Sadhav Shipping Limited IPO Subscription and Allotment

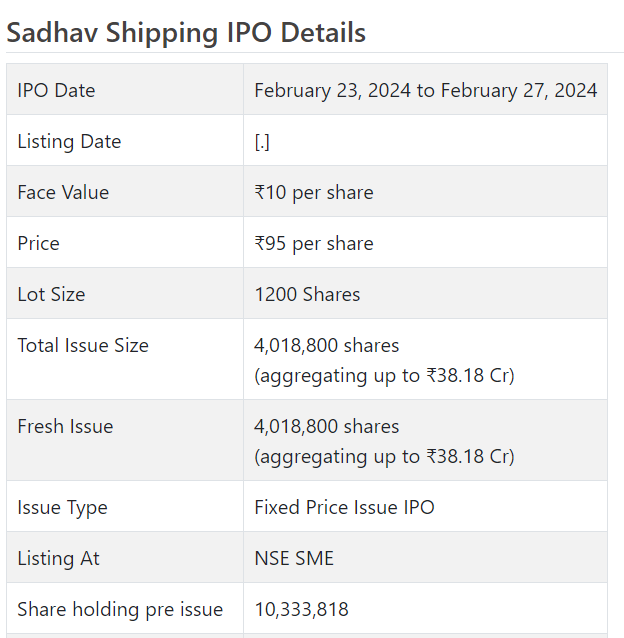

Sadhav Delivery Initial public offering is a decent value issue of Rs 38.18 crores. The issue is totally a new issue of 40.19 lakh shares.

Sadhav Delivery Initial public offering opened for membership on February 23, 2024 and will close on February 27, 2024. The distribution for the Sadhav Delivery Initial public offering is supposed to be settled on Wednesday, February 28, 2024. Sadhav Transportation Initial public offering will list on NSE SME with speculative posting date fixed as Friday, Walk 1, 2024.

Sadhav Delivery Initial public offering cost is ₹95 per share. The base parcel size for an application is 1200 Offers. The base measure of speculation expected by retail financial backers is ₹114,000. The base part size speculation for HNI is 2 parcels (2,400 offers) adding up to ₹228,000.

• SSL is taken part in working marine resources and related administrations including strategies.

• It posted consistent development in its primary concern aside from FY22 which stamped effect of the Pandemic.

• In light of FY24 annualized profit, the issue shows up completely evaluated.

• Significant port and strategies related administrations is on the ascent, this foreshadows well for this organization.

• Financial backers might get this wagered for medium to long haul rewards.

ABOUT Organization:

Sadhav Transportation Ltd. (SSL) is integrated with a goal to claim and work marine resources for administration ports, beach front planned operations and other port sea related administrations. Today SSL possesses and works 24 vessels that incorporates 19 claimed vessels and 5 leased vessels, in different areas of oceanic exchange India.

The organization has areas of strength for created base in the area and is offering its types of assistance to driving organizations which incorporates ONGC Ltd., Mumbai Port Power, Paradip Port Power, Bhabha Nuclear Exploration Community, Delivery Company of India, New Mangalore Port Power, Deendayal Port Power (Kandla/Vadinar), Jawaharlal Nehru Port Power (JNPA), BPCL, Gujarat Police, JSW Ports and that’s just the beginning.

With current Unique Situating seaward armada and devoted ready and a shore team SSL is resolved to give top tier administrations to its clients. The organization was the first to arrangement and work India’s most memorable Port based Level 1 Oil slick Reaction Office Center in Mumbai and are presently working in the greater part of the Significant Ports in India. With a cruising group of 200+ officials and team combined with successful and experienced shore the board; it is seeing economical development year on year.

As per the administration, SSL is one of only a handful of exceptional organization that has spent significant time in oil slick reaction portion and it is turning a unique advantage.

ISSUE Subtleties/CAPITAL HISTORY:

The organization is emerging with its lady Initial public offering of 4018800 value portions of Rs. 10 each at a decent cost of Rs. 95 for each offer to activate Rs. 38.18 cr. The issue opens for membership on February 23, 2024, and will close on February 27, 2024. The base application to be made is for 1200 offers and in products consequently, from that point. Post apportioning, offers will be recorded on NSE SME Arise. The issue comprises 28% of the post-Initial public offering settled up capital of the organization. The organization is spending Rs. 2.18 cr. for this Initial public offering and from the net returns, it will use Rs. 8.00 cr. for reimbursement/prepayment of specific borrowings, Rs. 15.50 cr. for capex on buy/procurement of boats/vessels, Rs. 8.00 cr. for working capital, and Rs. 4.50 cr. for general corporate purposes.

The issue is exclusively lead overseen by ISK Counselors Pvt. Ltd., and Maashitla Protections Pvt. Ltd. is the enlistment center of the issue. Sunflower Broking Pvt. Ltd. is the market creator for the organization. ISK has endorsed this issue for 94.95% and Sunflower for 5.05%.

Having given beginning value capital at standard the organization has given further value partakes in the value scope of Rs. 63.50 – Rs. 300 between Walk 2008 and September 2020. It has additionally given extra offers in the proportion of 2.5 for 1 in October 2023. The typical expense of securing of offers by the advertisers/selling partners is Rs. 7.02, Rs. 14.79, and Rs. 31.83 per share.

Post-Initial public offering, organization’s ongoing settled up value capital of Rs. 10.33 cr. will stand improved to Rs. 14.35 cr. In light of the upper Initial public offering cost band, the organization is searching for a market cap of Rs. 136.35 cr.

Monetary Execution:

On the monetary execution front, for the last three fiscals, the organization has posted a complete pay/net benefit of Rs. 61.24 cr. /Rs. 3.31 cr. (FY21), Rs. 69.78 cr. /Rs. 3.01 cr. (FY22), and Rs. 78.91 cr. /Rs. 7.75 cr. (FY23). For H1 of FY24 finished on September 30, 2023, it procures a net benefit of Rs. 4.07 cr. on a complete pay of Rs. 33.86 cr. In this manner its top and primary concerns posted development with the exception of FY22 where it denoted a difficulty following the Pandemic effect.

For the last three fiscals, it has detailed a normal EPS of Rs. 5.25, and a typical RONW of 14.05%. The issue is evaluated at a P/BV of 2.18 in view of its NAV of Rs. 43.58 as of September 30, 2023, and at a P/BV of 1.64 in view of its post-Initial public offering NAV of Rs. 57.96 per share.

On the off chance that we characteristic annualized FY24 income to its post-Initial public offering completely weakened paid-p capital, then, at that point, the asking cost is at a P/E of 16.76. The issue shows up completely evaluated.

For the detailed periods, the organization has posted PAT edges of 5.46% (FY21), 4.33% (FY22), 9.97% (FY23), 12.08% (H1-FY24), and RoCE edges of 12.63%, 10.93%, 13.25%, 6.47% individually for the alluded periods.

Profit Strategy:

The organization has not pronounced any profits for the revealed times of the proposition report. It will embrace a reasonable profit strategy in light of its monetary presentation and future possibilities.

Correlation WITH Recorded Friends:

According to the deal archive, the organization has shown Seamec Ltd., Information Marine, and Garware Marine as their recorded companions. They are exchanging at a P/E of 47.3, 35.3, and 300.89 (as of February 16, 2024). In any case, they are not tantamount on an apple-to-apple premise.

Trader BANKER’S History:

This is the sixth command from ISK Guides in the last four fiscals, out of the last 5 postings, all opened at expenses going from 1.08% to 47.23% on the date of posting.