Sanstar Limited IPO Full Details and Full Analysis

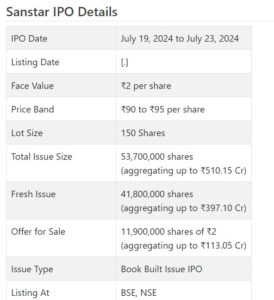

Sanstar Initial public offering is a book fabricated issue of Rs 510.15 crores. The issue is a mix of new issue of 4.18 crore shares collecting to Rs 397.10 crores and make available for purchase of 1.19 crore shares conglomerating to Rs 113.05 crores.

Sanstar Initial public offering opened for membership on July 19, 2024 and will close on July 23, 2024. The designation for the Sanstar Initial public offering is supposed to be settled on Wednesday, July 24, 2024. Sanstar Initial public offering will list on BSE, NSE with conditional posting date fixed as Friday, July 26, 2024.

Sanstar Initial public offering cost band is set at ₹90 to ₹95 per share. The base parcel size for an application is 150 Offers. The base measure of venture expected by retail financial backers is ₹14,250. The base parcel size speculation for sNII is 15 parts (2,250 offers), adding up to ₹213,750, and for bNII, it is 71 parcels (10,650 offers), adding up to ₹1,011,750.

• The organization is one of the significant makers of speciality items and fixing arrangements in India for food, creature sustenance and other modern applications.

• The organization trades its items to more than 49 nations all around the world.

• While it posted irregularity in top lines, its primary concern stamped consistent development.

• In light of FY24 super profit, the issue shows up forcefully estimated.

• All around informed financial backers might stop moderate assets as long as possible.

ABOUT Organization:

Sanstar Ltd. (Sanstar) is one of the significant makers of plant based speciality items and fixing arrangements in India for food, creature nourishment and other modern applications (Source: Organization Dispatched Ice and Sullivan Report, dated May 18, 2024). Its items incorporate fluid glucose, dried glucose solids, maltodextrin powder, dextrose monohydrate, local maize starches, altered maize starches and co-items like microbes, gluten, fiber and advanced protein, among others.

Sanstar’s speciality items and fixings arrangements add taste, surface, supplements and expanded usefulness to (I) food sources as fixings, thickening specialists, stabilizers, sugars, emulsifiers and added substances (in pastry kitchen items, candy parlor, pastas, soups, ketchups, sauces, creams, deserts, among others), (ii) creature sustenance items as nourishing fixings, and (iii) other modern items as deteriorates, excipients, supplements, covering specialists, fasteners, smoothing and complimenting specialists, completing specialists, among others.

According to Ice and Sullivan (Organization Appointed Report, dated May 18, 2024), with an introduced limit of 3,63,000 tons for every annum (1,100 tons each day), it is the fifth biggest maker of maize based speciality items and fixing arrangements in India. Its driving situation in the business, specialized information to finish explicit usefulness and nourishment items, over fifty years of presence, cutting edge fabricating offices, different item portfolio and customers in homegrown and worldwide business sectors, furnish it with upper hand.

Sanstar is a perceived Two Star Commodity house from Chief General of Unfamiliar Exchange, Legislature of India, while Sanstar Biopolymers Restricted, the recent Organization which was converged with it as per NCLT, Ahmedabad request dated November 23, 2023, is a perceived Three Star Product House. The organization sent out items to 49 nations across Asia, Africa, Center East, Americas, Europe and Oceania, during Monetary 2024, based on its Rehashed Combined Budget reports. Also, the Organization has impressions across India, with its items being sold in 22 states based on Rehashed Combined Budget reports, as on the date of this Distraction Outline. As of Walk 31, 2024, the organization has presence in 49 nations for trades. As of the said date, it had 271 representatives on its finance.

ISSUE Subtleties/CAPITAL HISTORY:

The organization is emerging with its lady combo Initial public offering of 41800000 new value shares issue (worth approx. Rs. 397.10 cr. at the upper cap), and a Proposal available to be purchased (OFS) of 11900000 value shares (worth Rs. 113.05 cr. at the upper cap). The organization has reported a value band of Rs. 90 – Rs. 95 for every value portions of Rs. 2 each. The general size of the issue will be approx. 53700000 offers worth Rs. 510.15 cr. The issue opens for membership on July 19 2024, and will close on July 23, 2024. The base application to be made is for 150 offers and in products subsequently, from there on. Post designation, offers will be recorded on BSE and NSE. The issue is 29.47% of the post-Initial public offering settled up value capital. From the net returns of the new value issue, the organization will use Rs. 181.56 cr. for capex on extension at Dhule plant, Rs. 100.00 cr. for reimbursement/prepayment of specific borrowings., and the rest for general corporate purposes.

The sole Book Running Lead Chief to this issue is Pantomath Capital Guides Pvt. Ltd., while Connection Intime India Pvt. Ltd. is the recorder to the issue.

Having given starting value shares at standard, the organization gave further value shares at a decent cost of Rs. 4.20 per share (in view of Rs. 2 FV), in December 2023. It has likewise given extra offers in the proportion of 1 for 1 in Walk 2012. The typical expense of obtaining of offers by the advertisers/selling partners is Rs. 0.34, Rs. 0.35, Rs. 0.44, Rs. 0.70, Rs. 1.80, and Rs. 2.17 per share.

Post-Initial public offering, its ongoing settled up value capital of Rs. 28.09 cr. will stand improved to Rs. 36.45 cr. In light of the upper cap of the Initial public offering cost band, the organization is searching for a market cap of Rs. 1731.32 cr.

Monetary Execution:

On the monetary execution front, for the last three fiscals, the organization has (on a united premise) posted an all out pay/net benefit of Rs. 504.77 cr. /Rs. 15.92 cr. (FY22), Rs. 1209.67 cr. /Rs. 41.81 cr. (FY23), and Rs. 1081.68 cr. /Rs. 66.77 cr. (FY24).

For the last three fiscals, the organization has posted a normal EPS of Rs. 3.55 and a normal RoNW of 30.22%. The issue is valued at a P/BV of 6.18 in view of its NAV of Rs. 15.37 as of Walk 31, 2024, and at a P/BV of 2.82 in view of its post-Initial public offering NAV of Rs. 33.64 per share (at the upper cap).

On the off chance that we quality FY24 annualized income to its post-Initial public offering completely weakened settled up value capital, then, at that point, the asking cost is at a P/E of 25.96. In view of FY23 income, the P/E remains at 41.49. Consequently the issue is forcefully evaluated.

The organization announced PAT edges of 3.15% (FY22), 3.46% (FY23), 6.17% (FY24), and RoCE edges of 23.19%, 23.82%, 25.73% for the alluded periods, separately. For the last three fiscals, the organization has posted CAGR of 45.46% for Incomes and 104.79% CAGR for PAT.

As per the administration, its as of late begun sunlight based power and internal combustion projects will contribute in primary concerns, and decrease in the red with get reserve funds finance cost and the continuous extension will add to its top and primary concerns before very long, that will work on their proportion of 36: 64 commodity: homegrown incomes with added edges following better item quality. The organization appreciates great interest for its subsidiary items across the food/pharma/individual consideration industry.

Profit Strategy:

The organization has not announced any profits for the revealed times of the proposition report. It has proactively embraced a profit strategy in November 2023, in view of its monetary presentation and future possibilities.

Correlation WITH Recorded Companions:

According to the deal record, the organization has shown Gujarat Ambuja Products, Gulshan Polyols, and Sukhjit Starch, as their recorded friends. They are exchanging at a P/E of 18.0, 71.8, and 14.3 (as of July 12, 2024). Be that as it may, they are not genuinely similar on an apple-to-apple premise.

Vendor BANKER’S History:

This is the tenth order from Pantomath Capital in the last three fiscals (counting the continuous one). Out of the last 8 postings, all recorded with an expenses going from 27% to 100.45% on the date of posting.

End/Venture Technique

The organization is one of the significant makers of speciality items and fixing arrangements in India for food, creature nourishment and other modern applications having great piece of the pie in worldwide and homegrown business sectors. For the announced periods, however it checked irregularity in its top lines, primary concern consistently developed. In light of FY24 super profit, the issue shows up forcefully evaluated. In the midst of rising interest for its items, the administration is sure of further developing the patterns announced and its presentation post extended limits. Very much educated financial backers might stop moderate assets as long as possible.

Survey By Dilip Davda on July 15, 2024