Nifty50 and Bank nifty Tomorrow Trend Analysis May 29

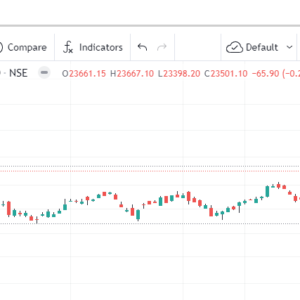

The Nifty 50 has seen rangebound exchanging and combined underneath the mental 23,000 imprint all through the meeting on May 28, as market members kept up with alert in front of the last period of the Lok Sabha political race, trailed by leave surveys due on June 1. Be that as it may, it figured out how to clutch 22,800, the prompt help for the record. Specialists accept that instability is supposed to stay high and the Clever might keep on combining, with a critical obstacle on the higher side at 23,000.

The Nifty 50 expanded its downtrend for three days straight in the midst of the steady battle among bulls and bears, declining by 44 to 22,888, and framed a negative candle design on the day to day diagrams with a lower high, lower low development. Nonetheless, the file actually exchanged well over all vital moving midpoints.

“The record stayed inside a reach as the absence of a breakout on either side neglected to give any directional development. The high India VIX recommends that market unpredictability could stay raised,” Rupak De, senior specialized examiner at LKP Protections, said.

Unpredictability leaped to a new two-year high on Tuesday, in front of the month to month F&O expiry on Thursday and the overall political decision results one week from now. The India VIX rose 4.32 percent to 24.20, the most noteworthy shutting level since May 25, 2022.

On the better quality, Rupak feels the 22,950-23,000 zone could go about as areas of strength for a for the Clever 50, and any ascent might draw in selling pressure. On the lower end, the Clever could float down towards 22,800/22,600, he said.

On the month to month choices front, the greatest Call open interest stayed at the 24,000 strike, trailed by the 23,500 and 23,000 strikes, with most extreme Call composing at the 23,000 strike, trailed by the 23,100 and 22,900 strikes. On the Put side, the 22,500 strike holds the greatest open interest, trailed by the 23,000 and 22,000 strikes, with most extreme composition at the 22,900 strike, and afterward the 22,400 and 22,700 strikes.

The above choices information showed that, in contrast with the weighty Call composing, Put scholars were less dynamic. The 23,000 level is supposed to be key opposition for the Clever on the higher side, while 22,500 is probably going to be critical help.

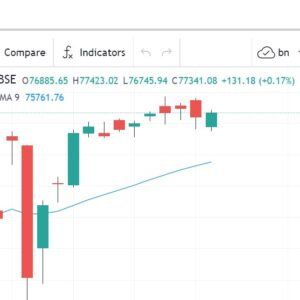

Bank Nifty

The Bank Nifty snapped a three-day series of wins and revised 140 focuses to close at 49,142, shaping a negative candle design on the everyday diagrams and showing some measure of fatigue at more elevated levels.

Jatin Gedia, specialized research examiner at Sharekhan by BNP Paribas, accepts that it is a normal benefit booking and not a pattern inversion.

Thus, “we will keep on keeping up with our inspirational perspective on the list. Concerning levels, 49,000 – 48,800 is the urgent help zone while 49,350 – 49,500 is the quick obstacle zone from a momentary viewpoint,” he said.