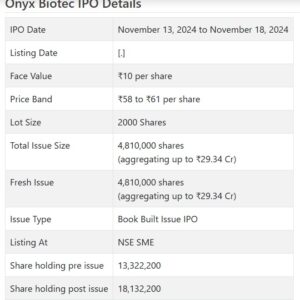

Onyx Biotec Initial public offering is a book constructed issue of Rs 29.34 crores. The issue is totally a new issue of 48.1 lakh shares.

Onyx Biotec Initial public offering opens for membership on November 13, 2024 and closes on November 18, 2024. The allocation for the Onyx Biotec Initial public offering is supposed to be concluded on Tuesday, November 19, 2024. Onyx Biotec Initial public offering will list on NSE SME with speculative posting date fixed as Thursday, November 21, 2024.

Onyx Biotec Initial public offering cost band is set at ₹58 to ₹61 per share. The base part size for an application is 2000 Offers. The base measure of speculation expected by retail financial backers is ₹122,000. The base part size speculation for HNI is 2 parcels (4,000 offers) adding up to ₹244,000.

• The organization is basically taken part in the assembling of sterile water for infusions, dry powder and syrup

• It posted irregularity in its top lines with exceptionally vacillation primary concerns.

• In light of FY25 annualized super profit, the issue shows up completely estimated.

• It is activity in an exceptionally cutthroat and divided section.

• All around informed financial backers might stop moderate assets for long haul.

ABOUT Organization:

Onyx Biotec Ltd. (OBL) began its activity in drug industry with sterile water for infusions in the year 2010. From that point forward, Onyx has been related with the medical care fragment and offering Clean Drug items and has turned into an unmistakable provider of clean items to large companies, which incorporates the top pharma organizations at container India level.

Onyx is resolved to give great items at reasonable cost. As of now, the Organization Fabricates Sterile Water for Infusions, and goes about as a drug contract maker offering a far reaching scope of Dry Powder Infusions and Dry Syrup for India and abroad. Its items are being handled and fabricated as per most ideal FDA rehearses that anyone could hope to find internationally. OBL’s framework and item is tried continually at each level to guarantee worldwide norms of value in-house and FDA Affirmed Research facilities. Its center business is centered around giving start to finish item advancement and assembling answers for clients. Its administration additionally remember readiness and recording of administrative dossiers for the Indian and worldwide business sectors.

Organization’s assembling office Unit I is having creation limit of 6,38,889 units of Sterile Water for Infusions each day and Unit II is having a limit of 40,000 units of dry Powder infusion each day and 26,667 units of dry syrup each day in a solitary shift. Its assembling units are outfitted with Present day Hardware, guarantees Quality Control and follows Feasible Practices. Its assembling units have been authorize by worldwide administrative office for example World Wellbeing Association Great Assembling Practice (“WHO-GMP”). As of July 31, 2024, it had 175 representatives on its finance and extra 20 provisional laborers in different divisions.

ISSUE Subtleties/CAPITAL HISTORY:

The organization is emerging with its lady book building course Initial public offering of 4810000 value portions of Rs. 10 each to activate Rs. 29.34 cr. (at the upper cap). The organization has declared a value band of Rs. 58 – Rs. 61 for each offer. The issue opens for membership on November 13, 2024, and will close on November 18, 2024. The base number of offers to be applied is for 2000 offers and in products subsequently, from there on. Post assignment, offers will be recorded on NSE SME Arise. The issue comprises 26.53% of the post-Initial public offering settled up capital of the organization. From the net returns of the Initial public offering, the organization will use Rs. 6.08 cr. for upgradation of assembling Unit I, Rs. 1.24 cr. for fast cartooning bundling line at Unit II, Rs. 12.00 cr. for reimbursement/prepayment of specific borrowings, and the rest for general corporate purposes.

The Initial public offering is exclusively lead overseen by Skyline The board Pvt. Ltd., while MAS Administrations. Ltd. is the recorder to the issue. Giriraj Stock Broking Pvt. Ltd., is the Market Creator for the organization.

Having given beginning value shares at standard worth, the organization gave further value partakes in the value scope of Rs. 11.00 – Rs. 24.00 per divide among November 2015, and February 2024. It has additionally given extra offers in the proportion of 1 for 1 in February 2024. The typical expense of procurement of offers by the advertisers is Rs. Nothing, Rs. 5.17, and Rs. 5.19 per share.

Post-Initial public offering, organization’s ongoing settled up value capital of Rs. 13.32 cr. will stand improved to Rs. 18.13 cr. In light of the upper value band of the Initial public offering, the organization is searching for a market cap of Rs. 110.61 cr. In the Issue table on page no. 51 of the proposition archive, the post-Initial public offering settled up capital is displayed as 18132000, which seems, by all accounts, to be typographical blunder.

Monetary Execution:

On the monetary execution front, for the last three fiscals, the organization has posted an all out pay/net benefit of Rs. 44.98 cr. /Rs. 3.35 cr. (FY22), Rs. 39.62 cr. /Rs. 1.85 cr. (FY23), and Rs. 53.87 cr. /Rs. 3.03 cr. (FY24). For 2M of FY25 finished on May 31, 2024, it procured a net benefit of Rs. 1.31 cr. on a complete pay of Rs. 10.54 cr. While it posted irregularity in its top lines for the detailed periods, it stamped wild variances in its primary concerns, that causes a stir, yet additionally worry over its maintainability going ahead.

For the last three fiscals, the organization has detailed a normal EPS of Rs. 2.26 and a normal RoNW of 12.88%. The issue is estimated at a P/BV of 3.10 in view of its NAV of Rs. 19.66 as of May 31, 2024, and at P/BV of 1.99 in light of its post-Initial public offering NAV of Rs. 30.62 (at the upper cap).

On the off chance that we quality FY25 annualized super income on post-Initial public offering completely weakened value capital, then the asking cost is at a P/E of 14.09, and in view of FY24 profit, the P/E remains at 36.53. The issue shows up completely estimated.

For the detailed periods, the organization has posted PAT edges of 7.47% (FY22), 4.67 % (FY23), 5.64% (FY24), 12.42% (2M-FY25), and RoCE edges of 20.47% (FY22), 10.13% (FY23), 12.19% (FY24), 4.99% (Q1-FY25). Its obligation EBITDA proportion of 11.33 as of May 31, 2024 raise concern.

Profit Strategy:

The organization has not delivered any profits for the announced times of the proposition record. It will take on a judicious profit strategy post posting, in light of its monetary presentation and future possibilities.

COMPARISION WITH Recorded Companions:

According to the proposition report, the organization has shown Suven Pharma and JB Synthetic compounds, as their recorded friends. It is exchanging at a P/E of 136 and 46.8 (as of November 08, 2024). In any case, they are not really practically identical on an apple-to-apple premise. The rundown of recorded peers gives off an impression of being an eyewash.

Trader BANKER’S History:

This is the tenth command from Skyline The board in the last two fiscals (counting the continuous one). Out of the last 9 postings, 2 opened at markdown, 1 at standard and the rest opened with a charges going from 8.47% to 141.23% on the date of posting.

End/Speculation System

The organization is participated in an exceptionally serious and divided portion of sterile water, dry power-syrup items. It stamped irregularity in its top lines for the revealed periods. Profoundly fluctuating main concerns causes a commotion. In light of FY25 super profit, the issue shows up completely valued. All around informed financial backers might stop moderate assets for long haul.

Audit By Dilip Davda on November 9, 2024

Audit Creator

DISCLAIMER: No monetary data at all distributed anyplace here ought to be understood as a proposal to trade protections, or as counsel to do as such in any capacity at all. All matter distributed here is only for instructive and data purposes just and by no means ought to be utilized for pursuing venture choices. My audits don’t cover GMP market and administrators courses of action. Perusers should counsel a certified monetary consultant prior to pursuing any real venture choices, put together the with respect to data distributed here. With section boundaries, SEBI maintains that main all around informed financial backers should partake in such offers. With insane postings in the new past, SME Initial public offerings drew the consideration of financial backers no matter how you look at it and lead to diviner frenzy. In any case, as SME issues have passage hindrances and proceeded with low inclination from the broking local area, any peruser taking choices in view of any data distributed here does so totally in spite of the obvious danger ahead. The above data depends on data accessible as of date combined with market insights. The Creator has no designs to put resources into this proposition.