United Heat Transfer Limited IPO Full Details

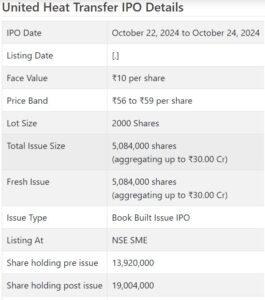

Joined Intensity Move Initial public offering is a book fabricated issue of Rs 30.00 crores. The issue is completely a new issue of 50.84 lakh shares.

Joined Intensity Move Initial public offering opened for membership on October 22, 2024, and will close on October 24, 2024. The allocation for the Assembled Intensity Move Initial public offering is supposed to be concluded on Friday, October 25, 2024. Joined Intensity Move’s Initial public offering will be listed on NSE SME with a speculative posting date fixed as Tuesday, October 29, 2024.

Joined Intensity Move Initial public offering cost band is set at ₹56 to ₹59 per share. The base part size for an application is 2000 Offers. The base measure of venture expected by retail financial backers is ₹118,000. The base parcel size speculation for HNI is 2 parts (4,000 offers) adding up to ₹236,000

• The organization is occupied with different sorts of modern/car heat exchangers assembling and showcasing.

• While it stamped irregularity in its top lines for the revealed periods, quantum bounce in main concerns from FY24 onwards remains a concern.

• In light of the FY25 annualized super profit, the issue shows up as completely estimated.

• It is working in an exceptionally serious and divided section.

• Very educated financial backers might stop moderate assets for the long haul.

ABOUT Organization:

Joined Intensity Move Ltd. (UHTL) is taken part in the production of the scope of shell and cylinder heat exchangers, air-cooled heat exchangers, pressure vessels and cycle stream slips hardware which is utilized as basic gear for petroleum and diesel motors, rail route motors, sea motors, cruise and freight ships, ships, delight boats, marine diesel, mining trucks, uber yachts, weighty motors, fishing boats, weighty trucks, vessels, fishing vessels, weighty haulages, power gen sets, super big haulers, off roadway motors and so on starting around 1995.

The organization expands its skill with the developing public and worldwide OEM industry for Intensity Exchangers, Dampness Separators Tension Vessels, and Cycle Stream Skids. It fabricates heat move hardware according to the TEMA (Cylindrical Exchanger Makers Affiliation) norms, ASME Segment VIII Div. 1, Div. 2, (unfired pressure vessels), Programming interface 660, 661, NES principles. Its solidarity lies in the brilliant quality and craftsmanship of items, the designing mastery of its group, and the constant quest for growing mechanically imaginative items. As of July 31, 2024, it had 105 workers on its finances.

ISSUE Subtleties/CAPITAL HISTORY:

The organization is emerging with its lady book building course Initial public offering of 5084000 value portions of Rs. 10 each to assemble Rs. 30.00 cr. (at the upper cap). The organization has declared a value band of Rs. 56 – Rs. 59 for every offer. The issue opens for membership on October 22, 2024, and will close on October 24, 2024. The base number of offers to be applied is for 2000 offers and in products subsequently, from that point. Post apportioning, offers will be recorded on NSE SME Arise. The issue is that 26.75% of the post-initial public offering settled up capital of the organization. From the net returns of the Initial public offering, the organization will use Rs. 5.73 cr. for reimbursement of specific obligations, Rs. 14.00 cr. for working capital, and the rest for general corporate purposes.

The Initial public offering is exclusively led and overseen by Insignia Investment Ltd., and Connection Intime India Pvt. Ltd. is the enlistment center to the issue. Insignia Investment Ltd. is likewise the Market Creator for the organization.

Having given beginning value shares at standard worth, the organization gave further value shares at a proper cost of Rs. 50 in June 2024. It has likewise given extra offers in the proportion of 1 for 1 in November 2025, and 2 for 1 in Walk 2024. The typical expense of procurement of offers by the advertisers is Rs. 1.67, Rs. 1.80, Rs. 1.84, and Rs. 16.67 per share.

Post-initial public offering, the organization’s ongoing settled up value capital of Rs. 13.92 cr. Will stand improved to Rs. 19.00 cr. In light of the upper-value band of the Initial public offering, the organization is searching for a market cap of Rs. 112.12 cr.

Monetary Execution:

On the monetary execution front, for the last three fiscals, the organization has posted a complete pay/net benefit of Rs. 47.96 cr. /Rs. 1.53 cr. (FY22), Rs. 70.40 cr. /Rs. 2.12 cr. (FY23), and Rs. 64.10 cr. /Rs. 6.24 cr. (FY24). For 4M of FY25 finished on July 31, 2024, it procured a net benefit of Rs. 2.43 cr. on a complete pay of Rs. 21.20 cr. While it posted irregularity in its top lines for the detailed periods, the flood in main concern for FY24 onwards causes a stir and worry over its supportability.

For the last three fiscals, the organization has revealed a normal EPS of Rs. 3.20 and a normal RoNW of 22.41%. The issue is valued at a P/BV of 2.87 given its NAV of Rs. 20.58 as of July 31, 2024, and at a P/BV of 1.91 given its post-initial public offering NAV of Rs. 30.86 per share (at the upper cap).

On the off chance that we trait FY25 annualized super income on post-initial public offering completely weakened value capital, then the asking cost is at a P/E of 15.40, and in light of FY24 profit, the P/E remains at 17.99. The issue moderately shows up completely estimated.

For the announced periods, the organization has posted PAT edges of 3.20% (FY22), 3.02 % (FY23), 10.36% (FY24), and 11.44% (4M-FY25), however, the RoCE edges information is absent in RHP.

Profit Strategy:

The organization has not delivered any profits for the announced times of the proposition record. It took on a profit strategy in July 2024givenof its monetary presentation and future possibilities.

COMPARISION WITH Recorded Friends:

According to the proposition archive, the organization has shown Patels Airtemp, and The Anup Engg., as their recorded companions. It is exchanging at a P/E of 30.4, and 49.6 (as of October 18, 2024). Nonetheless, they are not genuinely similar on an apple-to-apple premise.

Trader BANKER’S History:

This is the thirteenth command from Insignia Investment in the last three fiscals (counting the continuous one). Out of the last 10 postings, 1 opened at rebate, 1 at standard, and the rest opened with charges going from 4.82% to 110.64% on the date of posting.

End/Venture Methodology

The organization is part of different kinds of modern/auto heat exchangers assembling and showcasing. While it stamped irregularity in its top lines for the detailed periods, quantum bounce in primary concerns from FY24 onwards causes a commotion and remains a concern. Given the FY25 annualized super profit, the issue shows up completely evaluated. It is working in an exceptionally serious and divided portion. Very much educated financial backers might stop moderate assets for the long haul.

Survey By Dilip Davda on October 19, 2024