Niva Bupa Health Insurance Company Limited IPO Full Details

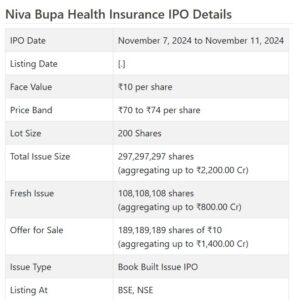

Niva Bupa Health care coverage Initial public offering is a book fabricated issue of Rs 2,200.00 crores. The issue is a mix of new issue of 10.81 crore shares collecting to Rs 800.00 crores and make available for purchase of 18.92 crore shares conglomerating to Rs 1,400.00 crores.

Niva Bupa Health care coverage Initial public offering opened for membership on November 7, 2024 and will close on November 11, 2024. The apportioning for the Niva Bupa Medical coverage Initial public offering is supposed to be concluded on Tuesday, November 12, 2024. Niva Bupa Health care coverage Initial public offering will list on BSE, NSE with provisional posting date fixed as Thursday, November 14, 2024.

Niva Bupa Health care coverage Initial public offering cost band is set at ₹70 to ₹74 per share. The base parcel size for an application is 200 Offers. The base measure of speculation expected by retail financial backers is ₹14,800. The base part size speculation for sNII is 14 parcels (2,800 offers), adding up to ₹207,200, and for bNII, it is 68 parcels (13,600 offers), adding up to ₹1,006,400.

• The organization is one of the main medical coverage organization in India, that has posted quick development in its business.

• It has presented approach holder agreeable items with world standard administrations.

• The organization set inside certain divides among the value scope of Rs. 67.15 – Rs. 85 in front of Initial public offering, that forecasts well.

• However at first sight the issue shows up forcefully valued, very much educated financial backers might stop assets for medium to long haul.

ABOUT Organization:

Niva Bupa Health care coverage Co. Ltd. (NBHICL) is one of the main medical coverage organization in India. Its motivation is to “give each Indian the certainty to get to the best medical care”. It intends to accomplish this reason through medical coverage items and administrations that empower clients to explore their medical care venture, by giving them admittance to a comprehensive wellbeing environment.

As per the RedSeer Report, NBHICL is one of India’s biggest and quickest developing SAHI in light of generally wellbeing GDPI of Rs. 5494.43 cr. in Financial 2024. From Financial 2022 to Monetary 2024, our in general GWP developed at a CAGR of 41.27% and our GWP from retail wellbeing developed at a CAGR of 33.41%. From the three months finished June 30, 2023 to the three months finished June 30, 2024, our in general GWP additionally became by 30.84% and our GWP from retail wellbeing became by 31.99%. Our development in generally speaking wellbeing GDPI from Financial 2022 to Monetary 2024 of 41.37% is one of the greatest developments among SAHIs, and is practically twofold of the business’ normal, which as per the RedSeer Report, expanded by 21.42% from Monetary 2022 to Financial 2024. According to the RedSeer Report, it had a piece of the pie in the Indian SAHI market of 17.29%, 16.24%, 15.58% and 13.87% for year-to-date August 2024 (Financial 2025), Fiscals 2024, 2023, and 2022 separately founded on retail wellbeing GDPI.

Answering the developing necessities of clients more than 16 years of tasks, it has constructed a history of item advancement taking care of a scope of client gatherings. The organization expects to make a health care coverage foundation of decision for clients in India. It offers clients the capacity to get to a far reaching wellbeing biological system and administration capacities by means of its ‘Niva Bupa Wellbeing’ portable application and site, in this manner offering them an all encompassing recommendation. This application gives clients admittance to a scope of medical services arrangements including diagnostics, computerized discussion, yearly wellbeing check-ups and wellbeing training content. Clients can likewise attempt claims accommodation, strategy overhauling and track wellbeing boundaries through this application. Through its different and developing item suite and ‘Niva Bupa Wellbeing’ portable application and site, the organization means to give clients admittance to a scope of medical services and illness the executives arrangements.

Our Advertisers – Bupa Singapore Property Pte. Ltd. furthermore, Bupa Speculations Abroad Restricted, are individuals from the Bupa Gathering. Through its relationship with the Bupa Gathering, the organization approaches its global medical services protection experience. Laid out in 1947, the Bupa Gathering is a global medical care association serving more than 50 million clients around the world, as at December 31, 2023, according to the RedSeer Report. As indicated by the RedSeer Report, without any investors, it reinvests benefits into giving more and better medical care to the advantage of current and future clients.

As per the RedSeer Report, Bupa offers health care coverage, medical care arrangement and matured administrations, and it has organizations all over the planet at the same time, chiefly, in the UK, Australia, Spain, Chile, Poland, New Zealand, Hong Kong SAR, Turkey, Brazil, Mexico, India, the US, Center East and Ireland. As per the RedSeer Report, Bupa additionally has a partner business in Saudi Arabia. According to the RedSeer Report, with Bupa Singapore Property Pte. Ltd. what’s more, Bupa Speculations Abroad Restricted as its Advertisers, the organization is the main medical coverage organization in India greater part constrained by an unfamiliar worldwide medical services bunch.

It had 14.99 million dynamic lives protected as of June 30, 2024. It is decisively centered around the retail wellbeing market and GWP from retail wellbeing items was 67.65% and 68.47% of by and large GWP for the three months finished June 30, 2024 and Financial 2024, individually. As per the RedSeer Report, in India, medical coverage suppliers can be comprehensively ordered into three primary sorts and as of August 31, 2024 there are four IRDAI-perceived public safety net providers barring specific guarantors, 21 confidential back up plans, and 7 IRDAI-perceived SAHIs. The retail health care coverage fragment is the most encouraging portion in the health care coverage industry in India as of Walk 31, 2024, because of higher normal expense per life, higher restoration rates and lower Consolidated Proportions when contrasted with bunch health care coverage, as per the RedSeer Report.

Its client driven approach is driven side-effect advancement. It has exhibited a history of item development, sending off items with “industry-first” highlights. According to the RedSeer Report, “Console” and “Console 2.0” items are one of the main health care coverage items available with remarkable “industry-first” elements, for example, (a) “2 Hours Hospitalization”, where all hospitalizations for at least 2 hours are covered, (b) “Lock the Clock”, where the age of an individual for premium estimation intentions is locked/fixed at the passage age until the time a case is paid, (c) “Console Perpetually”, where the base aggregate safeguarded can be conveyed forward after reestablishment and clients are qualified for twice aggregate protected post guarantee installment with no extra expenses, and (d) “More distant family First”, which gives the capacity to amount to 19 more distant family relations to the inclusion plan. As per the RedSeer Report, the “Console Advantage” highlight is the first of its sort in Quite a while concerning offering limitless reestablishment/top off of total safeguarded in a strategy year. Furthermore, as indicated by the RedSeer Report, its “Yearn” item contains a few “industry-first” highlights, for example, “M-iracle”, “Money sack” and “Future Prepared”, and “Senior First” item offers “industry-first” elements, for example, “2 Hours Hospitalization”.

It is centered around upgrading client experience and advancing client prosperity through making a “360-degree” wellbeing and wellbeing environment stage through ‘Niva Bupa Wellbeing’ portable application and site. Its wellbeing and health biological system stage gives clients a scope of highlights to take care of their requirements. This incorporates claims accommodation capabilities to submit repayment claims and track claims status and Organization Clinics finders, as well as a self-administration segment where clients can view and refresh their strategy subtleties and access their approach reports. The organization additionally gives admittance to comprehensive wellbeing the executives capacities through its wellbeing and health biological system.

As of June 30, 2024, the organization had 152436 individual specialists, 77 corporate specialists, 486 dealers, 196 Protection Showcasing Firms, 5500 retail location people, 14 Web aggregators, and 210 actual branches. It had a representative strength of 8555 as of the said date.

ISSUE Subtleties/CAPITAL HISTORY:

The organization is emerging with its lady combo book building course Initial public offering of 297297297 value portions of Rs. 10 every value Rs. 2200.00 cr. (at the upper cap). The organization has declared a value band of Rs. 70 – Rs. 74 for each offer. The issue comprises new value shares worth Rs. 800.00 cr. (approx. 108108108 offers at the upper cap), and a proposal available to be purchased (OFS) worth Rs. 1400.00 cr., (approx. 189189189 offers at the upper cap). The issue opens for membership on November 07, 2024, and will close on November 11, 2024. The base application to be made is for 200 offers and in products subsequently, from there on. Post allocation, offers will be recorded on BSE and NSE. The Initial public offering comprises 16.27% of the post-Initial public offering settled up value capital of the organization. From the net returns of the new value issue, the organization will use the accessible assets for enlarging its capital base.

The organization has apportioned at the very least 75% for QIBs, not over 15% for HNIs and not over 10% for Retail financial backers.

The joint Book Running Lead Administrators (BRLMs) to this issue are ICICI Protections Ltd., Morgan Stanley India Co. Pvt. Ltd., Kotak Mahindra Capital Co. Ltd., Hub Capital Ltd., HDFC Bank Ltd., Motilal Oswal Speculation Counselors Ltd., while KFin Innovations Ltd. is the recorder to the issue. Partner individuals for this issue are Kotak Protections Ltd., HDFC Protections Ltd., and Motilal Oswal Monetary Administrations Ltd.

The organization has given beginning value capital at standard worth, and has given/changed over additional value partakes in the value scope of Rs. 11.71 – Rs. 67.15 between September 2020, and October 2024. The typical expense of procurement of offers by the advertisers/selling partners is Rs. NA, Rs. 15.57, and Rs. 34.88 per share.

Post Initial public offering, organization’s ongoing settled up value capital of Rs. 1718.92 cr. will stand upgraded to Rs. 1827.03 cr. In view of the upper cap of Initial public offering valuing, the organization is searching for a market cap of Rs. 13520.00 cr.

Monetary Execution:

On the monetary execution front, for the last three fiscals, the organization has (on a merged premise) posted a GWP/net benefit/ – (loss) of Rs. 2809.97 cr. /Rs. – (196.53) cr. (FY22), Rs. 4073.03 cr. /Rs. 12.54 cr. (FY23), and Rs. 5607.57 cr. /Rs. 81.85 cr. (FY24). For Q1 of FY25 finished on June 30, 2024, it denoted a deficiency of Rs. – (18.82) cr. on a GWP of Rs. 1464.18 cr. According to notable information, all insurance agency have languid first half and significant exercises occurs in the final part to no one’s surprise.

For the last three fiscals, the organization has revealed a normal EPS of Rs. 0.05 (fundamental), and a typical RoNW of – (2.58) %. The issue is estimated at a P/BV of 6.19 in light of its NAV of Rs. 11.95 as of June 30, 2024, and is at a P/BV of 4.73 in light of its post-Initial public offering NAV of Rs. 15.66 per share (At upper cap).

In the event that we trait annualized FY25 profit to post-Initial public offering completely weakened equit

Çatalca su kaçağı tespiti Zeytinburnu’nda su kaçağı tespiti için harika bir ekip. Sorunumuzu çok hızlı çözdüler. https://oolibuzz.com/ustaelektrikci