RNFI Services Limited IPO Full Details

RNFI Administration’s Initial public offering is a book constructed issue of Rs 70.81 crores. The issue is a completely new issue of 67.44 lakh shares.

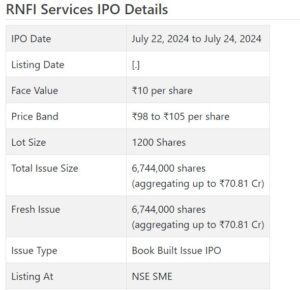

RNFI Administration’s Initial public offering opens for membership on July 22, 2024, and closes on July 24, 2024. The assignment for the RNFI Administration’s Initial public offering is supposed to be concluded on Thursday, July 25, 2024. RNFI Administration’s Initial public offering will be listed on NSE SME with a provisional posting date fixed as Monday, July 29, 2024.

RNFI Administration’s Initial public offering cost band is set at ₹98 to ₹105 per share. The base part size for an application is 1200 Offers. The base measure of speculation expected by retail financial backers is ₹126,000. The base part size venture for HNI is 2 parcels (2,400 offers) adding up to ₹252,000.

Decision Capital Counselors Pvt Ltd is the book-running lead chief of the RNFI Administration’s Initial public offering, while Horizon Monetary Administrations Private Ltd is the recorder for the issue. The market creator for RNFI Administration’s Initial public offering is Decision Value Broking.

• The organization has taken part in giving fintech arrangements in B2B and B2B2C models.

• It checked irregularity in its top lines for the revealed periods.

• Its main concern is stamped wild vacillations with Uber benefits for FY24. The executives ascribe this flood to their extended retail cash trade administrations.

• In light of the FY24 profit, the issue shows up as completely valued.

• Taking into account the splendid possibilities ahead, financial backers might stop assets for the medium to long-haul rewards.

ABOUT Organization:

RNFI Administrations Ltd. (RSL) is a tech-empowered stage offering monetary innovation arrangements in B2B and B2B2C monetary innovation field through a coordinated plan of action using online gateway and portable application, zeroing in on giving banking, computerized, and Government to Resident (“G2C”) administrations on Dish India premise. It isolates its business fundamentally into four (4) fragments specifically (I) business reporter administrations; (ii) non-business journalist administrations; (iii) undeniable cash transformer administrations; and (iv) protection broking. As of the date of this Distraction Outline, it is giving undeniable cash transformer administration through its Material Auxiliary (completely claimed), in particular RNFI Cash Private Restricted which is RBI enrolled undeniable cash transformer (“FFMC”) and protection broking administration through its entirely possessed Auxiliary, specifically Reliassure Protection Merchants Private Restricted which is enlisted as an immediate specialist (Life and General) with IRDAI. The organization is offering its types of assistance under the “Relipay” brand.

RSL goes about as a scaffold to guarantee the accessibility of tech-empowered monetary administrations all through the nation, remembering the underserved populace for the remotest of the spots by interfacing them to formal monetary channels. It likewise gives business and pay creating valuable open doors for retailers and organization accomplices by empowering them to give banking, computerized, and taxpayer-supported organizations to the end clients through its web and versatile application using a helped model. As of the date of this RHP, it has gone into plans with eleven (11) monetary organizations including Public Private, and Public area banks and installment banks wherein it is locked in as their business reporters for giving monetary consideration administrations. As a business reporter, it likewise gives doorstep administrations to KYC validation of the monetary establishment’s clients for use of pre-loaded cards and Fastag administration across India.

The organization began its excursion in the year 2015 in the fintech area with a mission to engage rustic India by advancing the openness of monetary innovation with basic and effective monetary arrangements and add to the improvement of a Computerized BHARAT and a dream to become one of the main monetary arrangements suppliers. Since the beginning of its activities, the organization has accomplished momentous achievements which is obvious by the way that as of Walk 31, 2024, it handled north of 115 lakhs month-to-month exchanges, and as of June 3, 2024, it is available in more than 28 States and 5 Association domains, 17,964 pin codes the nation over through its circulation organization. As of Walk 31, 2024, it has a worker strength of 1,405 representatives on an independent premise, assuming a significant part in catalyzing its development. As of June 03, 2024, it had 362515 front-end dispersion network accomplices.

ISSUE Subtleties/CAPITAL HISTORY:

The organization is emerging with its lady book building course Initial public offering of 6744000 value portions of Rs. 10 each to prepare Rs. 70.81 cr. at the upper cap. It has declared a value band of Rs. 98 – Rs. 105 for every offer. The issue opens for membership on July 22, 2024, and will close on July 24, 2024. The base application to be made is for 1200 offers and in products subsequently, from that point. Post allocation, offers will be recorded on NSE SME Arise. The issue comprises 27.03% of the post-initial public offering settled up capital of the organization. From the net returns of the Initial public offering, it will use Rs. 25.00 cr. for working capital, Rs. 10.81 cr. for capex on acquisition of Miniature ATMs/Workstations/Servers, and Rs. 5.30 cr. for reinforcing its innovation foundation, and the rest for general corporate purposes. The RHP has not demonstrated any arrangements for its spending on inorganic development however it is anticipating something very similar.

The issue is exclusively led and overseen by Decision Capital Guides Pvt. Ltd., and Horizon Monetary Administrations Pvt. Ltd. is the recorder of the issue. Decision Gathering’s decision Value Broking Pvt. Ltd. is the market creator for the organization.

Having given introductory value shares at standard worth, the organization gave further value shares for Rs. 1887 (based on Rs. 10 FV) in April 2023. It likewise gave extra offers in the proportion of 177 for 1 in November 2023. The typical expense of securing offers by the advertisers is Rs. Nothing per share.

Post-initial public offering, the organization’s ongoing settled up value capital of Rs. 18.21 cr. will stand upgraded to Rs. 24.95 cr. Given the upper Initial public offering cost band, the organization is searching for a market cap of Rs. 262 cr.

Monetary Execution:

On the monetary execution front, for the last three fiscals, the organization has (on a combined premise) posted a complete pay/net benefit of Rs. 190.80 cr. /Rs. 5.55 cr. (FY22), Rs. 1069.40 cr. /Rs. 4.89 cr. (FY23), and Rs. 930.03 cr. /Rs. 9.96 cr. (FY24). In this manner, while it posted irregularity in its top lies for the revealed periods, its primary concern varied fiercely. As indicated by the administration, their significant push for the retail cash trade section yielded advantages and they are centering to upgrade their play.

For the last three fiscals, it has detailed a normal EPS of Rs. 4.42 and a typical RoNW of 39.36%. The issue is valued at a P/BV of 6.05 in light of its NAV of Rs. 17.35 as of Walk 31, 2024, and at a P/BV of 2.56 given its post-Initial public offering NAV of Rs. 41.04 per share (at the upper cap).

On the off chance that we quality FY24 income to its post-initial public offering completely weakened settled-up capital, then, at that point, the asking cost is at a P/E of 26.31, and given FY23 income, the P/E remains at 53.57. In this manner the Initial public offering shows up completely estimated, limiting all close to term up-sides. Its obligation/value proportion remained at 1.02 as of Walk 31, 2024 raising concern. As indicated by the administration, this obligation is completely gotten against their property speculations.

For the announced periods, the organization has posted PAT edges of 2.95% (FY22), 0.46% (FY23), 1.06% (FY24), and RoCE edges of 33.25%, 24.28%, 29.74% individually for the alluded periods.

Profit Strategy:

The organization has not proclaimed any profits for the last five fiscals going before the date of this RHP. It will embrace a judicious profit strategy in light of its monetary presentation and future possibilities.

Examination WITH Recorded Companions:

According to the proposition record, the organization has shown BLS E-Serve, and Mos Utility as their recorded friends. They are exchanging at a P/E of 67.9 and 48.8 (as of July 16, 2024). Nonetheless, they are not similar on an apple-to-apple premise.

Vendor BANKER’S History:

This is the third order from Decision Capital in the last two fiscals (counting the continuous one), out of the last 2 postings, all recorded expenses went from 31.77% to 66.67% on the date of posting.

End/Venture Technique

The organization is occupied with giving fintech arrangements on B2B and B2B2C models and has given a significant push to the retail cash trade stage, which has yielded natural products. In light of the FY24 profit, the issue shows up as completely estimated. Taking into account brilliant possibilities and the extent of increasing the presentation, financial backers might stop assets for the medium to long-haul rewards.