RBI Financial Arrangement refreshes | Strategy repo rate unaltered at 6.5%; genuine Gross domestic product development for FY25 projected at 7%

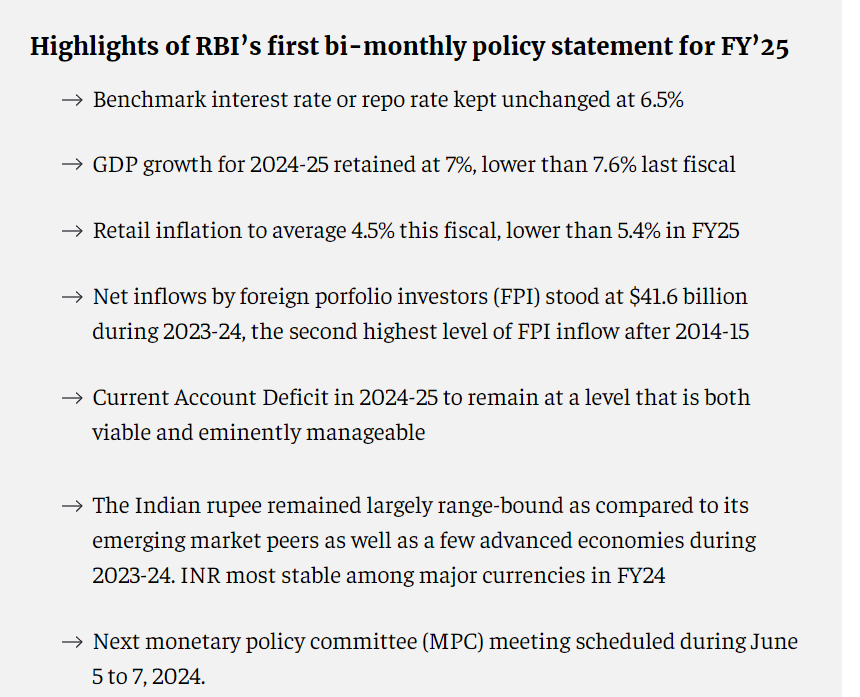

Declaring the choice of the Money related Arrangement Council of the Save Bank of India on April 5, Lead representative Shaktikanta Das said that strategy repo rates will stay unaltered at 6.5%.

The RBI likewise held Gross domestic product development figure of 7% for 2024-25 monetary year, with June quarter development at 7%, and September quarter at 6.9%. In the third and final quarter the development is supposed to be 7% each. This is lower than the 7.6% extension assessed for FY24.

In February, the Buyer Cost based Expansion (CPI) remained at 5.1%

The two-day audit meeting of the MPC that started on April 3 closes today. The RBI had kept up with the state of affairs on arrangement rates and positions in its last audit, which was held in February 2024. The focal financial power of India has kept the repo rate unaltered for the last six sequential MPC gatherings.

Domestic economic activity remains resilient: RBI

The MPC additionally noticed that homegrown monetary movement stays versatile, upheld by solid speculation interest and energetic business and shopper feelings. Title expansion has fallen off the December top; notwithstanding, food cost pressures have been intruding on the continuous disinflation process, presenting difficulties for the last plummet of expansion to the objective. Unusual inventory side shocks from unfavorable environment occasions and their effect on rural creation as likewise geo-political strains and overflows to exchange and product markets add vulnerabilities to the standpoint, Mr Das said.

Food price uncertainties continue to weigh on inflation outlook: RBI

Going on, food value vulnerabilities would keep on burdening the expansion viewpoint. A normal record rabi wheat creation in 2023-24, in any case, will assist with containing grain costs, the RBI said while reporting the Money related Arrangement’s choice on keeping up with the CPI expansion rate.

Early signs of a typical rainstorm likewise forecast well for the kharif season. Then again, the rising rate of environment shocks stays a key potential gain chance to food costs.

Low supply levels, particularly in the southern States and standpoint of above ordinary temperatures during April-June, likewise present concern. Tight interest supply conditions in specific heartbeats and the costs of key vegetables need close checking.

Fuel value collapse is probably going to develop in the close to term following the new reduced in LPG costs. Subsequent to seeing supported balance, cost move pressures looked by firms are appearing up predisposition. The new firming up of global raw petroleum costs warrants close checking.

Geo-political strains and unpredictability in monetary business sectors likewise present dangers to the expansion viewpoint, RBI added.

Headwinds from geopolitical tensions pose risk: RBI

The possibilities of fixed speculation stay splendid with business good faith, sound corporate and bank accounting reports, powerful government capital consumption and indications of upswing in the private capex cycle, the RBI said in a public statement declaring the choice of the Financial Strategy Panel.

Headwinds from international strains, unpredictability in global monetary business sectors, geoeconomic discontinuity, rising Red Ocean disturbances, and outrageous climate occasions, be that as it may, present dangers to the viewpoint, it added.

Services activity likely to grow to above pre-pandemic trend: RBI

Looking forward, a normal typical south-west storm ought to help horticultural movement. Producing is supposed to keep up with its energy on the rear of supported productivity, the RBI said while declaring the every other month Money related Approach choice for keeping the Gross domestic product development rate for FY25 at 7%.

Administrations action is probably going to develop over the pre-pandemic pattern. Confidential utilization ought to get forward momentum with additional get in provincial action and consistent metropolitan interest. An ascent in optional spending anticipated by metropolitan families, according to the Save Bank’s shopper overview, and further developing pay levels foreshadow well for the reinforcing of private utilization, it said in a public statement.