets. Let’s dissect the intricacies of this pivotal index.

Navigating Financial Terrain: Insights

- Interest Rate Dynamics: Fluctuations in interest rates exert a profound impact on bank stocks, necessitating a keen eye on central bank policies and macroeconomic trends.

- Credit Quality Metrics: Scrutinizing credit quality metrics sheds light on the health of the banking sector, offering invaluable insights into risk management practices.

- Regulatory Environment: Keeping abreast of regulatory developments is imperative, as changes in regulations can reshape the competitive landscape and alter investment dynamics.

Crafting Your Investment Strategy: Roadmap to Success

Armed with a comprehensive understanding of market dynamics, crafting a robust investment strategy becomes paramount. Here are actionable steps to navigate the complex terrain of financial markets effectively:

- Diversification: Spread your investments across different asset classes to mitigate risk and optimize returns.

- Continuous Learning: Stay abreast of market developments and leverage resources to enhance your financial acumen continually.

- Risk Management: Implement prudent risk management strategies to safeguard your portfolio against unforeseen market fluctuations.

- Long-Term Vision: Embrace a long-term investment horizon, focusing on fundamental factors rather than short-term market noise.

Empowering Your Financial Journey: Conclusion

In conclusion, the Nifty50 and Bank Nifty indices offer a gateway to unlock myriad investment opportunities. By leveraging actionable insights and adopting a strategic approach, you can navigate the dynamic landscape of financial markets with confidence and precision. Embark on your financial journey armed with knowledge, and let the power of informed decision-making propel you towards your investment goals.

Your blog is a true hidden gem on the internet. Your thoughtful analysis and engaging writing style set you apart from the crowd. Keep up the excellent work!