Tesla Stock: A Comprehensive Analysis

Introduction

Tesla, Inc., led by visionary entrepreneur Elon Musk, has captivated investors and enthusiasts alike with its innovative approach to electric vehicles (EVs), renewable energy, and technology. The company’s stock, listed on the NASDAQ exchange under the ticker symbol “TSLA,” has experienced remarkable growth and volatility, reflecting investors’ optimism about Tesla’s disruptive potential and concerns over its execution challenges. In this comprehensive analysis, we delve into the intricacies of Tesla’s stock, examining its historical performance, underlying fundamentals, key drivers, and potential risks.

Historical Performance

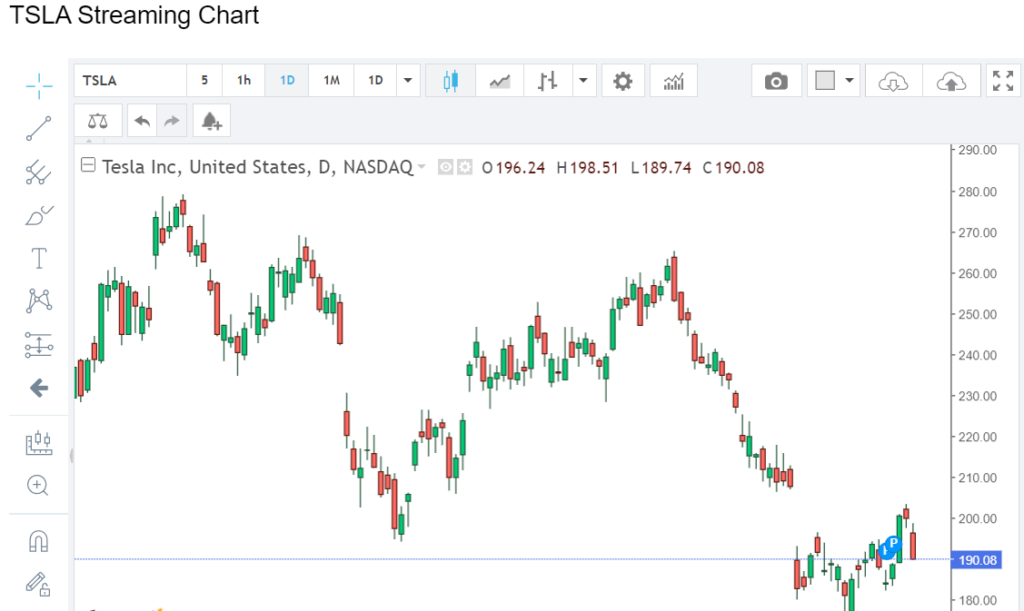

Tesla’s stock has been a rollercoaster ride for investors, characterized by dramatic swings in price and sentiment. Since its initial public offering (IPO) in 2010, Tesla’s stock has experienced exponential growth, fueled by a combination of ambitious growth plans, technological innovation, and market enthusiasm for sustainable transportation solutions. However, this growth has been punctuated by periods of volatility, with the stock price subject to sharp fluctuations in response to quarterly earnings reports, production delays, regulatory scrutiny, and macroeconomic trends.

Fundamental Analysis

Fundamentally, Tesla’s stock is shaped by various factors that influence its valuation and investor sentiment:

1. Revenue Growth: Tesla’s revenue growth trajectory is a key driver of its stock price. The company’s ability to increase vehicle deliveries, expand its product lineup, and diversify into renewable energy solutions impacts top-line growth and investor expectations for future earnings potential.

2. Production Efficiency: Tesla’s ability to ramp up production and achieve economies of scale is closely monitored by investors. Production bottlenecks, supply chain disruptions, and manufacturing challenges can impact profitability and investor confidence in Tesla’s execution capabilities.

3. Technological Leadership: Tesla’s position as a leader in electric vehicle technology and autonomous driving systems is a source of competitive advantage and market differentiation. Breakthroughs in battery technology, software development, and vehicle performance can drive investor optimism and support premium valuations.

4. Regulatory Environment: Regulatory developments, including government incentives for electric vehicles, emissions standards, and safety regulations, can impact Tesla’s market access, costs, and competitive positioning. Changes in regulatory frameworks may influence investor sentiment and market dynamics.

5. Competitive Landscape: Tesla faces competition from traditional automakers, tech giants, and emerging players in the electric vehicle space. Investors assess Tesla’s ability to maintain its market leadership, brand appeal, and innovation edge amidst intensifying competition and evolving consumer preferences.

Key Drivers

Several key drivers influence Tesla’s stock performance:

1. Vehicle Deliveries: Tesla’s quarterly vehicle delivery numbers serve as a barometer of demand for its products and operational efficiency. Beating or missing delivery targets can lead to significant stock price movements as investors adjust their expectations for future growth.

2. Earnings Reports: Tesla’s quarterly earnings reports provide insights into its financial performance, profitability, and cash flow generation. Positive surprises or disappointments in earnings results can impact investor sentiment and drive stock price volatility.

3. Innovation Announcements: Product announcements, technological advancements, and strategic initiatives unveiled by Tesla, such as new vehicle models, software updates, and energy storage projects, can influence investor perceptions of Tesla’s growth prospects and competitive positioning.

4. Market Sentiment: Tesla’s stock is heavily influenced by market sentiment, investor sentiment, and broader macroeconomic trends. Positive sentiment towards electric vehicles, renewable energy, and disruptive technology companies can fuel demand for Tesla’s stock, while negative sentiment or market downturns may lead to selling pressure.

Potential Risks

Investing in Tesla’s stock carries certain risks, including:

1. Execution Risks: Tesla faces execution risks related to production scalability, quality control, supply chain management, and regulatory compliance. Any setbacks in executing its ambitious growth plans could impact its financial performance and stock price.

2. Competition: The electric vehicle market is becoming increasingly competitive, with traditional automakers and tech companies investing in EVs and autonomous driving technology. Intensifying competition could erode Tesla’s market share, pricing power, and profitability.

3. Regulatory Challenges: Tesla operates in a highly regulated industry subject to government policies, safety standards, emissions regulations, and trade tariffs. Changes in regulations or government incentives could affect Tesla’s costs, market access, and competitive position.

4. Valuation Concerns: Tesla’s stock has often been characterized by high valuation multiples relative to its earnings, leading to concerns about its valuation being disconnected from fundamental performance metrics. Any correction in valuation multiples could lead to significant stock price declines.

Conclusion

Tesla’s stock represents a compelling investment opportunity for those bullish on the company’s disruptive potential, innovative technology, and leadership in the electric vehicle market. However, investing in Tesla’s stock also entails significant risks, including execution challenges, competition, regulatory hurdles, and valuation concerns. Investors should conduct thorough due diligence, assess their risk tolerance, and carefully monitor Tesla’s performance, market dynamics, and industry trends before making investment decisions.