Vishwas Agri Seeds Limited IPO Subscription and Allotments

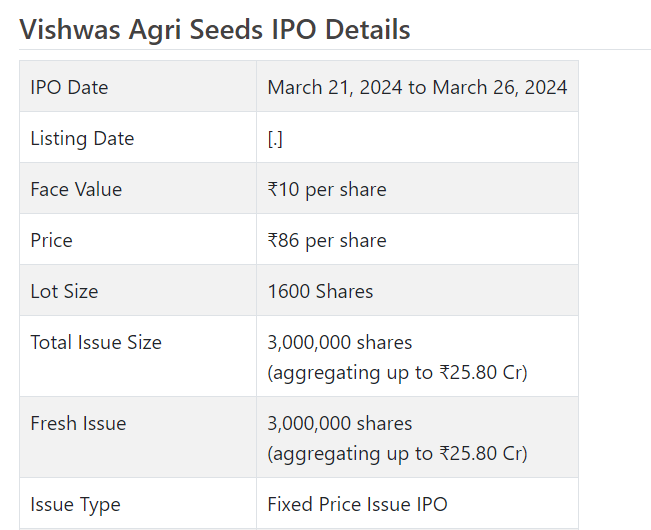

Vishwas Agri Seeds Initial public offering is a proper value issue of Rs 25.80 crores. The issue is totally a new issue of 30 lakh shares.

Vishwas Agri Seeds Initial public offering opened for membership on Walk 21, 2024 and will close on Walk 26, 2024. The apportioning for the Vishwas Agri Seeds Initial public offering is supposed to be finished on Wednesday, Walk 27, 2024. Vishwas Agri Seeds Initial public offering will list on NSE SME with conditional posting date fixed as Monday, April 1, 2024.

Vishwas Agri Seeds Initial public offering cost is ₹86 per share. The base parcel size for an application is 1600 Offers. The base measure of speculation expected by retail financial backers is ₹137,600. The base part size speculation for HNI is 2 parcels (3,200 offers) adding up to ₹275,200.

• VASL is occupied with handling and providing quality seeds.

• It checked static execution for FY22 and FY23 however posted higher edges for FY23.

• Post fruition of modernization, influence is noticeable in its H1-FY24 execution.

• New office and infra work will add to its top and main concerns going ahead.

• Financial backers might stop assets for the medium to long haul rewards.

ABOUT Organization:

Vishwas Agri Seeds Ltd. (VASL) is occupied with handling quality seeds and providing to ranchers by means of its dispersion organization. The Organization sells its seeds under the brand name “Vishwas”. Its seeds handling unit is furnished with optical arranging machine, they distinguish undesirable tones, inconspicuous staining, size and shape abandons, and unfamiliar materials. Further its seeds go through seed treatment process where seeds are handled by use of fungicide, insect poison, or a blend of both, to seeds to clean them from seed-borne or soil-borne pathogenic living beings and capacity bugs.

At first organization began seeds handling unit at Plot no. 61 Close to Akshar Sun oriented Jamvadi GIDC 2 Gondal, Rajkot-360311, Gujarat, India. Organization stopped its activities in Rajkot Unit in June 2023 to relocate in its own bigger office in Ahmedabad. In July 2023, Organization began business activities of seed handling unit alongside Stockroom and Cold storeroom at Unit no. 3 New R.S No. 460, Town: Bhayla, Taluka: Bavla, Area: Ahmedabad, Gujarat. The said handling unit, furnished with current innovation is spread across 5 sections of land.

VASL has profited term credit of Rs. 11.51 cr. from HDFC bank by means of authorization letter dated June 22, 2022 to develop the plant shed, to assemble Cold Capacity, Stockroom and Apparatus of seed handling unit. The said unit likewise outfitted with warehousing for putting away 4200 MT limit of stock and cold storage space to store 3000 MT of stock. Further, the organization is in course of setting up its own corporate place of business inside the reason of the said seed handling unit. Organization is additionally wanting to arrangement an in-house seed testing Research facility which will assist it with working on the nature of existing items, accompany new items and its variations.

As of Walk 31, 2023, it created seeds for in excess of 40 different field yields, vegetables and have the presence of its items in the province of Gujarat, Maharashtra, Rajasthan by means of its Deals and Conveyance organization. Vishwas has in excess of 75 assortments of Yields. Its item portfolio incorporates crop seeds for Groundnut, Soyabin, Wheat, Cumin, Green Gram, Dark Gram Exploration Half breed seeds for Cotton, Castor, Pearl Millet, Maize, crossover vegetable seeds, Stew, Tomato, Brinjal, Watermelon, Sweet Corn, cabbage, Onion, Coriander Seeds, Fenugreek, Mustard, Lucern, Carrot, and so on.

As of the date of recording this deal archive, it had 783 wholesalers in three states for example Gujarat, Rajasthan, and Madhya Pradesh. As of September 30, 2023, it had 77 workers on its finance.

ISSUE Subtleties/CAPITAL HISTORY:

The organization is emerging with its lady Initial public offering of 3000000 value portions of Rs. 10 each at a proper cost of Rs. 86 for each offer to activate Rs. 25.80 cr. The issue opens for membership on Walk 21, 2024, and will close on Walk 26, 2024. The base application to be made is for 1600 offers and in products subsequently, from that point. Post assignment, offers will be recorded on NSE SME Arise. The issue is 30% of the post-Initial public offering settled up capital of the organization. The organization is spending Rs. 1.90 cr. for this Initial public offering process, and from the net returns, it will use Rs. 7.60 cr. for capex on place of business, net seed testing lab, nursery set-up and rooftop top sun powered chargers, Rs. 11.00 cr. for working capital and Rs. 5.30 cr. for general corporate purposes.

The issue is exclusively lead overseen by ISK Counselors Pvt. Ltd., and Bigshare Administrations Pvt. Ltd. is the recorder of the issue. Sunflower Broking Pvt. Ltd. is the market creator for the organization.

The organization has given whole value capital at standard up until this point and has additionally given extra offers in the proportion of 2 for 5 in Walk 2023. The typical expense of obtaining of offers by the advertisers is Rs. 7.14 per share.

Post-Initial public offering, organization’s ongoing settled up value capital of Rs. 7.00 cr. will stand improved to Rs. 10.00 cr. In light of the upper Initial public offering cost band, the organization is searching for a market cap of Rs. 86.00 cr.

Monetary Execution:

On the monetary execution front, for the last three fiscals, the organization has posted a complete pay/net benefit of Rs. 53.83 cr. /Rs. 1.16 cr. (FY21), Rs. 64.86 cr. /Rs. 2.48 cr. (FY22), and Rs. 65.32 cr. /Rs. 5.34 cr. (FY23). For H1 of FY24 finished on September 30, 2023, it procured a net benefit of Rs. 4.51cr. on a complete pay of Rs. 42.48 cr.

For the last three fiscals, it has detailed a normal EPS of Rs. 12.43, and a typical RONW of 45.56%. The issue is evaluated at a P/BV of 3.20 in light of its NAV of Rs. 26.91 as of September 30, 2023, and at a P/BV of 1.93 in view of its post-Initial public offering NAV of Rs. 44.64 per share.

On the off chance that we characteristic annualized FY24 income to its post-Initial public offering completely weakened paid-p capital, then the asking cost is at a P/E of 9.53. Hence the issue shows up sensibly evaluated.

For the announced periods, the organization has posted PAT edges of 2.16% (FY21), 3.82% (FY22), 8.18% (FY23), 10.62% (H1-FY24), and RoCE edges of 15.23%, 19.99%, 23.84%, 14.60% individually for the alluded periods.

Profit Strategy:

The organization has not proclaimed any profits for the revealed times of the proposition archive. It will embrace a judicious profit strategy in light of its monetary presentation and future possibilities.

Examination WITH Recorded Friends:

According to the proposition report, the organization has shown Bombay Very Mixture, Kaveri Seed, and Upsurge Seeds as their recorded friends. They are exchanging at a P/E of 95.9, 13.3, and 28.9 (as of Walk 15, 2024). Nonetheless, they are not equivalent on an apple-to-apple premise.

Trader BANKER’S History:

This is the seventh command from ISK Consultants in the last four fiscals, out of the last 6 postings, all recorded with expenses going from 1.08% to 80% upon the arrival of posting.