Rudra Gas Enterprise Limited IPO: Fueling Investor Excitement , Rudra Gas Enterprise IPO: Energy Sector Buzz

Rudra Gas Endeavor Initial public offering is a decent value issue of Rs 14.16 crores. The issue is totally a new issue of 22.48 lakh shares.

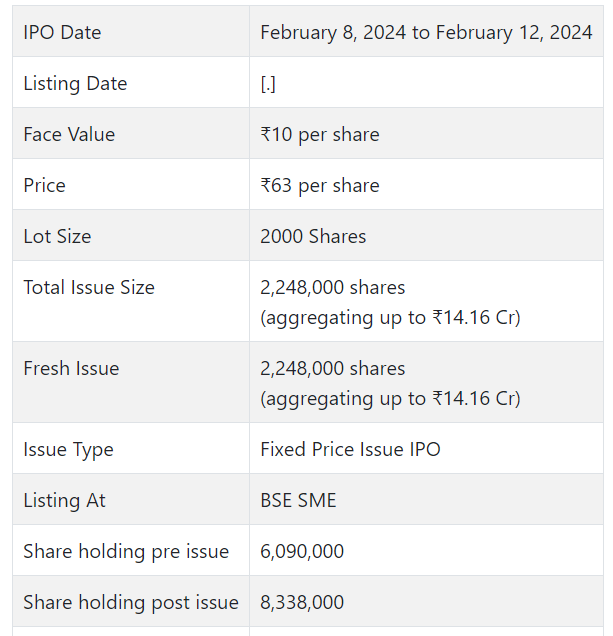

Rudra Gas Endeavor Initial public offering opens for membership on February 8, 2024 and closes on February 12, 2024. The assignment for the Rudra Gas Undertaking Initial public offering is supposed to be finished on Tuesday, February 13, 2024. Rudra Gas Endeavor Initial public offering will list on BSE SME with provisional posting date fixed as Thursday, February 15, 2024.

Rudra Gas Endeavor Initial public offering cost is ₹63 per share. The base part size for an application is 2000 Offers. The base measure of speculation expected by retail financial backers is ₹126,000. The base part size venture for HNI is 2 parcels (4,000 offers) adding up to ₹252,000.

• RGEL is in foundation section with significant spotlight on gas pipeline, fiber link organization.

• The organization is likewise in leasing of development apparatuses and vehicles.

• The organization posted consistent development in its top and primary concerns for the detailed periods.

• In view of its annualized FY24 profit, the issue shows up completely valued.

• Financial backers might stop assets for the medium to long haul.

ABOUT Organization:

Rudra Gas Undertakings Ltd. (RGEL) is taken part in different features of the framework area. It is primarily taken part in gas conveyance network projects, fiber link organization, leasing of development apparatus and vehicles. It gives start to finish answers for the city gas dispersion area.

Its administrations guarantee the protected and proficient transportation of fundamental assets, for example, Compacted Flammable gas (“CNG”) and Channeled Petroleum gas (“PNG”). In Fiber link network area, the organization offers administrations of establishments of optical Fiber link and upkeep thereof. Its principal center is around conveying projects promptly while maintaining the best expectations of security.

RGEL’s client base contains laid out players in the city gas circulation industry and media transmission industry, both out in the open and confidential area. Throughout the long term, it has effectively executed in excess of 50 activities and its major finished projects evaluate to around Rs. 127.08 cr. The organization get its income from gas pipeline projects, fiber link undertakings and Leasing of development hardware and vehicles. As of October 31, 2023, it has a request book of Rs. 327.83 out of which pay is reserved for Rs. 75.71 cr. As of October 31, 2023, it had 512 representatives on its finance.

ISSUE Subtleties/CAPITAL HISTORY:

The organization is emerging with its lady Initial public offering of 2248000 value portions of Rs. 10 each at a proper cost of Rs. 63 for each offer to prepare Rs. 14.16 cr. The issue opens for membership on February 08, 2024, and will close on February 12, 2024. The base application to be made is for 2000 offers and in products consequently, from that point. Post apportioning, offers will be recorded on BSE SME. The issue comprises 26.96% of the post-Initial public offering settled up capital of the organization. The organization is spending Rs. 1.42 cr. for this Initial public offering process, and from the net returns, it will use Rs. 9.50 cr. for working capital, and Rs. 3.24 cr. for general corporate purposes.

The issue is exclusively lead overseen by Straight shot Capital Consultants Pvt. Ltd., and Connection Intime India Pvt. Ltd. is the enlistment center of the issue. Straight shot Gathering’s Spread X Protections Pvt. Ltd. the market creator for the organization.

Having given beginning value capital at standard the organization gave further value shares at a decent cost of Rs. 258 for each offer in July 2023. It has additionally given extra offers in the proportion of 2 for 1 in July 2023. The typical expense of procurement of offers by the advertisers is Rs. 2.10, and Rs. 2.11 per share

Post-Initial public offering, organization’s ongoing settled up value capital of Rs. 6.09 cr. will stand upgraded to Rs. 8.34 cr. In view of the upper Initial public offering cost band, the organization is searching for a market cap of Rs. 52.53 cr.

Monetary Execution:

On the monetary execution front, for the last three fiscals, the organization has (on an independent premise) posted an all out income/net benefit of Rs. 28.17 cr. /Rs. 1.27 cr. (FY21), Rs. 43.96 cr. /Rs. 1.79 cr. (FY22), and Rs. 49.57 cr. /Rs. 3.52 cr. (FY23). For H1 of FY24 finished on September 30, 2023, it procures a net benefit of Rs. 2.47 cr. on an all out pay of Rs. 34.47 cr.

For the 7 months’ time of FY24 finished on October 31, 2023, the organization has (on a merged premise) posted an all out income of Rs. 34.47 cr. with a net benefit of Rs. 2.47.

For the last three fiscals, it has revealed a normal EPS of Rs. 4.89, and a typical RONW of 43.37%. The issue is estimated at a P/BV of 3.34 in light of its NAV of Rs. 18.87 as of October 31, 2023, and at a P/BV of 2.05 in view of its post-Initial public offering NAV of Rs. 30.77 per share.

On the off chance that we trait annualized FY24 income to its post-Initial public offering completely weakened paid-p capital, then the asking cost is at a P/E of 12.38. Consequently the issue shows up completely evaluated.

For the detailed periods, the organization has posted PAT edges of 4.52% (FY21), 4.09% (FY22), 7.12% (FY23), 7.20% (7M-FY24), and RoCE edges of 20.48%, 21.60% 25.26%, 14.86% separately for the alluded periods.

Profit Strategy:

The organization has not proclaimed any profits for the announced times of the deal report. It will embrace a reasonable profit strategy in light of its monetary exhibition and future possibilities.

Correlation WITH Recorded Companions:

According to the deal archive, the organization has shown Likhitha Infra as their recorded friends. It is exchanging at a P/E 16.1 (as of February 02, 2024). Be that as it may, they are not tantamount on an apple-to-apple premise.

Dealer BANKER’S History:

This is the 30th command from Direct route Capital in the last two fiscals, out of the last 10 postings, all opened at charges going from 2.67% to 200% on the date of posting.