Waaree Energies Limited IPO Full Details

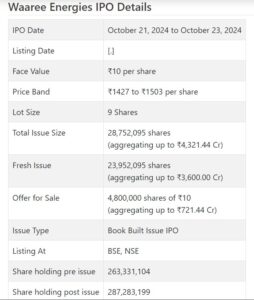

Waaree Energies Initial public offering is a book fabricated issue of Rs 4,321.44 crores. The issue is a mix of new issue of 2.4 crore shares conglomerating to Rs 3,600.00 crores and make available for purchase of 0.48 crore shares collecting to Rs 721.44 crores.

Waaree Energies Initial public offering opened for membership on October 21, 2024 and will close on October 23, 2024. The designation for the Waaree Energies Initial public offering is supposed to be finished on Thursday, October 24, 2024. Waaree Energies Initial public offering will list on BSE, NSE with conditional posting date fixed as Monday, October 28, 2024.

Waaree Energies Initial public offering cost band is set at ₹1427 to ₹1503 per share. The base parcel size for an application is 9 Offers. The base measure of venture expected by retail financial backers is ₹13,527. The base parcel size speculation for sNII is 15 parts (135 offers), adding up to ₹202,905, and for bNII, it is 74 parcels (666 offers), adding up to ₹1,000,998.

Waaree Energies Initial public offering is a book fabricated issue of Rs 4,321.44 crores. The issue is a mix of new issue of 2.4 crore shares conglomerating to Rs 3,600.00 crores and make available for purchase of 0.48 crore shares collecting to Rs 721.44 crores.

Waaree Energies Initial public offering opened for membership on October 21, 2024 and will close on October 23, 2024. The designation for the Waaree Energies Initial public offering is supposed to be finished on Thursday, October 24, 2024. Waaree Energies Initial public offering will list on BSE, NSE with conditional posting date fixed as Monday, October 28, 2024.

Waaree Energies Initial public offering cost band is set at ₹1427 to ₹1503 per share. The base parcel size for an application is 9 Offers. The base measure of venture expected by retail financial backers is ₹13,527. The base parcel size speculation for sNII is 15 parts (135 offers), adding up to ₹202,905, and for bNII, it is 74 parcels (666 offers), adding up to ₹1,000,998

• The organization is the biggest producer of sun based PV modules in India and is ready for better advancement proceeding.

• The organization stamped guard development in its top and main concerns from FY23 onwards, demonstrating the possibilities ahead.

• It is adding 6GW of ingot wafer, sun powered cell and sun oriented PV module fabricating office in Odisha, that will get bonus its monetary exhibition.

• In light of FY25 annualized profit, the issue shows up completely valued.

• Financial backers might lap it up for medium to long haul.

ABOUT Organization:

Waaree Energies Ltd. (WEL) is the biggest producer of sunlight based PV modules in India with the biggest total introduced limit of 12 GW, as of June 30, 2024. (Source: CRISIL Report, page 165) For Financial 2024, it had the subsequent best working pay among all the homegrown sunlight based PV module makers in India. (Source: CRISIL Report, page 179) The organization started tasks in 2007 zeroing in on sun oriented PV module producing with a plan to give quality, financially savvy maintainable energy arrangements across business sectors, and help in decreasing carbon impression preparing for economical energy accordingly working on personal satisfaction.

Throughout the long term, it has essentially extended total introduced limit from 4 GW in Financial 2022 to 12 GW, as of June 30, 2024, as confirmed by its capacity to rapidly finish extension designs effectively. Resulting to June 30, 2024, it has authorized 1.3 GW of sun based module fabricating office at Noida, Uttar Pradesh through auxiliary, IndoSolar Restricted (“IndoSolar Office”). Its sun based PV modules are as of now produced utilizing multi glasslike cell innovation, mono translucent cell innovation and arising advances, for example, Passage Oxide Passivated Contact (“TopCon”) which lessens energy misfortune and upgrades generally speaking proficiency. WEL’s arrangement of sunlight based energy items comprises of the PV modules, for example, (I) multi glasslike modules; (ii) mono translucent modules; and (iii) TopCon modules, containing adaptable modules, which incorporates bifacial modules (Mono PERC) (outlined and unframed), and building coordinated photograph voltaic (BIPV) modules. As of the date of this Distraction Outline, it worked five assembling offices in India spread over an area of 143.01 sections of land. The organization works one production line each situated at Surat (“Surat Office”), Tumb (“Tumb Office”), Nandigram (“Nandigram Office”), Chikhli (“Chikhli Office”) in Gujarat, India and the IndoSolar Office, in Noida, Uttar Pradesh.

WEL’s sun powered PV modules guarantees are protected by outside parties, which expects it to keep up with exclusive expectations for protection endorsement. It has gotten a level 1 PV module producer rating from the Bloomberg New Energy Money between Monetary 2018 and Financial 2024. Sure of its labs are authorize by the Public Certification Board for Testing and Adjustment Labs (“NABL”) which tests sun powered PV modules for quality check. Further, it guarantees that assembling offices are routinely examined by quality review firms. It is additionally included under the ALMM list recognized by the GoI, which empowers the organization to partake in different government plans pointed toward fostering the sun based industry in India. WEL likewise makes semi-adaptable sunlight based chargers available to be purchased to worldwide clients through its in-house innovative work in item application.

As of Walk 31, 2022, 2023 and 2024 and as of June 30, 2023 and June 30, 2024, the absolute quantities of clients served by it in India were 716, 566, 378, 836 and 1,067 while the organization served 26, 33, 36, 20 and 12 clients outside India in similar periods, separately. It means to follow an extension technique of executing customary limit increments, as well as persistent upgradation of assembling innovation and cycles driven by request and with an emphasis on integrating Mono PERC, huge size silicon wafer innovation as well as other new arising advances including TopCon. As of June 30, 2024, it had 1752 workers on its finance and is likewise recruiting contractors as and when required.

ISSUE Subtleties/CAPITAL HISTORY:

The organization is emerging with its lady combo book building course Initial public offering of approx. 28752096 value portions of Rs. 10 every value Rs. 4321.44 cr. (at the upper cap). The organization has reported a value band of Rs. 1427 – Rs. 1503 for every offer. The issue is approx. 23952096 new value shares (worth Rs. 3600.00 cr. at the upper cap), and a proposal available to be purchased (OFS) of 4800000 offers (worth Rs. 721.44 cr. at the upper cap). The issue opens for membership on October 21, 2024, and will close on October 23, 2024. The base application to be made is for 9 offers and in products consequently, from that point. Post designation, offers will be recorded on BSE and NSE. The Initial public offering comprises 10.01% of the post-Initial public offering settled up value capital of the organization. From the net returns of the new value issue, the organization will use Rs. 2775.00 cr. for part funding cost of 6GW of ingot wafer, sun powered cell and sun oriented PV module producing office in Odisha via interest in completely claimed auxiliary – Sangam Sun based One Pvt. Ltd., and the rest for general corporate purposes.

The organization has held shares worth Rs. 65.00 cr. for its qualified workers and from the rest, it has apportioned not over half for QIBs, at least 15% for HNIs and at least 35% for Retail financial backers.

The seven Book Running Lead Supervisors (BRLMs) to this issue are Hub Capital Ltd., IIFL Protections Ltd., Jefferies India Pvt. Ltd., Nomura Monetary Warning and Protections (India) Pvt. Ltd., SBI Capital Business sectors Ltd., Concentrated Financial Administrations Pvt. Ltd., and ITI Capital Ltd., while Connection Intime India Pvt. Ltd. is the enlistment center to the issue. Partner individuals for this Initial public offering are SBICAP Protections Ltd., Investec Capital Administrations (India) Pvt. Ltd., and Old fashioned Stock Broking Ltd.

Having given starting value shares at standard, the organization gave/changed over additional value partakes in the value scope of Rs. 40.00 – Rs. 550.00. between Walk 2014, and September 2024. It has likewise given extra offers in the proportion of 8 for 5 in February 2018. The typical expense of securing of offers by the advertisers/selling partners is Rs. Nothing, Rs. 2.14, Rs. 3.77, Rs. 4.03, and Rs. 225.00 per share.

Post Initial public offering, organization’s ongoing settled up value capital of Rs. 263.33 cr. will stand improved to Rs. 287.28 cr. In light of the upper cap of Initial public offering evaluating, the organization is searching for a market cap of Rs. 43178.67 cr.

Monetary Execution:

On the monetary execution front, for the last three fiscals, the organization has posted a complete pay/net benefit of Rs. 2945.85 cr. /Rs. 79.65 cr. (FY22), Rs. 6860.36 cr. /Rs. 500.28 cr. (FY23), and Rs. 11632.76 cr. /Rs. 1274.38 cr. (FY24). For Q1 of fY25 finished on June 30, 2024, it procured a net benefit of Rs. 401.12 cr. on a complete pay of Rs. 3496.41 cr. It stamped quantum bounce in its top and main concerns from FY23 onwards.

For the last three fiscals, the organization has revealed a normal EPS of Rs. 31.94 (fundamental), and a typical RoNW of 26.95%. The issue is estimated at a P/BV of 8.84 in light of its NAV of Rs. 169.94 as of June 30, 2024, and at a P/BV of 5.35 in light of its post-Initial public offering NAV of Rs. 281.16 per share (at the upper cap).

On the off chance that we trait FY25 annualized super income to its post-Initial public offering completely weakened settled up value capital, then the asking cost is at a P/E of 26.91, and in view of FY24 income, the P/E remains at 44.36. The issue generally shows up completely valued.

The organization detailed PAT edges of 2.70% (FY22), 7.29% (FY23), 10.96% (FY24), 11.47% (Q1-FY25), and RoCE edges of 23.49%, 48.83%, 36.95%, 9.56% for the alluded periods, separately.

Profit Strategy:

The organization has not announced any profits for the revealed times of the deal record. It embraced a profit strategy in September 2021, in view of its monetary presentation and future possibilities.

COMPARISION WITH Recorded Companions:

According to the deal record, the organization has shown Websol Energy, and Chief Energies, as their recorded friends, they are exchanging at a P/E of NA and NA (as of October 16, 2024). Nonetheless, they are not really similar on an apple-to-apple premise.

Vendor BANKER’S History:

The seven BRLMs related with the proposition have taken care of 82 public issues in the beyond three fiscals, out of which 22 issues shut beneath the deal cost on posting date.

End/Venture Procedure

The organization is the biggest sun powered PV modules producer in India and appreciates most favored accomplice in sun oriented energy fragment. It checked gigantic climb in its top and main concerns from FY23 ahead demonstrating the possibilities ahead and post its proposed extension, the organization is ready for better execution. In light of annualized FY25 profit, the issue shows up completely valued. Financial backers might lap it up for medium to long haul.

En iyi uyducu Malatya Uyducu Malatya, merkezi uydu sistemi kurulumunda çok başarılıydı. https://thesn.eu/blogs/8487/Malatya-Uyducu-24-saat