Sahaj Solar Limited IPO Full details

Sahaj Sun based Initial public offering is a book fabricated issue of Rs 52.56 crores. The issue is totally a new issue of 29.2 lakh shares.

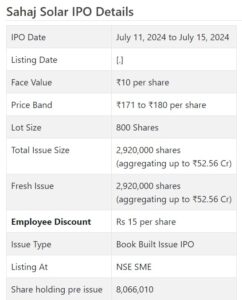

Sahaj Sun based Initial public offering opens for membership on July 11, 2024 and closes on July 15, 2024. The allocation for the Sahaj Sun powered Initial public offering is supposed to be concluded on Tuesday, July 16, 2024. Sahaj Sun oriented Initial public offering will list on NSE SME with speculative posting date fixed as Friday, July 19, 2024.

Sahaj Sun based Initial public offering cost band is set at ₹171 to ₹180 per share. The base parcel size for an application is 800 Offers. The base measure of speculation expected by retail financial backers is ₹144,000. The base part size venture for HNI is 2 parcels (1,600 offers) adding up to ₹288,000.

• The organization is participated in the assembling of PV modules, sun powered water siphoning frameworks and EPC administrations connected with sustainable power.

• The organization announced development in its top and primary concerns for the revealed periods.

• The unexpected lift in top and primary concerns for FY23 and FY24 cause a commotion and worry over its maintainability as the portion is moving past swarmed.

• In light of FY24 super profit, the issue shows up completely evaluated.

• All around informed/cash overflow financial backers might stop moderate asset as long as possible.

ABOUT Organization:

Sahaj Sun based Ltd. (SSL) is an environmentally friendly power arrangement supplier connected with significantly into three organizations being assembling of PV modules, giving sunlight based water siphoning frameworks and giving EPC administrations to Container India clients. The organization is a Sun oriented Arrangements giving organization having experience of very nearly multi decade in larger part of the verticals of sustainable power age. It is an assembling as well as a specialist organization which gives it an edge in the sun based power market.

First being PV Module fabricating, for which organization has a PV module producing plant having a limit of 100 MWs at its plant in Bavla, Ahmedabad, Gujarat, India empowering the organization to convey quality and reasonable sunlight based chargers to its clients. The Organization’s mechanized creation office offers mono and poly glasslike PV Modules for different sun powered projects across India and abroad. The plant is an incorporated assembling office for PV modules. Aside from polycrystalline module, the office fabricates Mono PERC (Passivated Producer and Back Contact) module, with at least 21% and higher productivity too. To upgrade effectiveness and brand situating, it involves Translucent Photovoltaic Innovation for assembling Sun based PV Modules. Its plant has the ability to produce tweaked size PV modules. The Organization has gained notoriety for sun oriented PV modules and is sold under the brand name of ‘SAHAJ’. It endeavors to convey solid sun based arrangements through items and accomplish this significantly through its smoothed out PV module producing line and thorough EPC arrangements.

Furthermore, the organization is participated in giving sun oriented water siphoning frameworks. A sun based water siphon is a use of Sun oriented PV Framework which one of our auxiliary organization). These parts include over 70% of the aggregate

framework cost.

The equilibrium parts of the sunlight based water siphoning framework are being rethought. As a

part of the Focal Government’s drive to build ranchers’ pay, the Service of New and Sustainable power (MNRE) has sent off the Pradhan Mantri Kisan Urja Suraksha evem Utthan Mahabhiyan (PM KUSUM) Plan for ranchers for establishment of sun oriented siphons and network associated sun based and other sustainable power plants in the country. Through this plan, in excess of 20 lakh ranchers (MNRE PM KUSUM plot) will benefit with independent sunlight based water siphoning framework which will empower them to deliver crops in numerous seasons and along these lines increment their salaries. The independent sunlight based water siphon has given the ranchers the valuable chance to work autonomous of framework power. The organization additionally plans and alters sun based versatile streetcars for the utilization in provincial and far off regions as and when expected to create power for sun oriented water siphoning, for off lattice power and to run different utilities by delivering power progressing.

Thirdly, the Organization being a coordinated sun oriented energy arrangements supplier, likewise offers designing, acquirement, and development (“EPC”) administrations to clients. Its EPC administrations incorporate plan, supply, establishment, testing, charging and keeping up with of all sizes of tasks going from basic homegrown sun oriented establishment to setting up an enormous scope Sun based Power Plant.

Its account holder long periods of 161 raises worry as its exchange receivables were Rs. 88.56 cr. as of Walk 31, 2024. Its contingent risk of Rs. 15.80 cr. for execution ensure additionally raise concerns. As of Walk 31, 2024, it had 62 workers on its finance. It additionally utilizes provisional worker as and when required.

ISSUE Subtleties/CAPITAL HISTORY:

The organization is emerging with its lady book building course Initial public offering of 2920000 value portions of Rs. 10 each to prepare Rs. 52.56 cr. at the upper cap. It has declared a value band of Rs. 171 – Rs. 180 for every offer. The issue opens for membership on July 11, 2024, and will close on July 15, 2024. The base application to be made is for 800 offers and in products subsequently, from there on. Post portion, offers will be recorded on NSE SME Arise. The issue comprises 26.58% of the post-Initial public offering settled up capital of the organization. From the net returns of the issue, it will use Rs. 39.42 cr. for working capital, and the rest for general corporate purposes.

The organization has held 24000 value shares for its qualified workers and offering them a rebate of Rs. 15 for every offer. From the rest, it has held 146400 offers for Market Creator, not over half for QIBs, at the very least 15% for HNIs and at the very least 35% for Retail financial backers.

The issue is exclusively lead overseen by Kunvarji Finstock Pvt. Ltd., and KFin Innovations Ltd. is the recorder to the issue. Aftertrade Broking Pvt. Ltd. is the market creator for the organization. The issue is endorsed to the tune of 15% by Kunvarji Finstock, and 85% by Aftertrade Broking Pvt. Ltd. (past known as RCSPL Offer Broking Pvt. Ltd.

Having given beginning value shares at standard worth, the organization gave/changed over additional value partakes in the value scope of Rs. 37.00 – Rs. 167.00 between February 2018 and January 2024. It has additionally given extra offers in the proportion of 4 for 5 in Walk 2018, and 1 for 2 in January 2023. The typical expense of securing of offers by the advertisers is Rs. 0.01, Rs. 5.96 and Rs. 19.68 per share.

Post-Initial public offering, organization’s ongoing settled up value capital of Rs. 8.07 cr.will stand improved to Rs. 10.99 cr. In view of the upper Initial public offering cost band, the organization is searching for a market cap of Rs. 197.75 cr.

Monetary Execution:

On the monetary execution front, for the last four fiscals, the organization has (on a solidified premise) posted a complete pay/net benefit of Rs. 62.19 cr. /Rs. 0.71 cr. (FY21), Rs. 67.29 cr. /Rs. 1.03 cr. (FY22), Rs. 185.81 cr. /Rs. 6.48 cr. (FY23), and Rs. 201.72 cr. /Rs. 13.37 cr. (FY24).

For the last three fiscals, it has detailed a normal EPS of Rs. 11.27, and a typical RoNW of 34.61%. The issue is estimated at a P/BV of 4.41 in view of its NAV of Rs. 40.83 as of Walk 31, 2024, and at a P/BV of 2.31 in view of its post-Initial public offering NAV of Rs. 77.82 per share (at the upper cap).

On the off chance that we trait annualized FY24 income to its post-Initial public offering completely weakened settled up capital, then, at that point, the asking cost is at a P/E of 14.79, and based on FY23 income, its P/E remains at 30.51. Consequently the issue shows up completely evaluated.

For the announced periods, the organization has posted PAT edges of 0.96% (FY21), 1.52% (FY22), 3.42% (FY23), 6.52% (FY24), and RoCE edges of 8.62%, 11.37%, 35.11%, 26.47% individually for the alluded periods.

Profit Strategy:

The organization has not proclaimed any profits for the detailed times of the proposition record. It will embrace a reasonable profit strategy in view of its monetary presentation and future possibilities.

Examination WITH Recorded Friends:

According to the proposition report, the organization has shown Shakti Siphons, Zodiac Energy, and Solex Energy, as their recorded companions. They are exchanging at a P/E of 63.8, 103 and 133 (as of July 05, 2024). Nonetheless, they are not tantamount on an apple-to-apple premise.

Dealer BANKER’S History:

This is the second order from Kunvarji Finstock in the continuous monetary. The main posting occurred opened at a markdown of – 8.70% on the date of posting.

End/Venture Technique

Off late we are seeing 1 out of 3 Initial public offering for this section and accordingly it is moving past swarmed. It seems many organization needs to encase the continuous extravagant for such organizations. This organization is in environmentally friendly power fragment with three verticals for example PV module producing, sun based power siphons and EPC in sustainable power. It stamped development in its top and main concerns for the announced periods. In light of FY24 super profit, the issue shows up completely valued. Very much educated/cash overflow financial backers might stop moderate asset for the drawn out remunerations.

Audit By Dilip Davda on July 6, 2024

Audit Creator

DISCLAIMER: No monetary data at all distributed anyplace here ought to be understood as a proposal to trade protections, or as counsel to do as such in any capacity at all. All matter distributed here is only for instructive and data purposes just and by no means ought to be utilized for pursuing venture choices. My audits don’t cover GMP market and administrators courses of action. Perusers should counsel a certified monetary consultant prior to going with any real speculation choices, put together the with respect to data distributed here. With passage hindrances, SEBI believes that main very much educated financial backers should take part in such offers. With insane postings in the new past, SME Initial public offerings drew the consideration of financial backers in all cases and lead to soothsayer franticness. Notwithstanding, as SME issues have passage hindrances and proceeded with low inclination from the broking local area, any peruser taking choices in view of any data distributed here does so altogether despite the obvious danger. The above data depends on data accessible as of date combined with market insights. The Creator has no designs to put resources into this proposition.