NTPC Green Energy Limited IPO Full Details

NTPC Environmentally friendly power Energy Initial public offering is a book fabricated issue of Rs 10,000.00 crores. The issue is totally a new issue of 92.59 crore shares.

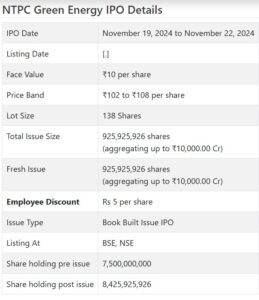

NTPC Environmentally friendly power Energy Initial public offering opens for membership on November 19, 2024 and closes on November 22, 2024. The allocation for the NTPC Efficient power Energy Initial public offering is supposed to be settled on Monday, November 25, 2024. NTPC Environmentally friendly power Energy Initial public offering will list on BSE, NSE with conditional posting date fixed as Wednesday, November 27, 2024.

NTPC Environmentally friendly power Energy Initial public offering cost band is set at ₹102 to ₹108 per share. The base parcel size for an application is 138 Offers. The base measure of speculation expected by retail financial backers is ₹14,904. The base part size venture for sNII is 14 parcels (1,932 offers), adding up to ₹208,656, and for bNII, it is 68 parts (9,384 offers), adding up to ₹1,013,472.

• The organization is the entirely possessed auxiliary of NTPC Ltd., a “Maharatna” PSU.

• It is the biggest environmentally friendly power public area venture (barring hydro).

• The organization is having sun based, wind power age resources and is presently adding hydroelectric cycle.

• It has posted benefits for the revealed times of its monetary presentation.

• The organization is extending its abilities to meet the Public authority of India’s objective of sustainable power age resources.

• In light of FY25 annualized profit, the issue is forcefully evaluated.

• It’s an unadulterated long haul story and subsequently, very much educated/cash overflow financial backers might stop moderate assets.

ABOUT Organization:

NTPC Efficient power Energy Ltd. (NGEL) is an entirely claimed auxiliary of NTPC Restricted, a ‘Maharatna’ focal public area venture. It is the biggest environmentally friendly power public area undertaking (barring hydro) with regards to working limit as of September 30, 2024 and power age in Monetary 2024. (Source: CRISIL Report, November 2024). Its sustainable power portfolio envelops both sun oriented and wind power resources with presence across various areas in excess of six states which mitigates the gamble of area explicit age fluctuation. (Source: CRISIL Report, November 2024).

NGEL’s functional limit was 3,220 MW of sun based activities and 100 MW of wind projects across six (6) states as of September 30, 2024. It has decisively centered around fostering an arrangement of utility-scale sustainable power projects, as well as ventures for public area endeavors (“PSUs”) and Indian corporates. Its ventures produce sustainable power and feed that power into the framework, providing a utility or off taker with energy. For its functional undertakings, the organization has gone into long haul Power Buy Arrangements (“PPAs”) or Letters of Grant (“LoAs”) with an off taker that is either a Focal government organization like the Sun based Energy Partnership of India (“SECI”) or a State government office or public utility.

As of September 30, 2024, its “Portfolio” comprised of 16,896 MWs including 3,320 MWs of working ventures and 13,576 MWs of contracted and granted projects. As of September 30, 2024, its “Ability under Pipeline, for which an update of figuring out (“MOU”) or term sheet has been placed with joint endeavor accomplices or off takers however where conclusive arrangements have not yet been placed, comprised of 9,175 MWs. As of September 30, 2024, its Ability under Pipeline along with Portfolio comprised of 26,071 MWs.

It estimates the evaluated limit of its plants in megawatts in substitute current (AC). Evaluated limit is the normal greatest result that a power plant can create without surpassing its plan limits. “Megawatts Working” addresses the total megawatt evaluated limit of sustainable power establishes that are dispatched and functional as of the revealing date. “Megawatts Contracted and Granted” addresses the total megawatt evaluated limit of sustainable power plants as of the detailed date which incorporate (I) PPAs endorsed with clients, and (ii) limit won and apportioned in sell-offs and where LoAs have been gotten.

As of Walk 31, 2024, its working/contracted and granted megawatts limits were 12396 MW for Sun based and 2100 MW for Wind, which was at 6011 MW and 2300 MW as of Walk 31, 2022 separately. As of September 30, 2024 it remained at 13796 MW and 3100 MW separately. The sun powered energy offers more than 93% in its complete incomes. Its ability development in pipeline for Sunlight based is 6925 MW and Wind 2250 MW as of September 30, 2024.

The organization trusts that it, alongside the NTPC Gathering, major areas of strength for have house insight in environmentally friendly power project execution and acquisition. In sunlight based projects, it as a rule gets a sense of ownership with obtainment of significant gear and supplies and the worker for hire constructs, commissions and hands over the sun oriented plant. It additionally utilizes the turnkey EPC contract model in view of explicit undertaking conditions. In wind projects, the organization for the most part utilizes the turnkey EPC model, going into contracts with OEMs for assembling, introducing, and authorizing wind turbines and the equilibrium of plant. Activity and support (“O&M”) administrations for its sustainable power projects are given through outsider specialist organizations.

As of September 30, 2024, its labor force included 232 representatives, and the organization used the administrations of 45 provisional worker.

ISSUE Subtleties/CAPITAL HISTORY:

The organization is emerging with its lady book building course Initial public offering worth Rs. 10000.00 cr. (approx. 925925926 offers at the upper cap) of Rs. 10 each. The organization has declared a value band of Rs. 102 – Rs. 108 for each offer. The issue opens for membership on November 19, 2024, and will close on November 22, 2024. The base application to be made is for 138 offers and in products subsequently, from there on. Post designation, offers will be recorded on BSE and NSE. The Initial public offering comprises 10.99% of the post-Initial public offering settled up value capital of the organization. From the net returns of the new value issue, the organization will use Rs. 7500.00 cr. for interest in its entirely possessed auxiliary NTPC Sustainable power Ltd. to reimburse/prepay its sure borrowings, and the rest for general corporate purposes.

The organization has held value shares worth Rs. 200.00 cr. for its qualified representatives and offering them a markdown of Rs. 5 for each offer, it has likewise saved shares worth Rs. 1000 cr. for the investors of parent organization NTPC Ltd., and from the rest, it has designated at the very least 75% for QIBs, not over 15% for HNIs and not over 10% for Retail financial backers.

The joint Book Running Lead Supervisors (BRLMs) to this issue are IDBI Capital Business sectors and Protections Ltd., HDFC Bank Ltd., IIFL Capital Administrations Ltd., and Nuvama Abundance The board Ltd., while KFin Advances Ltd. is the enlistment center to the issue. Partner part for this issue are HDFC Protections Ltd., and Nuvama Abundance The executives Ltd.

The organization has given whole value capital at standard worth up to this point. The typical expense of securing of offers by the advertisers/selling partners is Rs. 10.00 per share.

Post Initial public offering, organization’s ongoing settled up value capital of Rs. 7500.00 cr. will stand improved to Rs. 8425.93 cr. In light of the upper cap of the Initial public offering cost band, the organization is searching for a market cap of Rs. 91000 cr.

Monetary Execution:

On the monetary execution front, for the last two fiscals, the organization has posted a complete pay/net benefit Rs. 170.63 cr. /Rs. 171.23 cr. (FY23), and Rs. 2037.66 cr. /Rs. 344.72 cr. (FY24). For H1 of FY25 finished on September 30, 2024, it posted a net benefit of Rs. 175.30 cr. on a complete pay of Rs. 1132.74 cr. In this manner it stamped sharp leap in its top and main concerns from FY24 onwards, demonstrating its ongoing status and possible future patterns considering its extension designs hatching. FY23 benefits incorporates conceded tax break of Rs. 118.68 cr.

For the last three fiscals, the organization has revealed a normal EPS of Rs. NA, and a typical RoNW of 6.69 %. The issue is estimated at a P/BV of 9.89 in view of its NAV of Rs. 10.92 as of September 30, 2024, and is at a P/BV of 5.00 in light of its post-Initial public offering NAV of Rs. 21.59 per share (At upper cap).

On the off chance that we trait annualized FY25 income to post-Initial public offering completely weakened value base, then the asking cost is at a P/E of 257.14 and in view of FY24 income, the P/E remains at 263.41. Accordingly the issue shows up forcefully evaluated. However, taking into account its ongoing laid out limits and future extended limits, this is an unadulterated long haul story. As explained by the administration, the organization has no effect of US strategy on sustainable power as it is having tasks just in India. Being the forerunner in the portion with extra exercises on hydroelectric projects is going.

For the detailed monetary periods, the organization has revealed PAT edges of 31.49% (FY23), 17.56% (FY24), 16.20% (H1-FY25), however RoCE edges information is absent from the proposition archives.

Profit Strategy:

The organization has not announced any profits since its integrate (April 07, 2022). It embraced a profit strategy in September 2024, in light of its monetary exhibition and future possibilities.

COMPARISION WITH Recorded Friends:

According to the proposition archive, the organization has shown Adani Green and Reestablish Energy Worldwide PLC, as their recorded/unlisted friends. The recorded friend is exchanging at a P/E of around 184 (as of November 14, 2024). Nonetheless, they are not really equivalent on an apple-to-apple premise.

Shipper BANKER’S History:

The four BRLMs related with the deal have taken care of 52 public issues in the beyond three fiscals, out of which 14 issues have shut beneath the proposition cost on posting date.

End/Speculation Methodology

The organization is one of the main sustainable power producing PSU having sunlight based and wind power age resources. It is likewise adding hydroelectric resources and giving push of force stockpiling plans. However the organization posted net benefits for the revealed monetary periods, in light of FY25 annualized profit, the Initial public offering is forcefully evaluated. Very much educated/cash overflow financial backers might stop moderate assets for long haul, as this is an unadulterated long haul wagered.

Audit By Dilip Davda on November 14, 2024

Survey Creator

DISCLAIMER: No monetary data at all distributed anyplace here ought to be understood as a proposal to trade protections, or as counsel to do as such in any capacity at all. All matter distributed here is only for instructive and data purposes just and by no means ought to be utilized for going with speculation choices. Perusers should counsel a certified monetary guide prior to going with any real venture choices, in light of the data distributed here. My surveys don’t cover GMP market and administrators approaches. Any peruser taking choices in light of any data distributed here does so completely notwithstanding the obvious danger ahead. Financial backers ought to remember that any interest in securities exchanges is dependent upon flighty market-related chances. The above data is bas