Sathlokhar Synergys E&C Global Limited IPO Full Details

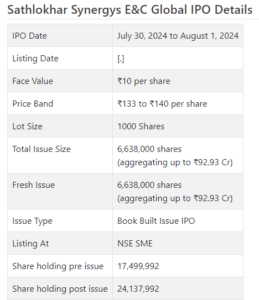

Sathlokhar Synergys E&C Worldwide Initial public offering is a book fabricated issue of Rs 92.93 crores. The issue is totally a new issue of 66.38 lakh shares.

Sathlokhar Synergys E&C Worldwide Initial public offering opens for membership on July 30, 2024 and closes on August 1, 2024. The allocation for the Sathlokhar Synergys E&C Worldwide Initial public offering is supposed to be settled on Friday, August 2, 2024. Sathlokhar Synergys E&C Worldwide Initial public offering will list on NSE SME with conditional posting date fixed as Tuesday, August 6, 2024.

Sathlokhar Synergys E&C Worldwide Initial public offering cost band is set at ₹133 to ₹140 per share. The base parcel size for an application is 1000 Offers. The base measure of venture expected by retail financial backers is ₹140,000. The base parcel size venture for HNI is 2 parts (2,000 offers) adding up to ₹280,000.

• The organization is participated in EPC contracts for all framework related exercises.

• It moved center around EPC from FY23 yielded the advantages as higher top and main concerns.

• The organization has orders worth Rs. 450 cr. available.

• In light of FY24 super profit, the issue shows up completely estimated.

• Financial backers might stop assets for long haul.

ABOUT Organization:

Sathlokhar Synergys E and C Worldwide Ltd. (SSEGL) is an incorporated designing, obtainment and development (“EPC”) (plan and fabricate) and infra turnkey contracting organization offering particular types of assistance for development of structures and framework offices for modern, warehousing, business, institutional, drug projects, sunlight based projects, medical clinics, inns, resorts and manors and so on. We are having experience in plan and development of different undertakings across states in India for example Tamil Nadu, Karnataka, Uttar Pradesh, West Bengal and Pondicherry. It additionally attempts EPC projects for government substances through delicate contribution process. The organization offers types of assistance across the worth chain going from point by point planning, arranging, acquirement of the multitude of materials aside from particular work material, designing of the endlessly project execution – the site work with generally speaking undertaking the board and consummation of all stirs up to authorizing and conveying or taking over for their expected reason.

The organization likewise gives the establishment of Mechanical, Electrical and Plumbing Organizations in development projects. It has in-house experts; MEP Originators and Specialists who carefully fabricate and execute the MEP Undertakings. It is additionally an approved channel accomplice for Goodbye Power Planetary groups Ltd, for giving establishment, deals, charging and support administrations of its items according to commonly concurred terms in connection with its Sunlight based Power Tasks.

It is an ISO 9001:2015 (Quality Administration Framework), ISO 14001: 2015 (Climate The board Framework) and ISO 45001:2018 (Word related Wellbeing and Security The executives Framework) ensured organization. Further, it offers freely on projects, offered by divisions of government specialists and different substances subsidized by the GoI.

We have coordinated in-house capacities to convey a task from conceptualization to the end with quicker time required to circle back and spotlight on de-gambling at every possible opportunity. Its center skill lies in expertly dealing with the worth chain and drawing in and holding ability to expand esteem creation. The organization is extending its presence in different states to increase its activities. As of the date of recording this deal report, it had 118 workers on its finance. Likewise, it additionally employs authoritative work as and when required.

ISSUE Subtleties/CAPITAL HISTORY:

The organization is emerging with its lady book building course Initial public offering of 6638000 value portions of Rs. 10 each to activate Rs. 92.93 cr. at the upper cap. It has reported a value band of Rs. 133 – Rs. 140 for every offer. The issue opens for membership on July 30, 2024, and will close on August 01, 2024. The base application to be made is for 1000 offers and in products subsequently, from there on. Post assignment, offers will be recorded on NSE SME Arise. The issue is 27.50% of the post-Initial public offering settled up capital of the organization. From the net returns of the Initial public offering, it will use Rs. 73.00 cr. for working capital, and the rest for general corporate purposes.

The issue is exclusively lead overseen by GYR Capital Counsels Pvt. Ltd., and Purva Sharegistry (India) Pvt. Ltd. is the enlistment center to the issue. Giriraj Stock Broking Pvt. Ltd. is the market producer for the organization and buying in 3.66% of the all out issue size, while Keenness Stock Broking Ltd. is buying in 5.38% of the absolute issue size. Consequently generally 9.04% of the absolute issue size is saved for the market creators.

The organization has given whole introductory value shares at standard worth. It has given extra offers in the proportion of 31 for 4 in May 2024. There seems, by all accounts, to be some crisscross in one or the other number of offers apportioned as reward, or the proportion of reward issue, as it doesn’t count the last settled up capital before the Initial public offering. The typical expense of obtaining of offers by the advertisers is Rs. 1.14 per share.

Post-Initial public offering, organization’s ongoing settled up value capital of Rs. 17.50 cr. will stand upgraded to Rs. 24.14 cr. In view of the upper Initial public offering cost band, the organization is searching for a market cap of Rs. 337.93 cr.

Monetary Execution:

On the monetary execution front, for the last three fiscals, the organization has posted an all out pay/net benefit of Rs. 58.52 cr. /Rs. 0.88 cr. (FY22), Rs. 87.16 cr. /Rs. 5.46 cr. (FY23), Rs. 247.32 cr. /Rs. 26.21 cr. (FY24). As indicated by the administration, their attention on EPC contracts and other particular administrations from FY23 forward yielded the advantages and FY24 profit are credited to this shift. The organization has orders close by worth Rs. 450 cr. furthermore, a lot more in the pipeline holding up endorsement.

For the last three fiscals, it has revealed a normal EPS of Rs. 8.61, and a typical RoNW of 46.69%. The issue is valued at a P/BV of 6.04 in view of its NAV of Rs. 23.16 as of Walk 31, 2024, and at a P/BV of 2.53 in view of its post-Initial public offering NAV of Rs. 55.29 per share (at the upper cap).

On the off chance that we trait FY24 income to its post-Initial public offering completely weakened settled up capital, then the asking cost is at a P/E of 12.89, and in light of FY23 income, the P/E remains at 61.95. In this manner in view of FY24 super profit, the issue shows up completely estimated limiting all close to term up-sides.

For the revealed periods, the organization has posted PAT edges of 1.50% (FY22), 6.26% (FY23), 10.61% (FY24), and RoCE edges of 10.87%, 40.56%, 87.33% separately for the alluded periods.

Profit Strategy:

The organization has not proclaimed any profits for the revealed times of the deal report. It will embrace a judicious profit strategy in light of its monetary exhibition and future possibilities.

Examination WITH Recorded Companions:

According to the proposition report, the organization has shown K2 Infra, Suraj Domain Engineers, and SRM Project workers as their recorded friends. They are exchanging at a P/E of 27.5, 43.4 and 21.1 (as of July 26, 2024). Nonetheless, they are not similar on an apple-to-apple premise.

Shipper BANKER’S History:

This is the 29th command from GYR Capital in the last four fiscals (counting the continuous one), out of the last 10 postings, all recorded with charges going from 36.36% to 366.67% on the date of posting.

End/Venture Technique

The organization is working in a profoundly cutthroat and divided section. Be that as it may, it has made a specialty put in and presently has requests worth Rs. 450 cr. available. In light of FY24 super profit, the issue shows up completely evaluated. Financial backers might stop assets for long haul.

Audit By Dilip Davda on July 27, 2024

Audit Creator

DISCLAIMER: No monetary data at all distributed anyplace here ought to be understood as a proposal to trade protections, or as exhortation to do as such in any capacity at all. All matter distributed here is only for instructive and data purposes just and by no means ought to be utilized for settling on venture choices. My audits don’t cover GMP market and administrators approaches. Perusers should counsel a certified monetary consultant prior to going with any real venture choices, put together the with respect to data distributed here. With section hindrances, SEBI believes that main all around informed financial backers should partake in such offers. With insane postings in the new past, SME Initial public offerings drew the consideration of financial backers in all cases and lead to diviner frenzy. Be that as it may, as SME issues have passage hindrances and proceeded with low inclination from the broking local area, any peruser taking choices in light of any data distributed here does so altogether despite all advice to the contrary. The above data depends on data accessible as of date combined with market discernments. The Creator has no designs to put resources into this proposition.